Hamish McRae: Working out how to quit QE will be new boy Carney’s first challenge

Mark Carney begins work at the Bank of England tomorrow. There is a great temptation, as you can see from the stuff that is being written about the appointment, to see this as leading to a significant shift in policy – something that will enable the UK economy to reach “escape velocity”. The fact that the Bank has been given additional responsibilities for regulating the banking system, making the job on paper at least more powerful, increases the temptation.

There are, however, two problems with this. One is the common sense objection that he is just one vote on the monetary committee, primus inter pares perhaps, but the outgoing Governor, Sir Mervyn King, was in the minority on several occasions, including his last meeting. The new Governor has to persuade.

The other problem is that the developed world is about to begin the long march back from the exceptionally easy monetary policies that have dominated for the past five years. Global monetary policies move loosely in step.

Whatever we do in Britain will be part of a much wider movement and we are only the third most important players in that. The Federal Reserve and the European Central Bank (ECB) both matter more, simply because they are dealing with a larger chunk of the world economy. (So too does the Bank of Japan but the Japanese are so different from the rest of the developed world that what they do will not have huge impact beyond Japan itself.)

At first sight the Fed and the ECB appear likely to move in different directions. The Fed looks like starting to tighten policy later this year, and the intimation of that by its chairman, Ben Bernanke, 10 days ago has certainly spooked the bond markets. His message was that though interest rates would remain very low, the Fed would probably start to taper down its monthly purchases of treasury bills later this year and end them in 2014.

Other board members have since been trying to soften his remarks, saying basically that the Fed would only start tightening as and when data supported such a policy. Actually, that was implicit in what he said, so I think the sharp reaction was more that his remarks were a trigger making people aware that the next five years will be different from the past five than anything else.

By contrast, policy at the ECB is frozen at the moment by the need to protect the weaker parts of the eurozone. Germany probably will need higher interest rates in the coming months; indeed, some argue that in an ideal world it would already have higher rates. But the ECB has, of course, to set a single rate for the entire region, which inevitably means that some parts have the wrong rate.

Right now there are tiny signs of a recovery in consumer confidence, but they are uneven and in the Club Med countries from a very low level. But a year from now, the ECB may find the pressure to start tightening will be irresistible.

What does this mean for us? The dominant feature of the next five years (Mark Carney has said he will step down after five years) will be this global movement back to tighter money.

The rise in long-term interest rates, one aspect of that movement, has already begun. In fact you could argue that it began last summer, for US and UK government bond yields hit their lowest point then, though it only really started motoring in the past month.

The trick will be to tighten policy in the gentlest, most cautious way, so that we avoid choking off the present modest signs of growth as they feed through to the rest of the economy, but also avoid scaring the markets and the business community by not doing enough.

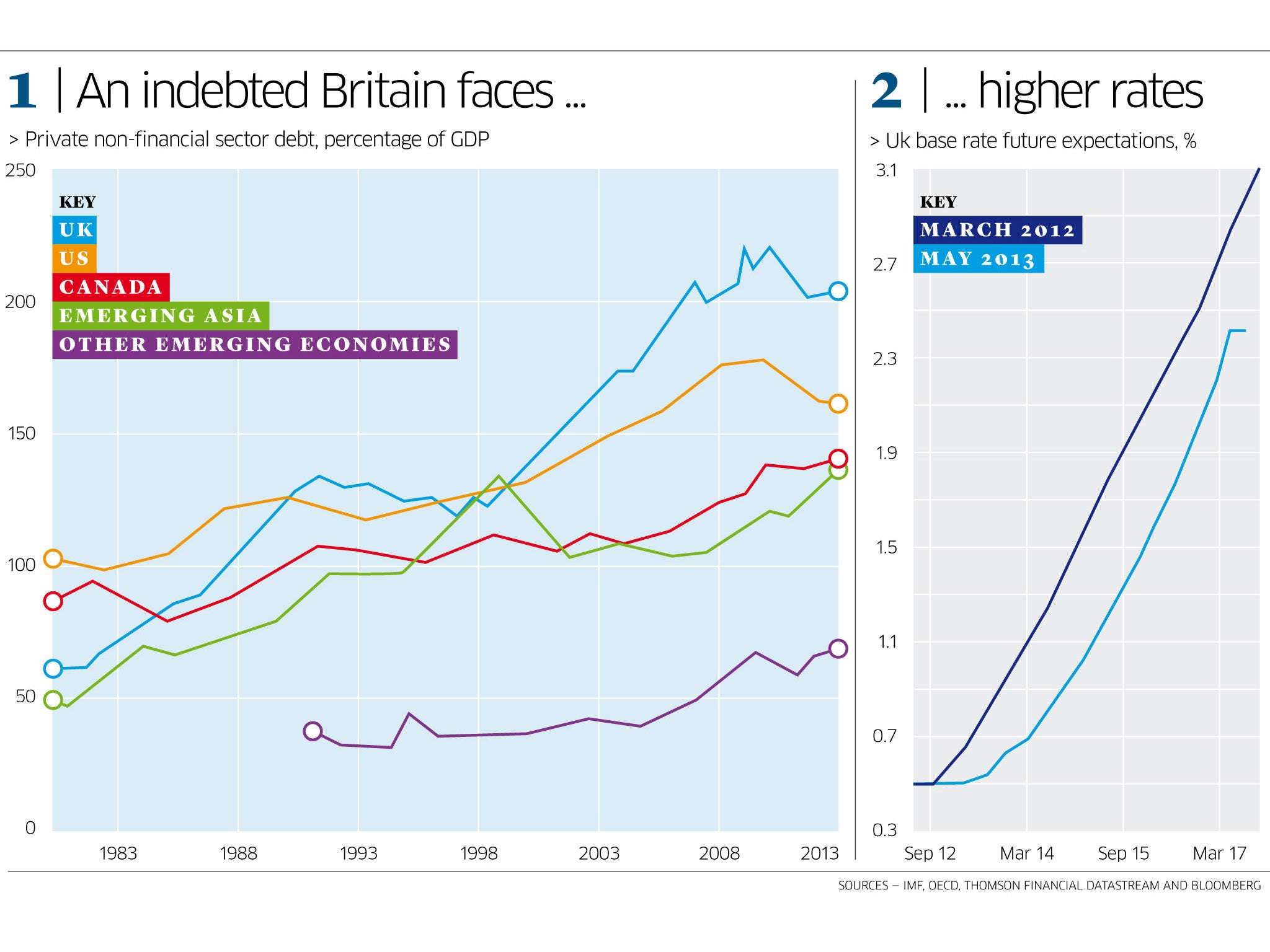

You can see the need for caution in the main graph. That shows private-sector debt (excluding that of banks and other financial institutions) for a number of different countries and regions.

As you can see we are top of this particular league table. Through the 1990s our debt levels were much the same as those of the US. Then we both went on a borrowing binge, but our binge was even more excessive than that of the Americans. Both have come back a bit, but the fact that we remain so indebted means that any significant rise in rates would have a devastating impact. (Canadians, note, have been much more responsible, while the emerging world, ex-Asia, has very low debts indeed.)

So rates have to rise slowly. How slowly? Well, expectations have shifted sharply in recent months. In the small graph you can see what has happened to interest rate expectations between March and May. Thus in March it was expected that base rates would not get back even to 1 per cent until 2016; by May that had shifted a year forward to 2015 – still you might think a fair way off, but I suspect coming forward still further now.

The risks of tightening too quickly are obvious; the risks of tightening too slowly, less so.

But as the new Bank for International Settlements annual report states, that long period between 2003 and 2007 when policy was too loose helped create the disaster that followed. It argues that there is a case for policy to have started tightening already and notes that the longer the tightening is delayed the bigger the challenge becomes.

My own feeling, for what it is worth, is that the case for ending quantitative easing in Britain is simply that it seems to have become ineffective in boosting demand but is starting to show through in asset prices such as housing. Figuring out how to exit will be the first challenge for Mr Carney, but that, of course, is precisely why we hired him.

Welcome!

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks