Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

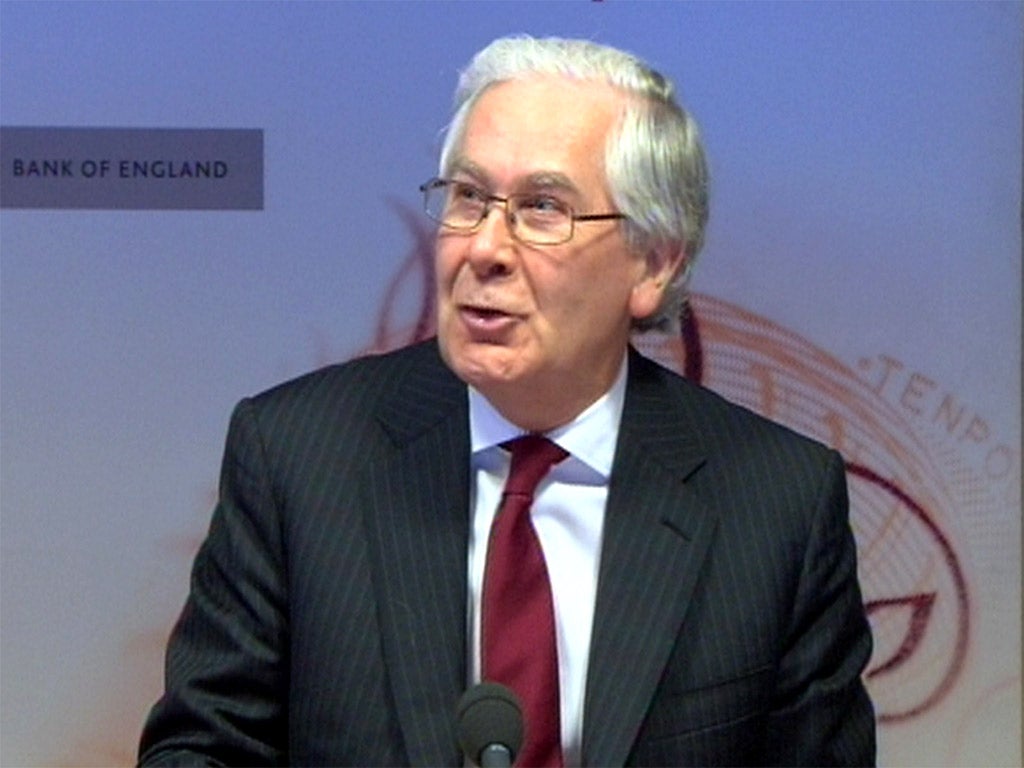

Your support makes all the difference.In 12 February 1993 the Bank of England summoned journalists to a press conference to unveil something described as an "Inflation Report". This turned out to be a dense, but impressively clear, document laying out the central bank's forecasts for the path of prices and growth for the UK economy over the coming years. And, for the first time, the Bank tried to explain what economic judgments underpinned those forecasts. The press conference was chaired by a 45-year-old former London School of Economics academic called Mervyn King, who had been appointed as the Bank's chief economist in 1991.

The Inflation Report was very much Mr King's baby. He was determined to inject some academic rigour into the Bank's analytical work in the aftermath of Black Wednesday the year before, when sterling had been forced out of the European Exchange Rate Mechanism. That debacle had shaken confidence in the competence of policymakers at the Treasury, but also those at Threadneedle Street. The Inflation Report, which was to be published every three months, was part of Mr King's plan to sharpen the Bank's analytic output and also to assist policymakers in their new determination to target inflation. In 1997 the Bank was granted operational independence over hitting the target and Mr King was promoted to deputy governor. Yet he carried on chairing the Inflation Report presentations just as before. Mr King even continued heading the meetings when he succeeded Eddie George into the Governor's chair in 2003.

But nothing lasts forever. Yesterday Sir Mervyn (he was knighted in 2011) delivered his 82nd and final Inflation Report. The Governor, who retires at the end of next month, has not missed a single of these quarterly press conferences in 20 years.

Sir Mervyn is known to regard the Inflation Report, and the clarity the document brings to the debate over economic policymaking, as a pillar of his legacy. But how does that particular pillar look? In the "nice" decade (Sir Mervyn's acronym for "non-inflationary consistently expansionary") that followed Britain's emergence from the recession of the early 1990s, the Inflation Report seened to perform very well. It accurately forecast a stable rate of inflation and strong growth. But since 2007 things have gone awry on the forecasting front. The report's estimates for inflation and growth have been wildly out. Consumer prices inflation has been consistently higher than the Inflation Report forecasts (and well above the Bank's official 2 per cent target).

The Inflation Report, also, failed to anticipate the most severe downturn in gross domestic product since the 1930s when the economy plummeted like a stone in 2008. And growth has fallen well short of the Inflation Report forecasts pretty much ever since. Indeed yesterday saw the first (modest) upward revision in an Inflation Report growth outlook since before the financial crisis. All the rest of the revisions have been downward, as the Bank has been forced to respond to weak output data flowing out of the Office for National Statistics.

To critics this record suggests something has gone fundamentally wrong with the Bank's economic analysis, steered by the hands-on Governor. Policy inflation hawks argue the Bank has been too complacent about price pressures. Policy doves, who focus on growth, on the other hand, say the Bank has underestimated the impact of George Osborne's investment spending cuts on output and confidence.

Sir Mervyn doesn't accept either charge. He responds that the Bank was rocked by an unforeseeable global spike in energy prices and also the eurozone crisis. The Governor has also grumbled over the inflationary impact on consumer prices of the Coalition's decisions to hike Value Added Tax and to triple tuition fees. The trouble with this defence is that Inflation Reports continued to be optimistic on growth even after the eurozone crisis broke out and oil prices shot up. And the Government's VAT and tuition fees hikes hardly came out of a clear blue sky. Both were well flagged.

One defence of the Inflation Report that sidesteps the troublesome forecasting record is that the public's inflation expectations remain well anchored despite persistent CPI overshoots. People don't expect prices to spiral upwards as they did in the 1970s. Some credit the Inflation Report and the openness of monetary policymaking under Sir Mervyn for that.

Yet when it comes to analytical openness, the Inflation Report has been overtaken by the Office for Budget Responsibility, the official independent Treasury forecaster established by the Chancellor in 2010. The OBR's forecasts provide considerably more granular economic detail than the Inflation Report.

Last year an independent review of the Bank's forecasting by David Stockton, a former Federal Reserve official, also pointed to shortcomings in the Inflation Report process.

Sir Mervyn is going to miss his quarterly press conferences. "They are the probably the one event I look forward to, and prepare most hard for, and believe to be most valuable," he said yesterday. They aren't going anywhere of course. In August, for the first time ever, the Inflation Report will be chaired by someone other than its creator when the Canadian Mark Carney takes the helm at Threadneedle Street.

But there will be changes. In his confirmation hearing in Parliament this year Mr Carney described the Inflation Report as "best practice when it came out" and made it clear that there were improvements to be made. We now wait to see how much of the King's baby will be thrown out with the bathwater by his successor.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments