Property prices: meet the planet’s super-rich making a mint in the UK

UK real estate now makes up a sizeable chunk of the wealth of the world’s billionaires

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Property has long been regarded as a playground for the rich – an arena where house and office developers make big profits.

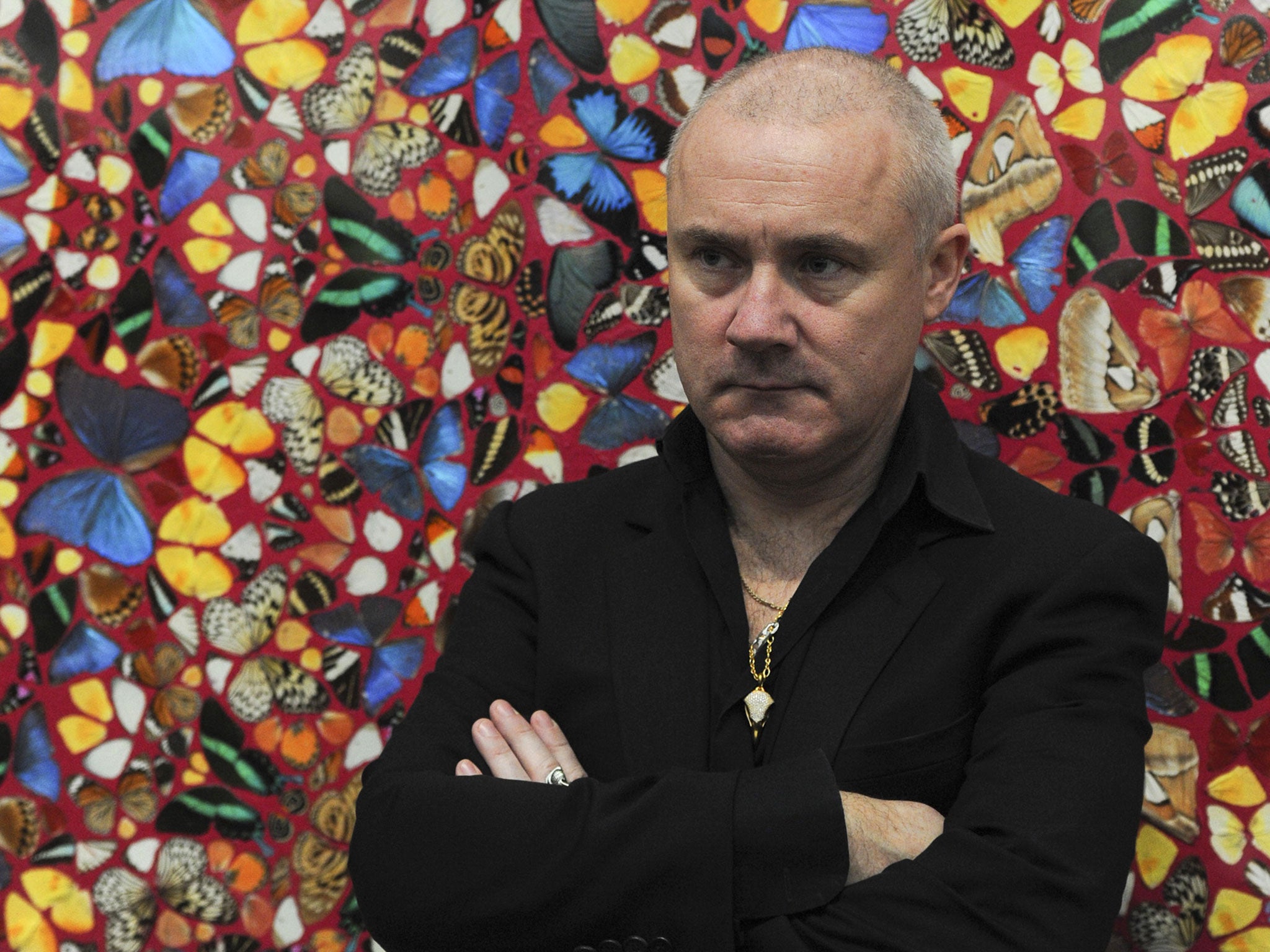

The combined wealth of British real estate’s top 250 investors has topped £300bn for the first time, research shows today. But in a surprising twist, it turns out some of the biggest buyers do not have a background in bricks and mortar. Instead international retail gurus, chief executives of non-property companies and even the artist Damien Hirst are among some of the most prominent property barons today.

Estates Gazette magazine’s Rich List 2015, shows that the total wealth of the top 250 is £306bn – a 40 per cent hike on 2014.

While this does not solely include real estate holdings, an inspection of the top 10 investors shows a tranche of their fortune does indeed come from UK property – around £10bn.

The trade magazine’s list, compiled by Philip Beresford, features 60 billionaires this year. Just six years ago there were only nine entrants with wealth of more than £1bn

So who are these prominent investors. What do they own here? And what’s their background?

The Spanish billionaire Amancio Ortega, owner of the fashion empire Inditex, tops the Estates Gazette list with a fortune of £45.7bn.

The son of a railway worker and famed for founding the Zara chain, some of Mr Ortega’s wealth includes more than £1.3bn worth of London property.

In April, through his investment vehicle Pontegadea, he snapped up a £400m stretch on Oxford Street including retail space, adding to a number of office buildings such as Devonshire House opposite the Ritz.

Notoriously secretive, Mr Ortega does not discuss his property empire. But West End agents believe he wants part of the space to house some of his fashion brands, such as Pull and Bear. Meanwhile, office rents reaching £150 per sq ft in parts of the capital mean he has a steady income and safe haven for some of his wealth.

At number two is Wang Jianlin, the boss of China’s largest commercial property company, Dalian Wanda. His luxury flats and hotel project, One Nine Elms in London’s Vauxhall, is due for completion in 2016-17 and has been financed to the tune of £700m, contributing to Mr Wang’s £22.7bn wealth, according to Estates Gazette.

Riding high too is the Duke of Westminster – the net asset value of his property business Grosvenor Group recently surpassed £4bn.

Also in the top 10 are a host of other international investors like Mr Ortega, whose primary or founding business is not property.

Crosstree Real Estate was established in 2011 and is now worth about £375m. It was launched as part of the empire of the Swiss-Italian pharmaceuticals billionaire Ernesto Bertarelli and his family. British purchases include a council office in King’s Cross, north London, where Crosstree will link up with the hip American hotelier André Balazs for a boutique hotel.

Mr Bertarelli is also rumoured to be eyeing a deal involving the O2 arena in London. Crosstree is believed to be looking to spend around £100m on a 50 per cent stake in the retail and leisure element of the Greenwich landmark, where it would set up a retail outlet.

Meanwhile, in November 2014, Safra Group, controlled by he Brazilian banking billionaire Joseph Safra, made its debut London property purchase, forking out £726m to buy The Gherkin tower in the heart of the City.

Noella Pio Kivlehan, the Estates Gazette Rich List editor, says the UK – and London in particular –is a big target for overseas money.

“The market is transparent and it has many unrivalled trophy buildings which appeal to foreign investors. Not only are they a safe investment, but they look good in their portfolios” she says.

International money makes up a large proportion of the Rich List, with 109 entrants hailing from the UK, 16 from Ireland and the remainder from Spain, China, Hong Kong and Switzerland.

The magazine says property in the UK is viewed worldwide as a safe haven from the sort of domestic financial worries that have beset Chinese investors, for example.

But it’s not just skyscrapers that are in demand. At number four on the list, Thomas and Raymond Kwok of Hong Kong’s Sun Hung Kai Properties agreed to team up with FTSE 250 landlord Capital & Counties in 2012 to build flats that form part of the £8bn transformation of Earls Court in west London.

“It’s not just the ‘old’ trophy buildings that appeal. Foreign investors are creating modern- day trophy assets” adds Ms Pio Kivlehan.

The wider list does also, of course, feature a number of traditional property names, such as Steve Morgan, the boss of housebuilder Redrow, developer Gerald Ronson, and Fawn and India Rose James – the granddaughters of the late porn magnate Paul Raymond, who amassed a number of buildings in Soho.

Elsewhere, a number of famous names who made their money in other sectors, such as retail and computers, and are now ploughing part of their wealth into property assets. These include Sports Direct founder Mike Ashley and Lord Sugar.

But one of the more unlikely names to feature is Damien Hirst. “The artist owns at least 18 properties in Britain and two abroad,” Estates Gazette says. In one project he designed an estate of 500 eco homes in Ilfracombe, Devon.

The Monopoly board is open to all.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments