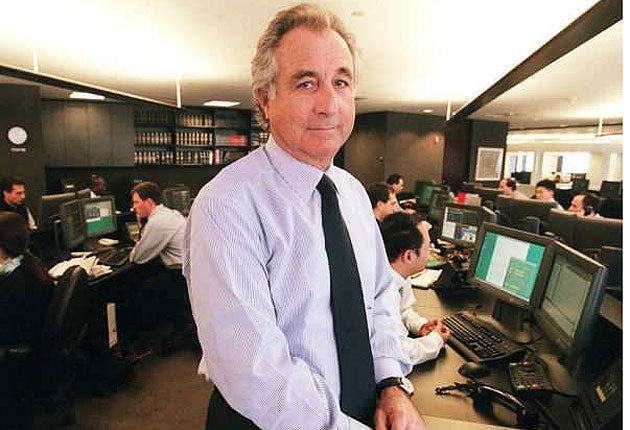

Feted by the rich, Madoff was a schemer supreme

In the Florida resort Bernard Madoff called home, neighbours trusted him with their nest eggs. Stephen Foley investigates

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Bernard Madoff didn't defraud just anyone. This was an elite conman, a man with impeccable credentials built up over decades, circulating in a rarefied world where the rich and famous courted him for access to his miracle-grow investment scheme. Mr Madoff was no hawkish salesman. He often turned down the country club members competing to throw money at him.

The shame of being rebuffed was matched only by the pride of those who were let in, and were able to boast that, yes, their fortunes were in the hands of one of the finance world's best-respected grandees.

Palm Beach, of course, is a world consumed by these issues of who's in and who's out, where one's social viability depends on being on the most exclusive dinner-party circuit, owning the best waterfront house, patronising the most respected charitable boards, and attending the right clubs. And it was in this Florida resort, golfing retreat and retirement paradise for the East Coast wealthy, that Mr Madoff found his victims – and where the trauma of his unmasking is now being most keenly felt.

Scores of residents could be ruined by news that Mr Madoff had made off with their life savings, many more will suffer serious losses. Some of the signs of financial distress popped up almost immediately. Already four multi-billion-dollar condominiums have been put on the market by the fraudster's victims, competing with each other to sell out before what they fear might turn into a mini-glut of sales. Local pawn shops reported a spike in business, as rich clients sought short-term loans to tide them over while they sorted out their finances. Dog walkers, gardeners and other hired helps are murmuring about lay-offs to come.

And then there is the $250,000-a-year (£160,000) Palm Beach Country Club, where Mr Madoff had been a prominent, if aloof, member since 1996. Perhaps a third of its 300 members had put money into Madoff Investment Securities, either because they knew him directly or because they were recommended to him by some of the club's most senior members. These men, too, were duped and have lost fortunes.

"All I can say is that this is an awful, awful time for us," Ruth Shapiro told a reporter from The New York Times over the weekend. Her 95-year-old husband, Carl Shapiro, and their son-in-law Robert Jaffe had talked up the wonders of their golfing buddy's mysterious investment system, which had returned a regular-as-clockwork 11-13 per cent for more than a decade. Friends and acquaintances clamoured for an introduction.

The Palm Beach Country Club is the height of exclusivity. As well as the entry fee well into six figures – and, some say, into seven figures for certain types who are less well connected – members are required to contribute to charity, something that marks it out from many other similar institutions.

Set up in 1959 by wealthy Jews who had been excluded by the Anglo-Saxon cliques of the island's other clubs, it remains predominantly Jewish today, which is why so many Jewish charities have turned up among the victims of Mr Madoff's giant Ponzi scheme.

"There were a lot of very sophisticated people who were duped, and that happens a great deal when you've had somebody decide to be unscrupulous," said Harvey Pitt, a former chairman of the Securities and Exchange Commission, Wall Street's regulator. "It isn't just the big investors. There's a lot of charitable and foundation money involved in this, which is the real tragedy."

Members of the club and of the nearby Boca Rio golf club, where Mr Madoff also drummed up business, and other residents are now left counting the cost. They told stories of losing everything from $40,000 to an entire nest egg worth well over $1m. Some of the most powerful names in business, might have lost hundreds of millions of dollars.

Mr Madoff's expansive waterfront mansion in Palm Beach is one of numerous homes in the enclaves of the super-rich, evidence of a life well-connected. His pad on Manhattan's Upper East Side is valued at about $6m, and he also has a home in Long Island, weekend getaway of Wall Street's power-brokers. His network of victims is inevitably as extensive as his network of contacts, cultivated assiduously over a career of almost five decades – one in which he seemed, even to those who knew him best, entirely beyond reproach. A Hofstra Law School graduate, he started his career with $5,000 saved working as a lifeguard on Long Island, just the sort of up-by-the-bootstraps foundation myth that Wall Street loves. He earned a reputation as a pioneer of electronic trading and helped develop the Nasdaq stock market for technology companies, even serving as its chairman.

At age 70, he was – until his sensational arrest last Thursday morning – one of the titans of the finance industry, sitting at the intersection of business and philanthropy. His own charitable foundation bankrolled many other philanthropic ventures in numerous US cities, which now face a difficult future, as if the market crash had not already made fundraising tougher. Brandeis University in Boston, the New York Public Theatre, the Gift of Life Bone Marrow Foundation, a Boca Raton-based group the runs a database of bone marrow donors ... the list goes on. New York's Yeshiva University, North America's oldest Jewish educational institution, where Mr Madoff was chairman of its Sy Syms School of Business, said yesterday he had resigned all involvement.

"It's like you find out the Tooth Fairy died," Robert Battalio, professor of trading at University of Notre Dame's Mendoza College of Business, told USA Today.

How did he get away with it? The details of the fraud will be dissected for many months. So far, we know very little except what Mr Madoff and his sons told the FBI. The estimate of $50bn in losses is his alone, and although we know the scheme has run for years, we don't know if there was a single, fateful moment when he crossed over from legitimately managing clients' money to cooking the books. We may never know what possessed him – whether it was a craving for money and status, or a fear of losing them.

His sons, who called the police after their father's confession to them last Wednesday evening, say that they left the management of the investment business to him, that he kept the books under lock. There are many mysteries on the 17th floor of the lipstick-shaped Midtown Manhattan building where Madoff Investment Securities is headquartered, and where guards now stand at the doors, as investigators pore over documents. Certainly, the FBI is focused first and foremost on testing that amazing assertion, that Mr Madoff acted entirely alone in puffing up a $50bn investment business based on lies.

There were red flags. After a questioning article on Mr Madoff's extraordinary investment returns in 2001, he invited some investors to audit the books, and got a clean bill of health. In 2005 and 2007, the SEC conducted investigations into other parts of the business that revealed minor errors, but failed to overturn any big stones. A hedge fund advisory firm, Aksia, told its clients not to touch Mr Madoff last year, after finding his accounts were audited by a three-person firm operating out of a 13-by-18 ft location in an office park in New York City's northern suburbs. One partner, in his late 70s, lives in Florida. The other employees are a secretary, and one active accountant, Aksia said.

And yet still the money kept rolling in. Wall Street, it seems, never asks hard questions as long as the profits are rolling in. Indeed, so attractive had Mr Madoff's returns appeared, that banks and hedge funds around the world began clamouring for a piece. Fairfield Greenwich, a hedge fund set up by a Connecticut acquaintance, Walter Noel, funnelled more than half its assets into Mr Madoff's fund – and built much of Fairfield's own reputation on the access it provided to the miracle of Madoff. As well as investing directly, European banks lent money to the wealthy clients who did have an "in".

Until recently, Mr Madoff's extensive network provided a torrent of money with which he was able to pay all those who cashed out. Then came the credit crisis and the stock market crash. The wealthy have lost so much on sour investments that they have had to cash in their best ones – and Mr Madoff was landed with requests from clients who wanted $7bn back. Little wonder friends said he appeared under pressure recently.

Then on Tuesday last week, he made the unusual move of handing several hundred million dollars of bonuses to top staff, well ahead of the normal time to pay them. It was a signal that the game was up, that he wanted to hand his lieutenants something before putting his hands out for the cuffs. The money was never paid. In the salon of his Upper East Side apartment on Wednesday night, his sons Andrew and Mark heard his confession. With their call to the FBI, the largest fraud on Wall Street finally saw the light of day.

The scam

*The Ponzi scheme is named after an Italian immigrant in Boston named Charles Ponzi who had hit upon a seemingly easy way to make money. He set about buying International Postal Reply Coupons (IRCs) in Italy that were good for the purchase of stamps in the US. He promised Bostonians huge returns if they invested in his scheme. Soon the money coming in far outstripped the number of IRCs in circulation. But Ponzi continued to pay the interest promised to customers with the funds coming in from new investors. Thus was born the classic pyramid – or Ponzi – scheme we still know today, where existing customers are paid not with money earned from genuine investments but from fresh cash coming in from others. After Ponzi was convicted of fraud in 1920, investigators found that 17,000 people had entrusted money to him – and many were ruined.

The biggest losers

*Steven Spielberg

The film director's charity, the Wunderkinder Foundation, had invested a significant portion of its assets with Mr Madoff. In 2006, his firm accounted for about 70 per cent of the charity's interest and dividend income. Spielberg made annual donations to the charity of $1m (£654,000).

*Fred Wilpon

The owner of the New York Mets baseball team put some of his own money and that of his investment firm, Sterling Equities, into Mr Madoff's company Investment Securities. But Bob DuPuy, the president and chief operating officer of Major League Baseball, has denied that Mr Wilpon's losses will have any effect on the team itself, since it is a separate entity.

*Senator Frank Lautenberg

The New Jersey senator's charitable family foundation also had a stake in Mr Madoff's investment fund. The Lautenberg Foundation had assets worth almost $14m (£9.1m) in 2006, and donates money to a variety of religious, educational, civic and arts organisations in New Jersey and elsewhere. Mr Lautenberg's lawyer said in an email that the senator was "very distressed" about the possible loss of funds, but that the full scale of the damage was not yet known.

*Norman Braman

The former owner of the American football team Philadelphia Eagles is the 281st richest man in the United States, according to Forbes magazine, but he too fell invested with Mr Madoff. The 76-year-old, who is worth an estimated $1.7bn (£654m) has amassed a fantastically expensive art collection, which includes pieces by Picasso, Andy Warhol and Jasper Johns.

*Mortimer Zuckerman

A source close to Mr Zuckerman, a 70-year-old real estate magnate who also owns the American tabloid newspaper the New York Daily News, had a fund which invested almost all of its assets with Mr Madoff. He is number 188 on the Forbes list, with an estimate wealth of $2.4bn (£1.5bn).

*Elie Wiesel

Jewish schools and charities have been particularly hard hit by the losses, and among them is the Elie Wiesel Foundation for Humanity. The charity was founded in 1986 by the Holocaust survivor and writer, shortly after he was awarded that year's Nobel Peace Prize.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments