Bitcoin ETF vs. Ethereum ETF: Which Will Dominate the Crypto Landscape?

With Bitcoin and Ethereum ETFs becoming popular choices, the big question is which one will come out on top

The Independent was not involved in the creation of this sponsored content.

As cryptocurrencies become more established, investors are looking for new ways to gain exposure to these digital assets. One of the most popular methods is through Exchange-Traded Funds (ETFs), which allow individuals to invest in Bitcoin or Ethereum without directly owning the digital coins themselves. But with both Bitcoin and Ethereum ETFs now available, the question arises: which one will dominate the market?

https://unsplash.com/photos/a-group-of-rings-jsVkNHGVkUY

What Are ETFs and How Do They Work?

An Exchange-Traded Fund (ETF) is a type of investment fund that holds a collection of assets like stocks, bonds, or commodities. ETFs are traded on stock exchanges, just like regular stocks, making them easy to buy and sell. The big advantage of ETFs is that they offer investors a simple way to own a diverse range of assets, reducing risk.

Crypto ETFs work similarly but are focused on cryptocurrencies. They allow investors to gain exposure to digital currencies like Bitcoin or Ethereum without having to deal with buying and managing the actual coins.

Bitcoin ETFs: The First to Market

Bitcoin was the first cryptocurrency, and it has remained the most well-known and valuable digital asset. With the Bitcoin Price consistently reflecting its strong market presence, the introduction of Bitcoin ETFs provided an exciting opportunity for both institutional and everyday investors to gain exposure to Bitcoin through the traditional stock market. This was a game-changer, as it allowed people to invest in Bitcoin without having to worry about digital wallets, private keys, or security risks associated with holding the actual coins.

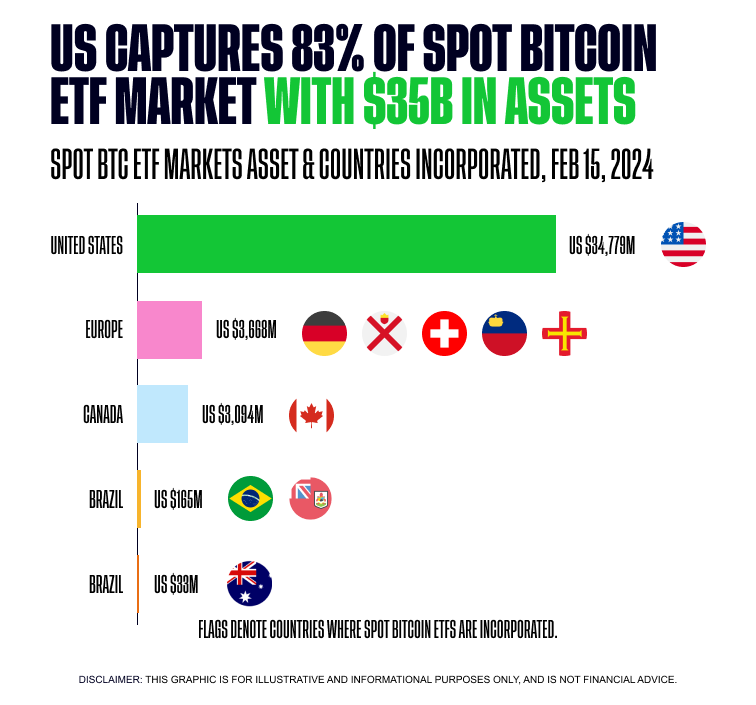

Today, spot Bitcoin ETFs are incorporated in 12 countries globally and are traded in 6 key geographical markets. These ETFs are available in major G20 nations like the United States, Canada, Germany, Brazil, and Australia, as well as in Hong Kong, Thailand, Bermuda, Jersey, Switzerland, Liechtenstein, and Guernsey.

The primary markets where these Bitcoin ETFs are traded include the US, Europe, and Canada, with growing markets in Brazil and Australia. Additionally, Hong Kong joins this list, becoming the first Asian country to host a Bitcoin ETF.

This expansion of Bitcoin ETFs provides more opportunities for investors worldwide to get involved in the crypto market through traditional financial products, offering a balance between exposure to digital assets and the security of regulated investments.

How Bitcoin ETFs Have Performed

Since their launch, Bitcoin ETFs have attracted a lot of attention and investment. In fact, the first day of trading for Bitcoin ETFs reportedly yielded over $4.66 billion in trading volume. Their performance has generally followed the ups and downs of Bitcoin itself, but with added liquidity and ease of trading on the stock market. This has made Bitcoin ETFs particularly attractive to investors who believe in the long-term potential of Bitcoin but want the ability to quickly buy or sell their investment when needed.

Why Bitcoin ETFs Are Popular

Bitcoin ETFs have gained significant popularity for a few key reasons. First, Bitcoin is often referred to as the "digital gold" of cryptocurrencies, which gives it a strong reputation as a reliable store of value. This perception, combined with its established brand, makes Bitcoin a preferred choice for many investors looking for a stable entry into the crypto market.

There are several reasons why Bitcoin ETFs have been so popular. First, Bitcoin is seen as the "digital gold" of cryptocurrencies. Bitcoin ETFs provide a secure, regulated and more convenient way to invest in Bitcoin. Unlike buying and holding Bitcoin directly, which requires managing private keys and the security of the digital wallets, ETFs offer a regulated and secure alternative. These ETFs are traded on the New York Stock Exchange, making it easier for both individual investors and institutions to include Bitcoin within their portfolios.

Ethereum ETFs: The Rising Star

Ethereum is the second-largest cryptocurrency by market value, and it offers something different from Bitcoin. While Bitcoin is primarily seen as a store of value, Ethereum is known for its blockchain, which supports smart contracts and decentralized applications (dApps). When Ethereum ETFs were introduced, they opened up a new way for investors to gain exposure to this innovative platform and its growing ecosystem.

Performance of Ethereum ETFs

Ethereum ETFs have shown strong performance, although they are newer to the market than Bitcoin ETFs. Ethereum ETFs’ trading volumes on the first day of trading ($1.08 Billion) suggest that they are off to a good start. However, it’s worth noting that Ether’s spot ETF volumes were just a quarter of what spot Bitcoin ETFs registered on their first day. This raises the question: Can Ethereum ETFs build up and surpass Bitcoin ETFs in terms of demand and volume?

Bitcoin may have the first-mover advantage, but Ethereum also has some strengths. Here are some of the key factors that may allow Ethereum to give Bitcoin a run for its money in the spot ETF segment:

- Ethereum Shines in Utility: Ethereum’s blockchain supports smart contracts, which has led to the growth of a vast ecosystem of over 4,000 dApps. These applications drive robust demand for ETH, particularly in the form of gas fees.

For context, Ethereum fees ranged from as low as $1.22 million to as high as $38 million in the last 12 months. This utility gives Ethereum a unique edge over Bitcoin, which is primarily seen as a store of value.

- Staking and Passive Income: Ethereum’s staking model provides opportunities for passive income, comparable to dividends in traditional finance. This aspect might be particularly appealing to traditional investors looking for steady returns.

- Price Advantage: From a price perspective, ETH trades at a value considerably lower on the charts compared to BTC. This lower entry point may enhance the perception that investing in Ethereum ETFs could provide investors with higher potential gains, especially as Ethereum continues to grow.

Who Will Dominate the ETF Market: Bitcoin or Ethereum?

Market Dominance

Bitcoin has always been the leader in the crypto world, and this is reflected in the popularity of its ETFs. Bitcoin ETFs have generally attracted more investment than Ethereum ETFs, partly because Bitcoin was the first to market and has a larger, more established following. However, Ethereum’s growth in areas like DeFi and smart contracts is challenging Bitcoin’s dominance, and this is starting to show in the ETF market.

Who’s Investing?

The types of investors in Bitcoin ETFs and Ethereum ETFs can be quite different. Bitcoin ETFs tend to attract more conservative investors who see Bitcoin as a safe, long-term investment. In contrast, Ethereum ETFs appeal more to those interested in the technology behind cryptocurrencies and the future of decentralized applications.

These differences in investor profiles could shape the future of the ETF market, with Bitcoin ETFs potentially maintaining their lead among risk-averse investors, while Ethereum ETFs capture the attention of those seeking higher growth potential.

Final Thoughts

Experts are divided on which ETF will dominate. Some believe that Bitcoin’s status as the first and most trusted cryptocurrency will keep its ETFs in the lead. Others argue that Ethereum’s broader applications and technological advancements give it the edge. Ultimately, the decision on which ETF to invest in will depend on individual investor goals and their outlook on the future of the cryptocurrency market.