Billionaires: How the influence of extra zeroes makes them easy to hate

A Politico poll shows 76 per cent of registered voters – both Democrats and Republicans – think the wealthiest Americans should pay more, writes Roxanne Roberts. Yet America’s billionaires are reluctant to agree

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.When did “billionaire” become a dirty word?

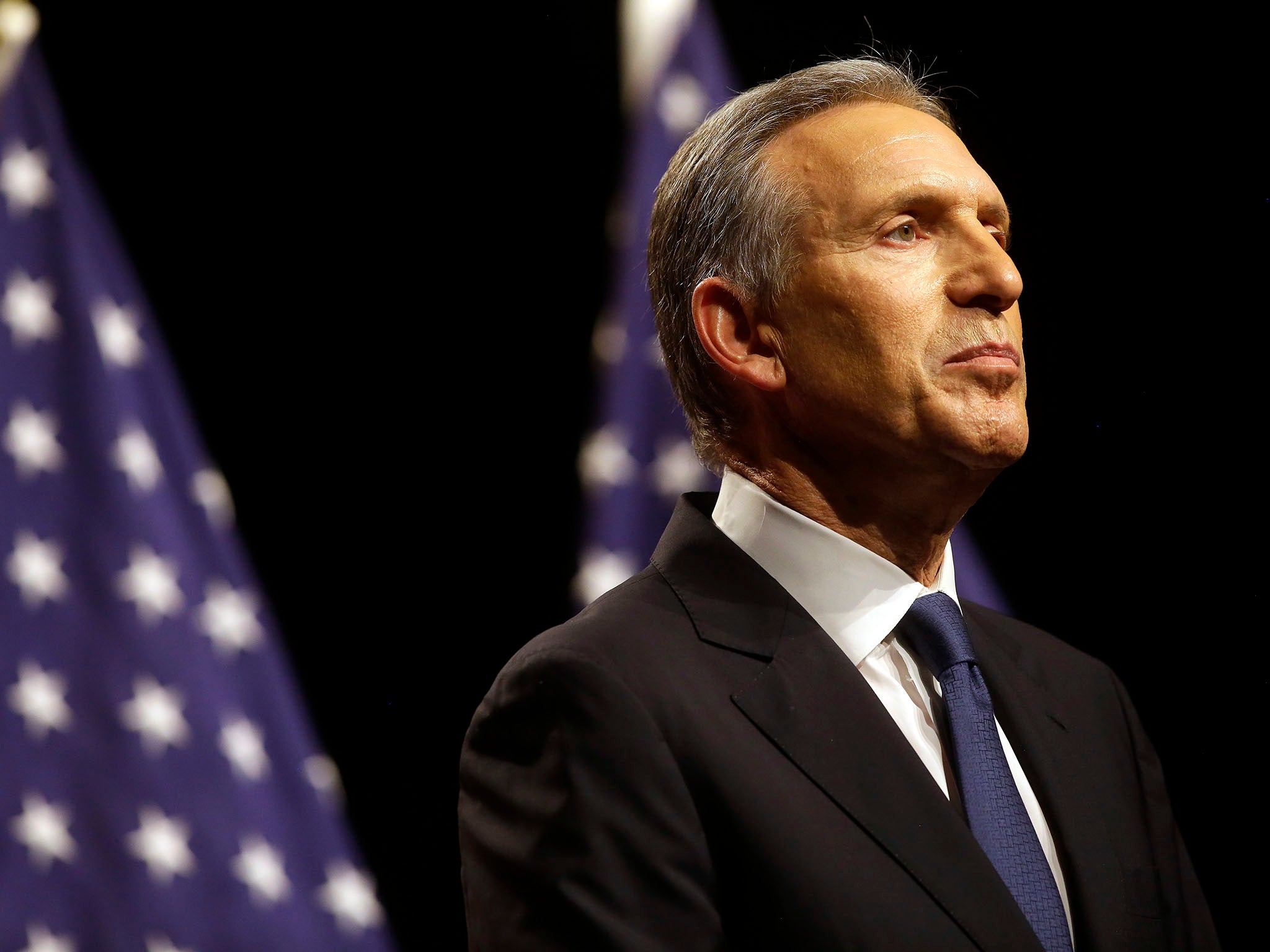

Maybe it was when former Starbucks chief executive Howard Schultz dismissed Massachusetts senator Elizabeth Warren’s proposal for higher taxes on fortunes of $50m or higher as “ridiculous”.

Or when an audience at the World Economic Forum in Davos, Switzerland, laughed out loud at the suggestion that the super-rich should contribute more.

Or perhaps it was during the government shutdown, when commerce secretary Wilbur Ross was baffled when federal workers went to food banks to feed their families. “I know they are [using food banks], and I don’t understand why,” he said in a CNBC interview. Ross, a self-proclaimed billionaire and buddy of President Trump, suggested furloughed workers take out short-term loans instead.

Or maybe it was when Dan Riffle, an aide to representative Alexandria Ocasio-Cortez, coined a new progressive slogan: “Every billionaire is a policy failure.”

Schultz, who is worth an estimated $3.5bn, told an interviewer that he doesn’t like being called a billionaire. These days, he prefers “a person of means” because billionaires have become shorthand for income inequality, tax cuts and special interests. Toying with a run for president, Schultz bills himself as a centrist alternative to liberal candidates such as Warren – and mocks her tax plan as unrealistic and unpatriotic.

“It’s so un-American to think that way,” he said with all the nuance and self-awareness of a man unaccustomed to either.

But Howard – can we call you Howard? – here’s the thing: we’re starting to “think that way”. We’re starting to think that maybe it’s undemocratic for the richest 1 per cent in this country to control 40 per cent of the nation’s wealth. In the 1950s, the average chief executive made 20 times more than their employees; now, chief executives earn 361 times more – about $13m per year at the country’s top corporations.

Those 2017 tax cuts? The primary benefits went to those who were already rich.

I don’t think it really makes a big difference to someone in a steel plant whether Bill Gates is worth $10bn or $20bn

All this comes into sharper relief during tax season, when the average worker is crunching numbers and calculating how much of their annual income goes to the government. A new Politico poll shows 76 per cent of registered voters – both Democrats and Republicans – think the wealthiest Americans should pay more.

This isn’t about blaming any specific billionaire, but a growing resentment that the richest people and corporations have somehow managed to get richer while most working stiffs are just one or two missed paychecks away from a food bank. It’s not a debate about marginal tax rates or the unregulated free market: it’s a gut feeling that the game is rigged, and the middle class and the poor are losing. The average American family can barely afford to send their kid to any college, much less bribe their way into an elite university.

“I don’t think it really makes a big difference to someone in a steel plant whether Bill Gates is worth $10bn or $20bn,” says financial writer Roger Lowenstein. “It makes a lot of difference to him whether he’s making $40,000 with a good retirement plan and a good healthcare plan or whether he’s making $60,000. And those types of jobs aren’t paying as well as they used to.”

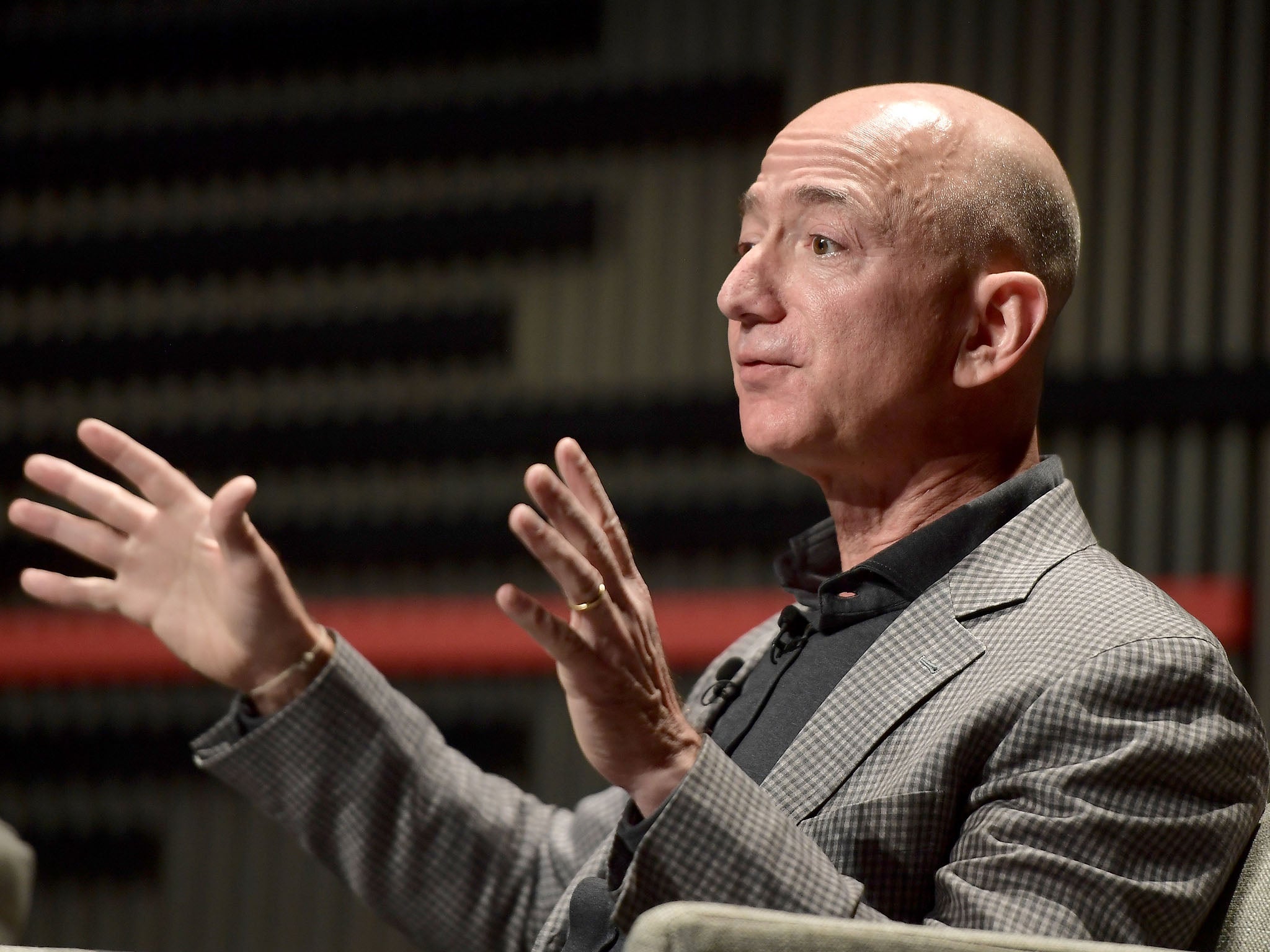

For the record, estimates are that Bill Gates is worth $97bn. Almost a third of the world’s billionaires are Americans, including the world’s richest man Jeffrey Bezos, who’s worth an estimated $131bn.

And so the question of the moment – actually, of the 2020 election cycle – is this: are billionaires contributing their fair share?

There was no federal income tax in the United States until 1913, almost two decades after congress first passed a 2 per cent income tax on the wealthiest citizens to curb the influence of big money in politics during America’s first Gilded Age. That tax was struck down in the courts, and it took a constitutional amendment to finally enact it.

A century later, leaders of the second Gilded Age are equally resistant to higher taxes, arguing that chief executives are better suited to solve America’s problems than politicians.

During a panel on inequality at Davos this year, businessman Michael Dell (worth an estimated $26bn) was asked what he thought about Ocasio-Cortez’s idea of a 70 per cent tax on any income over $10m.

The room erupted in laughter, knowing exactly what was coming.

“Wow, what a great question!” said Dell, shifting in his seat. The billionaire explained he felt “much more comfortable” donating millions through his private foundation “than giving them to the government. So, no, I’m not supportive of that,” he said confidently. “And I don’t think it will help the growth of the US economy. Name a country where that’s worked. Ever.”

“The United States,” answered Erik Brynjolfsson, head of the MIT Initiative on the Digital Economy.

What’s interesting, aside from the question of whether Dell’s personal comfort should factor into the tax code, was that he was unaware that from 1932 and 1981 the top tax rate in the US never fell below 63 per cent and rose as high as 92 per cent. It wasn’t until the election of Ronald Reagan that top tax rates dropped from 70 per cent to 28 per cent.

“For the last 40 years we have been living under a market fundamentalist ideology that you could trace to the Reagan-Thatcher revolution,” explains Anand Giridharadas, a progressive commentator and author of Winners Take All. He describes the basic tenets of that ideology: government is bad, taxes are bad, regulation is bad – but rich people are not only good but will make the world a better place.

“We now know that this kind of winners-take-all philosophy allows the very fortunate, through rigging political power to assist their economic power, to basically monopolise the future itself,” he says. “I think people are well aware that there are some people who’ve managed to get themselves on the right side of every (political) change. And most people haven’t.”

And yet billionaires, for the most part, have evaded criticism by branding themselves as great innovators, personifying the American ideals of rags-to-riches opportunity and hard work. (“If we did it, you can do it, too!”)

$131bn

net worth of Jeff Bezos, the world's richest man

The 2008 recession challenged that narrative: an estimated 7 to 10 million Americans lost their homes; 8 million lost their jobs, and the average household lost a third of its net worth. Big banks got bailouts; homeowners didn’t. Only one banker went to jail and Wall Street went back to business as usual, handing out millions in bonuses the following year.

The outrage bubbled up in 2011, when Occupy Wall Street took over New York City’s Zuccotti Park and camped out in other cities around the country. The protests made headlines with a message of economic inequality and corporate influence with the slogan: “We are the 99 per cent.”

Did anything really change? Not really. The only lasting legacy of the movement is the term “the 1 per cent”.

Then came Donald Trump, the populist billionaire who tapped into the grassroots resentment of those left behind. Trump promised to restore their jobs and their dignity using his skills as a successful businessman and negotiator, says Giridharadas. To liberals critical of the president, he “literally became the definition of the elite charade of changing the world. He became the rich guy who says he’s fighting for the forgotten man while enriching himself. Win-win.”

Trump’s $1.5 trillion tax cut package was passed in 2017, with lavish assurances the cut would boost economic growth for everybody. But the bulk of the benefits went to corporations and the richest Americans – who already have complicated portfolios of investments and deductions – not to average Americans.

In 2017, the median household income was $61, 858. According to last year’s Report on the Economic Wellbeing of US Households by the Federal Reserve, 40 per cent of adults said that they would not be able to pay for an unexpected expense of $400 without borrowing money, and 25 per cent say they have no retirement savings or pension at all.

“I don’t begrudge anybody making a million or hundreds of millions of dollars. I really don’t,” Joe Biden said last month. “But I do think there’s some shared responsibility and it’s not being shared fairly for hardworking, middle-class and working-class people.”

It’s fair to say no one likes paying taxes. Mark Zuckerberg (worth estimated at $62bn) and his fellow billionaires point to their personal philanthropy, which is all well and good but not a substitute to paying into a system for public schools, infrastructure, courts, military and public health.

What’s fair? Blackstone’s co-founder Stephen Schwarzman was paid $786m in 2017, adding to his net worth of almost $13bn. He will not pay income taxes on the majority of those earnings, thanks to tax laws, deferments and other loopholes.

We don’t know how much President Trump has paid in taxes over the years, given that he has yet to release his tax records. When Hillary Clinton attacked him for paying zero federal income tax. Trump was unfazed: “That makes me smart,” he bragged.

We now know that this kind of winners-take-all philosophy allows the very fortunate, through rigging political power to assist their economic power, to basically monopolise the future itself

That sentiment – billionaires are smart and know how to work the system, the rest of us are chumps – has sparked a new grassroots movement for the rich to pay more. Warren’s 2 per cent “wealth tax” targets people with a net worth of $50m; those with $1bn or more would be taxed 3 per cent.

“The top 0.1 per cent of Americans own almost as much wealth as the bottom 90 per cent, and the 400 richest Americans own more wealth than all black households and a quarter of Latino households combined,” she says. “I’ve been talking about this extreme concentration of wealth for a long time.”

But – and you’ll be shocked, shocked – the richest Americans have not been enthusiastic about her proposal.

In a podcast last month, Gates said that politicians were “missing the picture” because most of the rich get their money from investments, which are taxed at a lower rate. That’s why Warren Buffett (worth an estimated $82bn) famously says he pays a lower tax rate on his investment income than his secretary pays on her salary (earned income).

Two weeks ago, Buffett told CNBC’s Squawk Box that “the wealthy are definitely undertaxed relative to the general population” but fundamentally, he doesn’t want to change economic policies that worked so well for so many years: “I don’t want to do anything to the goose that lays the golden eggs.”

Former New York mayor Michael Bloomberg (worth an estimated $55bn) was more blunt about Warren’s proposed tax, saying it “probably is unconstitutional”.

“We need a healthy economy and we shouldn’t be ashamed of our system,” he said during a January visit to New Hampshire. “If you want to look at a system that’s noncapitalistic, just take a look at was perhaps the wealthiest country in the world, and today people are starving to death. It’s called Venezuela.”

Venezuela! There are many reasons for the country’s tragic collapse, but the only word that matters at the moment is “socialism”.

“Republicans and these plutocrats just love Venezuela,” says Giridharadas. “They want to convince us that the choice is plutocracy or gulags. Anyone talking about significant change in the system is a communist.”

The taunting label was the trigger word at this year’s Conservative Political Action Conference: in addition to a five-minute video denouncing progressives, socialism was the go-to word for speakers to wake up the crowd. “You know what the biggest threat to America is?” thundered former White House staffer Sebastian Gorka. “Not socialism in Moscow, socialism here! In America!”

Which brings us back to Howard Schultz. Here, in America, he’s having a hard time making the case for billionaires.

At an appearance at SXSW last weekend, Schultz said he thinks taxes should be raised on the wealthy but hasn’t figured out the details. He said economic inequality is bad, but he loves the free market and thinks progressive Democrats are pushing “socialism”. When asked to define it, he responded: “If you want a good description of socialism, just look at Venezuela.”

The audience fell silent. A few people booed. “You don’t like that?” he asked the crowd.

It appears that being a really rich CEO does not prepare you for the campaign trail. Schultz said he was still mulling a White House run: “Give me some time to kind of feel my way through.”

Tick, tock, Howard. The 2020 clock is ticking, and waits for no billionaire.

© Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments