Is the UK really set to drop out of the world’s top 10 economies by 2030 – and does it matter?

How plausible are these predictions? What assumptions are they based on? And what real significance does any of it have? asks Ben Chu

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

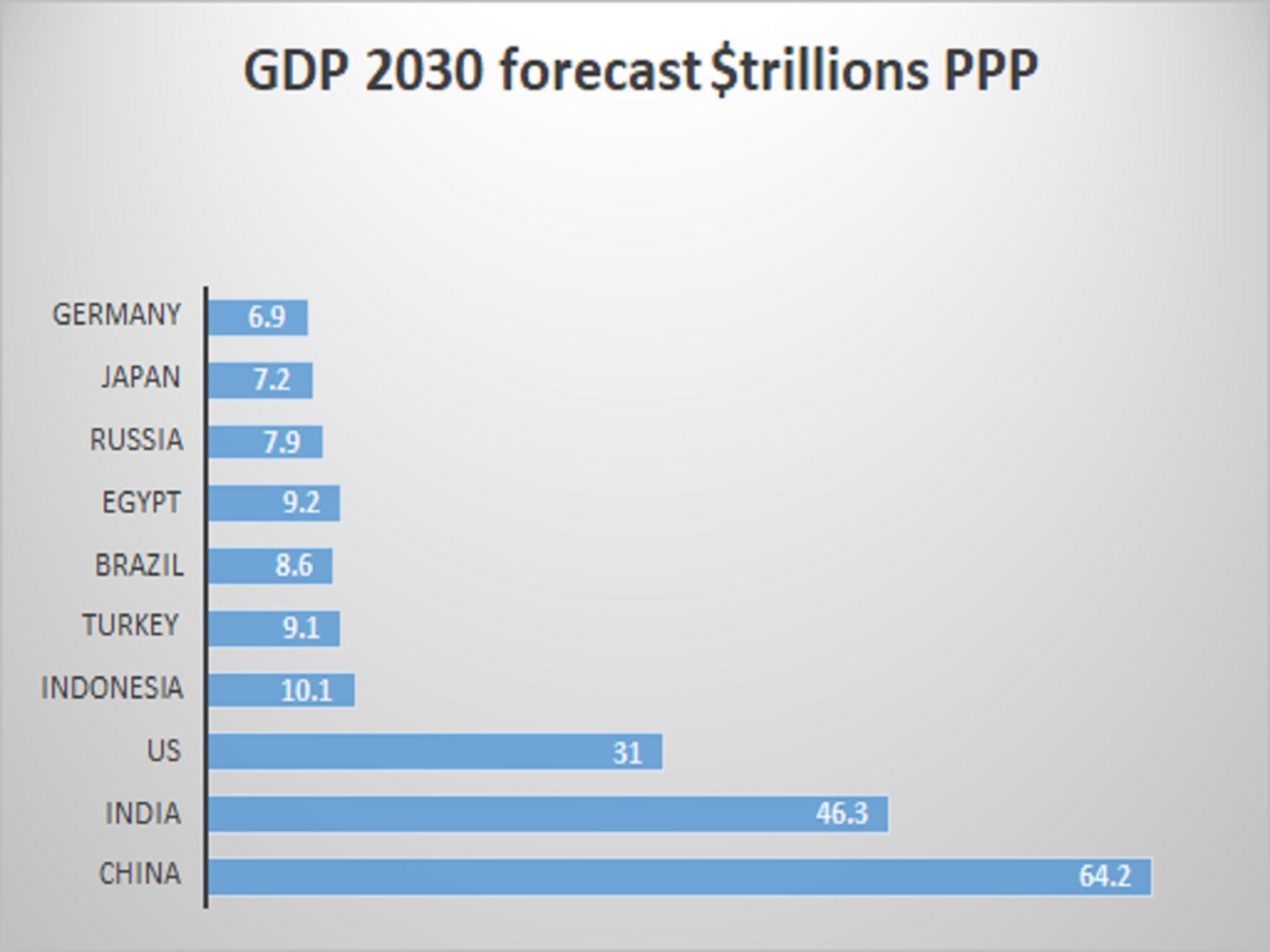

Your support makes all the difference.China and India will be the two biggest economies in the world by 2030, according to a report by analysts at Standard Chartered bank.

The US will be a distant third and the UK will not even be in the top 10.

Countries such as Indonesia, Turkey, Egypt and Brazil will all be higher than us on the list.

But how plausible are these predictions? What assumptions are they based on? And what real significance does any of it have?

What precisely is being measured here?

The answer is Gross Domestic Product (GDP) and the exchange rate used is something called Purchasing Power Parity (PPP).

Standard Chartered’s projections suggest the size of the Chinese economy in 2030 on this measure will be $64.2 trillion, India’s will be $46.3 and the United States’ will be just $31 trillion.

What is Purchasing Power Parity?

A US dollar generally goes much further in poorer countries than in richer ones – something anyone who has, for instance, eaten out in Thailand or bought something from a market stall while on holiday in Morocco will know.

When one makes a statistical adjustment for this fact of diverging purchasing power, the measured size of a less developed economy rises. This is GDP at PPP.

Using the measure, China is already larger than the US, having surpassed America in 2015.

And Indian output at PPP actually surpassed that of the UK way back in 1995.

Is there another way of measuring the size of an economy then?

Yes. One could use simple market exchange rates.

By this measure the US is still today the world’s biggest economy, with a $7 trillion lead over China.

Using market exchange rates rather than PPP would also most likely change the 2030 picture.

The International Monetary Fund does not forecast beyond 2023, but at this date the Fund thinks the US will still be the world’s largest economy at market exchange rates and that the UK will still have a comfortable lead over the likes of Indonesia, Turkey, Brazil, Russia and the rest with little evidence of catchup.

India, however, will surpass the UK even at market exchange rates in the coming years.

Which is the better measure?

Views are divided. Some economists argue market exchange rates give a better indication of the relative importance of national economies in the global trade and financial system.

This is certainly the measure that financial traders mostly use.

The PPP adjustment is also based on global surveys to measure relative purchasing power which are conducted only irregularly and infrequently and which are inevitably sketchy.

But other economists argue that PPP gives a better indication of shifts in a developing country’s domestic consumer demand.

“PPP is generally regarded as a better measure of overall wellbeing,” says the IMF.

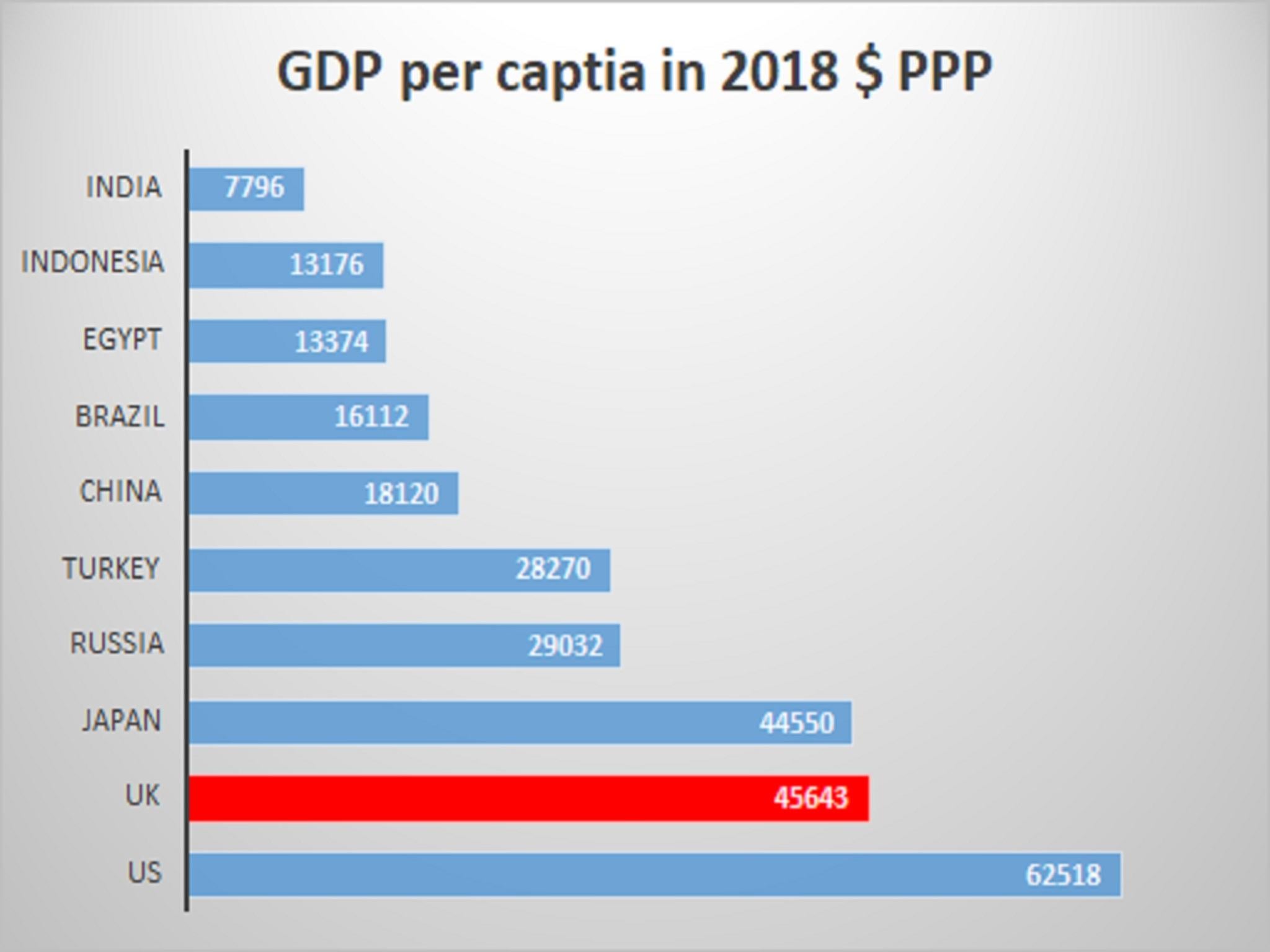

Yet, leaving aside this debate, the important thing to recognise is that neither measure gives an indication of average living standards in each country, of a country’s general level of prosperity.

The reason why China is larger than the US at PPP exchange rates is because it has a population four times larger.

If one measures GDP at PPP per person a very different picture emerges, with China on $18,000 and the US on $63,000.

And the UK is doing far better than India with a GDP at PPP per capita of $46,000 versus just $7,800.

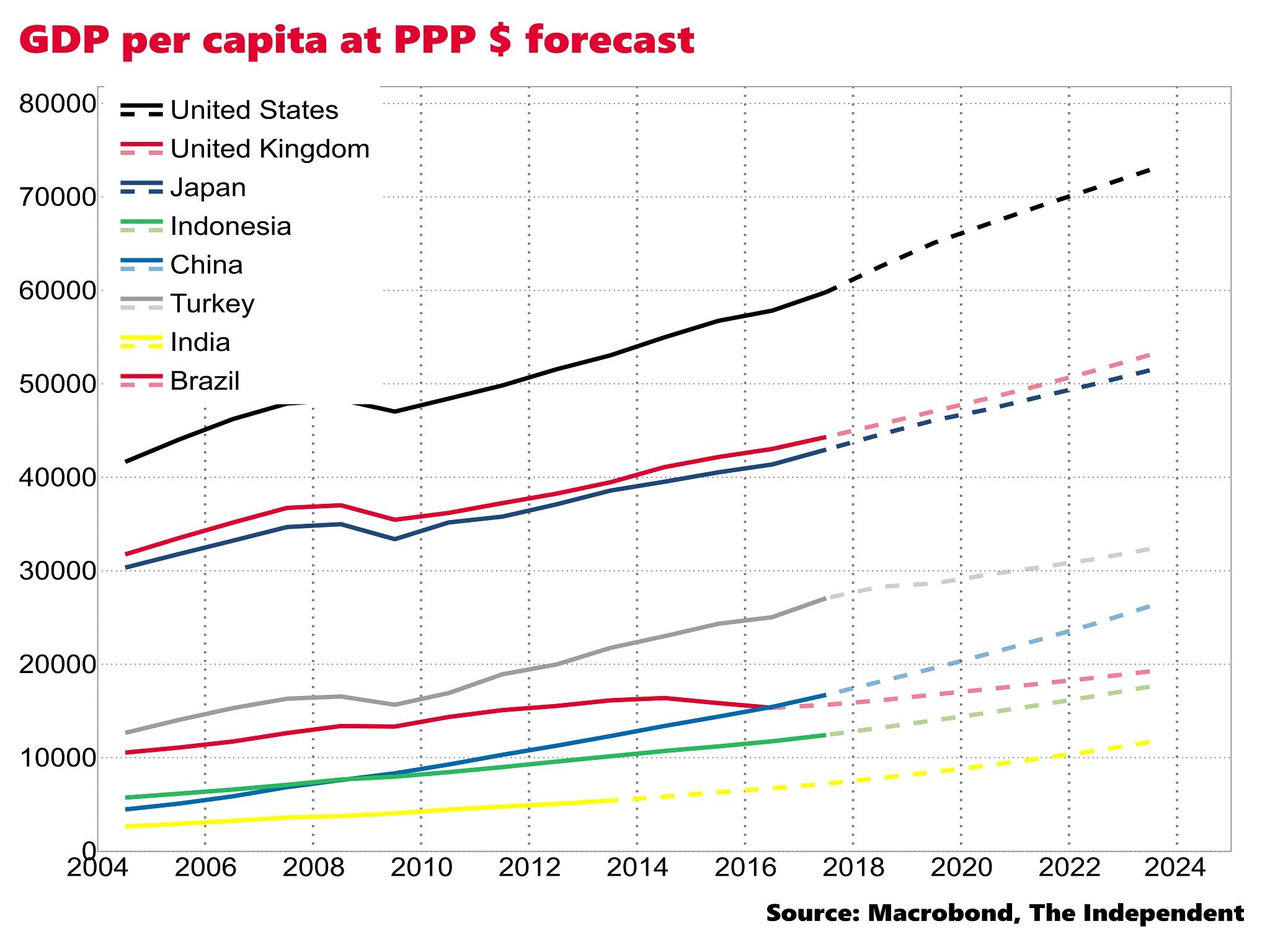

Moreover, on the IMF’s projections over the next five years there is little sign of catchup on this metric between the US and the UK and those developing world countries. Not even China gets close.

We can pretty safely predict that people in the developed world will, on average, still be much better off than those in developing countries in 2030.

How plausible are these projections?

Standard Chartered says its forecasts are “underpinned by one key principle: countries’ share of world GDP should eventually converge with their share of the world’s population, driven by the convergence of per-capita GDP between advanced and emerging economies”.

This isn’t unreasonable. As developing countries deploy the productivity boosting technologies of the rich world, they should, in theory, become more productive and their growth rates should be more rapid.

This is why China has had a double digit GDP annual growth rate for the past 20 years but growth rates in Europe and the US have been below 3 per cent.

And ultimately countries with bigger populations should have bigger national economies, whether measured by market exchange rates or PPP.

Yet, assuming an uninterrupted catchup path for poorer countries is questionable, crises are inevitable. A few years ago many economists were projecting rapid growth in Brazil, but instead the country fell into a savage recession. One cannot rule out such a temporary reversal for China or India.

There has also been a clear tendency for developing countries to get stuck in a “middle income trap” where, after rapid growth up to a certain level, developing countries seem unable to make the leap to developed world per capita incomes.

Indeed, avoiding this trap has become an obsession for Chinese policymakers in recent years. They are not assuming a straight line to prosperity, even if some western bank analysts are.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments