Britain’s massive unclaimed benefits failure – and how to fix it

While the government’s opponents rage about benefits being cut, claims on what remains are often barely 50 per cent of those entitled

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.With the new tax year now underway in the UK, it’s time to familiarise yourself with any changes to the social security system. But one constant that also deserves your attention is unclaimed benefits – a huge and largely overlooked issue that runs to billions of pounds each year.

It relates to means tested benefits, the ones where people’s eligibility and the size of the payout depends on their circumstances. Eligible people don’t always claim as much as they should, so many of society’s most needy receive less help than the system intends. What can we do about this – and is anything stopping us?

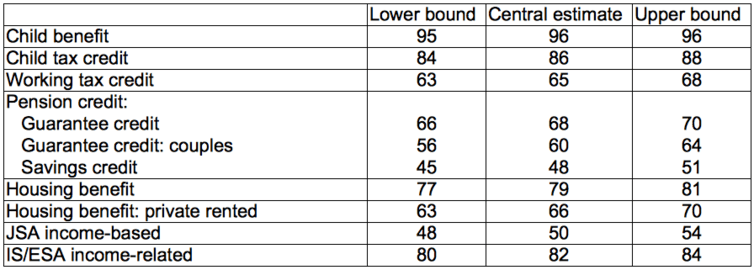

The UK government regularly estimates the take up of benefits as percentages, currently through Her Majesty’s Revenue and Customs (HMRC) and the Department for Work and Pensions (DWP). It is necessary for the departments to produce estimates because the figures are based on sampling, not actual take up.

Number crunching

The latest published estimates, for the tax year 2014-15, are in the table below. They show that with the exception of child benefit, for which take up is close to universal, the proportion of people not claiming is often very significant indeed.

This is despite the fact that these schemes have been in place for a number of years. The total unclaimed amount for the DWP’s estimates alone – pension credit, housing benefit, jobseeker’s allowance, income support and employment and support allowance – is £13bn a year.

Take-up rates (%)

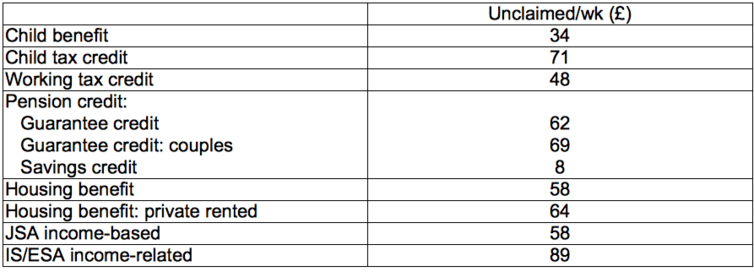

These unclaimed benefits average out for non-claimants as per the table below. These DWP-HMRC estimates are snapshots of different families over the year.

Average weekly unclaimed benefit

In many cases people don’t realise how much they are entitled to. I’ll quickly outline a couple of examples to give a sense of the complexity. In both cases, the scale of benefits is likely to remain fairly constant over the long term.

First, the pension guarantee credit, which is designed to top up the weekly income of over-65s where it is below £159.35. Someone receiving the full basic state pension of £122.30 per week with no other income or savings is entitled to claim a pension guarantee credit of £37.05 per week (£159.35 – £122.30). This amounts to nearly £2,000 a year.

Second, the child tax credit (CTC) and working tax credit (WTC). Assume a married couple of an appropriate age, together working 40 hours a week to earn a gross income of £14,400. They have two young children with no special needs.

Their maximum allowable WTC is £4,780 (this combines the basic WTC of £1,960, an additional £2,010 for being a couple, plus £810 because they work more than 30 hours a week). To be eligible for the maximum, however, the couple’s annual income must not exceed £6,420. The remainder is subject to a 41 per cent deduction, which in their case will apply to £7,980 (£14,400-£6,420), amounting to a £3,272 deduction. So they are entitled to £1,508 (£4,780-£3,272).

If you’re still with me, they then need to work out their child tax credit. It’s a maximum allowable £6,105 (£545 for being a family and £5,560 (2 x £2,780)) for having two children. This time the maximum allowable income for a full payment is £16,105, meaning they’re within the threshold so they should get £6,105. Combining this with their WTC entitlement, they’re due £7,613.

The fix

You can get all this information online through the government’s information pages on benefits – or through the Child Poverty Action Group’s annual welfare benefits and tax credits handbook. But at £61 a copy, few hard-up people are likely to buy one – especially when you need an updated version every tax year. It would therefore be an idea for all public libraries to have copies of the current edition in their reference section.

Martin Lewis. Steve Parsons/PA

Even then, potential applicants still need to know what they are looking for. Here, Citizens Advice could play an important part, if the public were encouraged by the government to make more use of them for this issue. Moneysavingexpert.com founder Martin Lewis could do more as well. Perhaps he might be persuaded to include this topic in his The Martin Lewis Money Show to explain how large unclaimed benefits can be.

Besides all this, there may be reason to be hopeful for the future. All of the benefits I have been referring to, with the exceptions of child benefit and pension credit, are due to be gradually replaced by a single payment known as universal credit by 2021. One would think this will avoid benefits being overlooked to the same extent, but time will tell – getting it off the ground has certainly not been smooth.

If universal credit eventually succeeds, it will have closed a huge gap. At a time the UK’s austerity policies have been very tough on certain people on social security, that would be a major step in the opposite direction.

The fix

You can get all this information online through the government’s information pages on benefits – or through the Child Poverty Action Group’s annual welfare benefits and tax credits handbook. But at £61 a copy, few hard-up people are likely to buy one – especially when you need an updated version every tax year. It would therefore be an idea for all public libraries to have copies of the current edition in their reference section.

Even then, potential applicants still need to know what they are looking for. Here, Citizens Advice could play an important part, if the public were encouraged by the government to make more use of them for this issue. Moneysavingexpert.com founder Martin Lewis could do more as well. Perhaps he might be persuaded to include this topic in his The Martin Lewis Money Show to explain how large unclaimed benefits can be.

Besides all this, there may be reason to be hopeful for the future. All of the benefits I have been referring to, with the exceptions of child benefit and pension credit, are due to be gradually replaced by a single payment known as universal credit by 2021. One would think this will avoid benefits being overlooked to the same extent, but time will tell – getting it off the ground has certainly not been smooth.

If universal credit eventually succeeds, it will have closed a huge gap. At a time the UK’s austerity policies have been very tough on certain people on social security, that would be a major step in the opposite direction.

Specialist Professional, University of Glasgow. This article first appeared on The Conversation (theconversation.com)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments