Network Rail: Paranoia, bonus bungles and debt

The latest board minutes from the UK's major infrastacture organisation reveal a business troubled by its public perception and on the brink of a £14.5bn bond catastrophe, reports Mark Leftly

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The board minutes of Network Rail, the government-backed body that owns and operates Britain's most vital track and 17 major stations from Glasgow Central to Waterloo, usually make for turgid reading.

For example, in June chief executive David Higgins, who had recently taken over after getting the London Olympics built on-time and to within its revised £9.3bn budget, informed colleagues that the Jubilee weekend had "gone pretty well". On 20 September, finance director Patrick Butcher pointed out that "cost efficiency measures were almost on target".

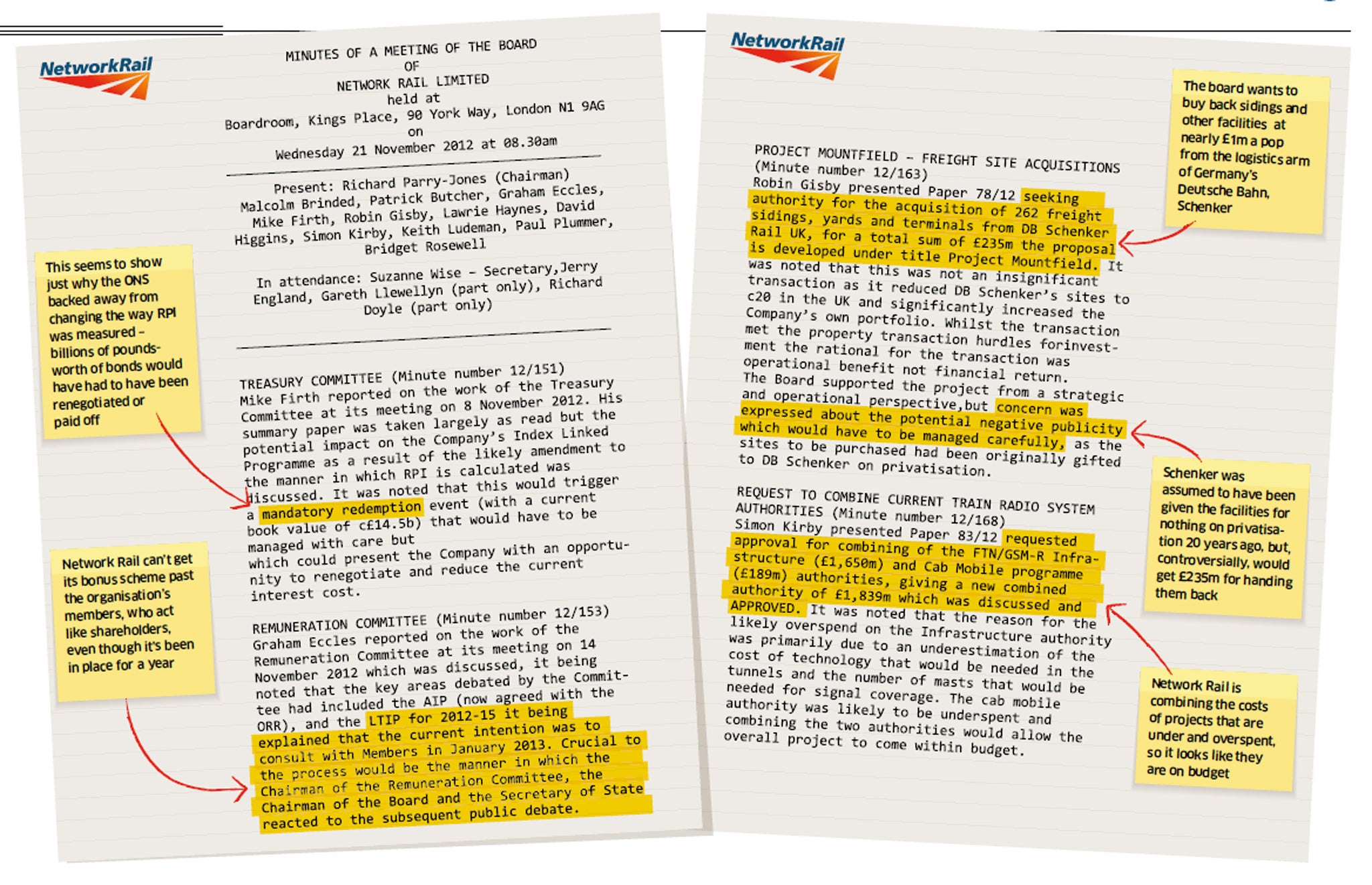

And then, as if from nowhere, minutes of an extraordinarily revealing board meeting of 21 November are published deep in Network Rail's website. They show an organisation that was close to having to renegotiate £14.5bn of bonds, an unresolved bonus structure, controversial re-purchasing of assets privatised nearly 20 years ago, what one finance source describes as accounting "jiggery pokery", and a near-paranoia about media interpretation of its work.

At 8.30 that Wednesday morning, Mike Firth, a non-executive director who was once head of corporate banking at HSBC, delivered the jaw-dropping news that any changes to the way the key inflation measure, the Retail Price Index, was calculated could "trigger a mandatory redemption event".

At the time, the Office for National Statistics had questioned the methodology behind RPI, which most commentators expected it to alter this month. There was widespread surprise when the calculation was left untouched, the ONS rather cryptically adding that it had to "balance competing user needs in developing its recommendations".

A change to RPI would have fundamentally altered the terms of Network Rail's bonds, leaving one of the country's most strategically crucial organisation's having to renegotiate or repay £14.5bn used to fund capital expenditure.

An industry source argues that the government, which provides Network Rail with financial guarantees to ensure it gets good borrowing terms, might have had to step in and help Network Rail pay back the £14.5bn.

A Network Rail spokesman says: "If the ONS had announced a new RPI index and the change was considered 'fundamental' and 'materially detrimental' then we would have had to try and agree a change to the RPI index so that neither the issuer or note holders were in no better or worse position than if the index change had not occurred.

"If agreement could not be reached then there would have been a risk of mandatory redemption."

Network Rail boasts that it is "run like a listed company". Yet it's difficult to imagine any large Plc that would have failed to agree a bonus scheme before the period that it was due to come into force.

The organisation's long-term incentive plan covers 2012-15, yet the board's minutes show that executives weren't due to "consult with members", who act like shareholders, until this month. Reports in December suggested that Network Rail is considering a package that could see executives earn 125 per cent of salary. This would see Higgins, for example, get up to £700,000 on top of his £560,000 basic salary.

"If they haven't got the scheme set up in 2012 that means there isn't much of an incentive for management in the first year," chuckles a senior rail figure.

The Network Rail spokesman concedes that "we have tried but have yet to have full stakeholder support" for the incentive plans and that a resolution might not be possible until the annual general meeting in July.

However, at least the minutes seem to show that the board acknowledged how contentious the bonus issue could be in the wake of last year's shareholder spring. They said that "crucial to the process" would be reactions, including that of Transport Secretary Patrick McLoughlin, to the "public debate" about their bonuses.

Indeed, the board is clearly concerned about public perception. One example relates to how the organisation does not pay a dividend to its members, which differentiates them from shareholders of a conventional company.

When discussing what amounts to a bit of internal accounting the word "dividend" is used. It seems unlikely that anyone would question Network Rail's wording here, yet the minutes state that "consideration of the 'not for dividend' brand would take place".

More seriously, "concern was expressed about the potential negative publicity which would have to be managed carefully" in relation to Project Mountfield. This was a plan to buy 262 freight sidings, yards and terminals from DB Schenker UK for £235m.

The senior rail source's reaction to that pricetag shows why the board was so concerned. He argued that such assets were almost certainly not worth nearly £1m each when they could not easily be used for other, perhaps more profitable operations, such as housing shops.

Worse still, the minutes stated that Schenker was "originally gifted" these assets on privatisation. At the time Schenker was known as English, Welsh and Scottish Railway but was bought out by Germany's Deutsche Bahn in 2007. "The taxpayer will have effectively paid twice for those sidings, handing them over for nothing and then spending money getting them back," laughs the source.

However, the spokesman says that Network Rail has since discovered that a commercial transaction did take place, but has no records on how much Schenker paid for them. Besides, following a consultation process with industry and members, Network Rail has decided not to pursue this plan, though it might still buy back "a portion" of the sites.

Later that meeting, Simon Kirby, the managing director for infrastructure projects, requested – and received – approval to combine a £1.65bn and £189m programmes relating to train radios. The former was overbudget as the cost of technology needed in tunnels and the number of masts used for signal coverage had been underestimated, while the latter was underspent.

Kirby argued that combining the two "would allow the overall project to come in within budget". While this is certainly true, a finance source argues that this can only be considered "jiggery pokery" used to disguise problems in key infrastructure projects.

Network Rail dismiss this accusation, claiming that there is "no biggy here". The spokesman argues: "At the end of the day we operate a 'single till' approach where some projects cost more than we estimate and some less but, so long as we deliver the outputs required by the regulator at the end of the five years for the budget set, it doesn't matter how we balance things in the interim."

No doubt, the famously calm Higgins will think that none of these issues are particularly major. However, outsiders do not agree, amazed at how close Network Rail came to having huge problems with £14.5bn of bonds and why the bonus scheme appears to be in such disarray.

The last board meeting was due to be held on 15 January. In the past, few have been particularly excited about what the next published minutes will say, but after the revelations from November, they will be required reading for anyone wanting to know how Network Rail is run.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments