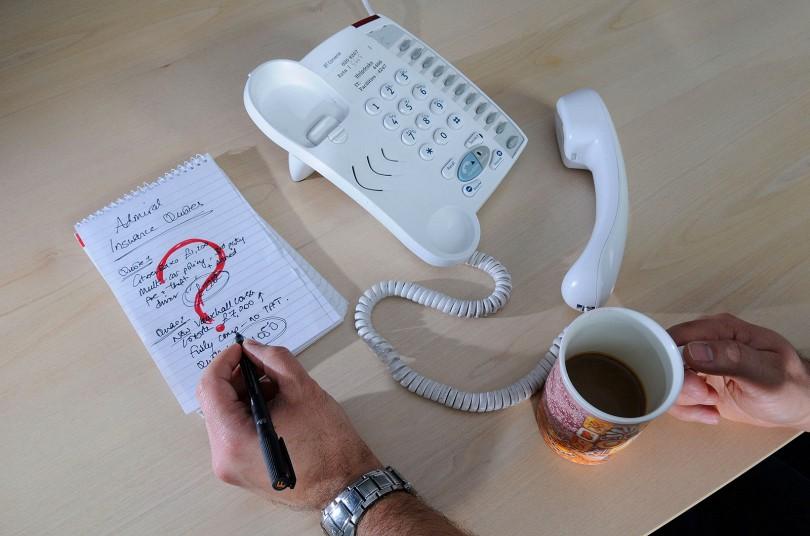

As premiums hit record levels, cash strapped motorists need a break from money grubbing insurers

The industry has again called on the Government to cut claims costs as premiums soar when there the overall cost of claims is falling

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.“It’s time cash strapped motorists got a break,” says Rob Cummings, head of motor and liability at the Association of British Insurers on the back of figures showing premiums hit a record high average cost of £481 per person last year.

That's a rise of 9 per cent. No wonder the ABI describes insurance inflation as having gone “into overdrive”.

In response, the industry has called for the rapid introduction of reforms to cut the cost of compensating people who suffer whiplash injuries. It also wants the Government change the discount rate applied to the final awards made to people who suffer far more serious injuries - life changing injuries that leave them permanently disabled - so they get less.

Mr Cummings is such a doughty campaigner it’s a wonder he doesn’t get himself fitted up for a cape and a Zorro mask before taking to the skies.

Is it a bird? Is it a plane? No it’s Motorman, the fearless defender of Britain’s road users!

Or should that be motor-mouth, because, you see, we’ve heard this sort of thing before from Mr Cummings and his friends. We hear it every year insurance premiums rise, as they did in 2016, when they also hit a new record.

Last year, upon the release of the figures, Mr Cummings was crying about “tough times for the honest motorist”.

Those tough times were certainly not reflected in the profits reported by his members. It’s a good bet that they won’t be reflected in the results we’re going to see put out over the coming weeks.

When premiums rise, but claims don't, profits go up. Claims are rising though, I hear you cry. It’s because of all those dodgy lawyers with their dodgy clients feigning whiplash!

Well, no. They're not. Thompsons, the law firm, points out that the total cost of claims actually fell in 2016. Before you say ‘well they would say that wouldn’t they’, the data showing that comes from, drum roll please, Mr Cummings’ employer: The ABI.

Its General Insurance Overview Statistics for 2016 shows net claims came in at £6.88bn. The previous year the number was £7.8bn. In fact, it has fallen every year since 2010, which casts a whole new light on things.

What Mr Cummings well knows is that while claims costs play a role in the cost of premiums, his members will ultimately charge what they think they can get away with.

Their primary concern is for their shareholders. Their executives’ multi million pound bonuses are linked to the profits made for them and the dividends paid to them. A cursory perusal of some of the listed insurers’ annual reports will show you that they are handsome indeed.

Premiums have hit record levels not through claims hitting record levels but because those executives need shareholders’ dividends to hit record levels so they get paid record bonuses. Cutting claims costs is just as likely to feed into their pockets as it is to feed into lower premiums for motorists. More likely.

This isn’t rocket science. Yet an overly credulous British media continue to trot out the ABI’s line when it releases its premium tracker without considering what the facts, and the ABI’s own statistics, are really saying.

Insurance companies should pay out when people get hurt as a result of bad drivers. That’s what insurance is there for. If it doesn’t do that it isn’t insurance. It’s a tax.

Competition between companies should allow for that to happen while at the same time keeping premiums at a reasonable level.

The fact that that isn’t happening at a time when the overall level of claims is falling indicates that there isn’t enough of it. While you may see a lot of brands before you when you click on a motor insurance price comparison site, dig a little deeper and you’ll find that they are actually all owned by just a handful of companies.

Competition regulators have already taken one look at the industry and taken a dim view of what they found. As I’ve said in the past, they should look again. A fearless defender of Britain’s motorists should demand no less.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments