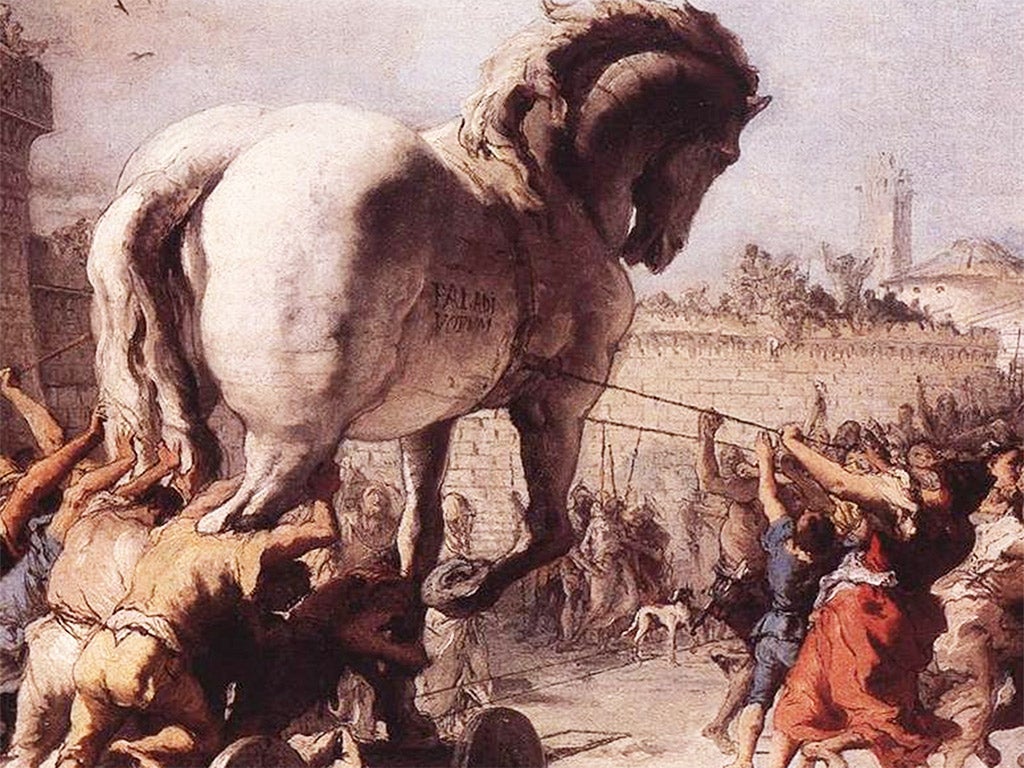

The private equity giants, the Greek target and a ‘Trojan horse’

Luxembourg court to hear allegations that Apax and TPG ‘plundered’ for profit

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The aggressive tax and financing structures used by London private equity giants will come under intense scrutiny in a crucial court hearing in Luxembourg on Wednesday.

In what will be perhaps the most high-profile case in the tax haven since the hugely embarrassing “Luxleaks” documents on tax avoidance last year, three judges will hear final arguments in a multibillion-dollar case arising from the collapse of two telecoms companies bought, loaded with debt and then sold by Britain’s Apax Partners and TPG of the US.

Apax and TPG bought the Greek mobile phone companies TIM Hellas and Q-Telecom in the mid 2000s for €1.98bn (£1.4bn at today’s exchange rate), basing the new holding company for the combined business in Luxembourg. Most of the purchase money was borrowed, with the private equity firms putting in only €390m of their own funds’ money, according to court filings.

A year later they tried to sell the business but could not find any bidders at the price they wanted. Instead they made TIM Hellas issue €1.4bn of debt, using the proceeds to redeem complicated tax-efficient securities known as Cpecs that they held in the business. TIM Hellas paid such a high price for those Cpecs that the process resulted in the private equity funds and other Cpec investors extracting nearly €1bn of cash from the company.

Having loaded TIM Hellas with debt, they sold it on in 2007 to an Egyptian investor for €3.4bn, only for it to collapse two years later into administration through the London High Court.

Critics say the debt burden left by its owners made TIM Hellas’s collapse inevitable, although the private equity firms deny this, blaming the financial crisis and changes in telecoms law instead. The UK liquidators are now pursuing Apax and TPG for the money they made when TIM Hellas redeemed their Cpecs – a move that creditors say stripped €974m from the company.

The liquidators – Andrew Hosking and Simon Bonney – have said in a New York legal claim that the Cpec deal represented “duplicitous and catastrophic plunder” of the company. They claimed that the takeover of the business – which the private equity funds gave the secret codenames Project Troy and Project Helen – was in fact “a state-of- the art Trojan horse designed to financially infiltrate TIM Hellas and Q-Telecom and then systematically pillage their assets from within by piling on debt in order to make large distributions to equity owners”.

The private equity firms deny this claim and describe it as “an outrageous mischaracterisation of events”. That case is due to be heard in New York next year.

Meanwhile, in Luxembourg, Mr Hosking and Mr Bonney are pursuing the directors who TPG and Apax installed to run TIM Hellas for permitting the Cpec transaction in the first place.

Their Luxembourg lawsuit characterises the Cpec redemption as having been done at an “astronomical price” and says the trade was “abusive”– claims that Apax and TPG strongly deny.

The liquidators will also argue in court that the Cpec deal broke Luxembourg laws banning companies from distributing money to shareholders when there is not an adequate pot of profit in the business from which to make the payout. In effect, the liquidators argue, the money was a dividend and should not have been taken from borrowings under Luxembourg tax law.

They are expected to cite a recent Luxembourg ruling that the payment was a “hidden dividend”, which should be subject to a €200m tax bill to the Luxembourg state.

One creditor to TIM Hellas, SPQR Capital’s Bertrand des Pallieres, told The Independent: “This case reveals the private equity industry at its very worst. Apax and TPG loaded up Hellas with debt and used the proceeds to hand themselves huge distribution payments. This was immoral and illegal, as we will tell the Luxembourg court. You cannot pull €1bn out of a company that has no reserves. It was a greedy and cynical manoeuvre that left creditors and the company itself stranded.”

But the private equity firms strenuously reject those claims, saying in a joint statement: “All aspects of the December 2006 refinancing were made crystal clear to noteholders at the time, including the resultant debt level, the use of the funds raised and the sum to be paid to investors.”

They say it is “entirely misleading” to blame the collapse of TIM Hellas on the debt pile they left it with after the refinancing. They point to the company’s own insolvency filings, which blamed the economic crisis and new telecoms laws.

At 3pm on Wednesday, a panel of three judges from the 15th division of Luxembourg’s commercial court will, in open court, hear the final, oral arguments of the two sides.

The case in the New York bankruptcy court is focusing on how much the private equity firms got TIM Hellas to pay for their Cpecs. Despite being little over a year old, they were valued at 35 times their par value – a figure the liquidators describe as “preposterous”. TPG and Apax say they were completely open about the valuation to bondholders.

Whatever the judges decide, an unwelcome light has been shone on how the private equity industry makes its money in tax havens like Luxembourg.

The investor: Nikesh Arora

The TIM Hellas case has also engulfed Silicon Valley billionaire Nikesh Arora, one of the directors put into the company by Apax and TPG. The former Google executive, 47, was named as a defendant in the US case by the liquidators because he was one of the Cpec holders alongside TPG and Apax, raising more than €1m when TIM Hellas bought them. He is since understood to have reached an out-of-court settlement.

Since then, questions have been asked about his dealings at SoftBank, a Japanese telecoms investment group where he has been vice chairman for the past seven months. Mr Arora has pledged to spend $483m (£316m) buying shares in SoftBank. A source has claimed to The Independent that he will raise the bulk of this through a loan, allegedly on expectations he will be paid at least $50m a year for five years. Mr Arora lives in a $20m villa in Atherton, California and a flat in Belgravia.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments