EU plans to cut Russia energy ties by 2027 cements economic iron curtain with Putin

Sanctions and longer-term plans signal a lasting divide between east and west. The only questions now are how hard and fast politicians will move, writes Anna Isaac

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The balance between economic self-harm and the need to ramp up the pain for Russia to undermine its war effort in Ukraine is proving tricky for the European Union.

It moved quickly and sharply to sanction hundreds of individuals with links to the Putin regime. It has also implemented, along with the US, UK and others, big financial barriers to broader trade with Russia.

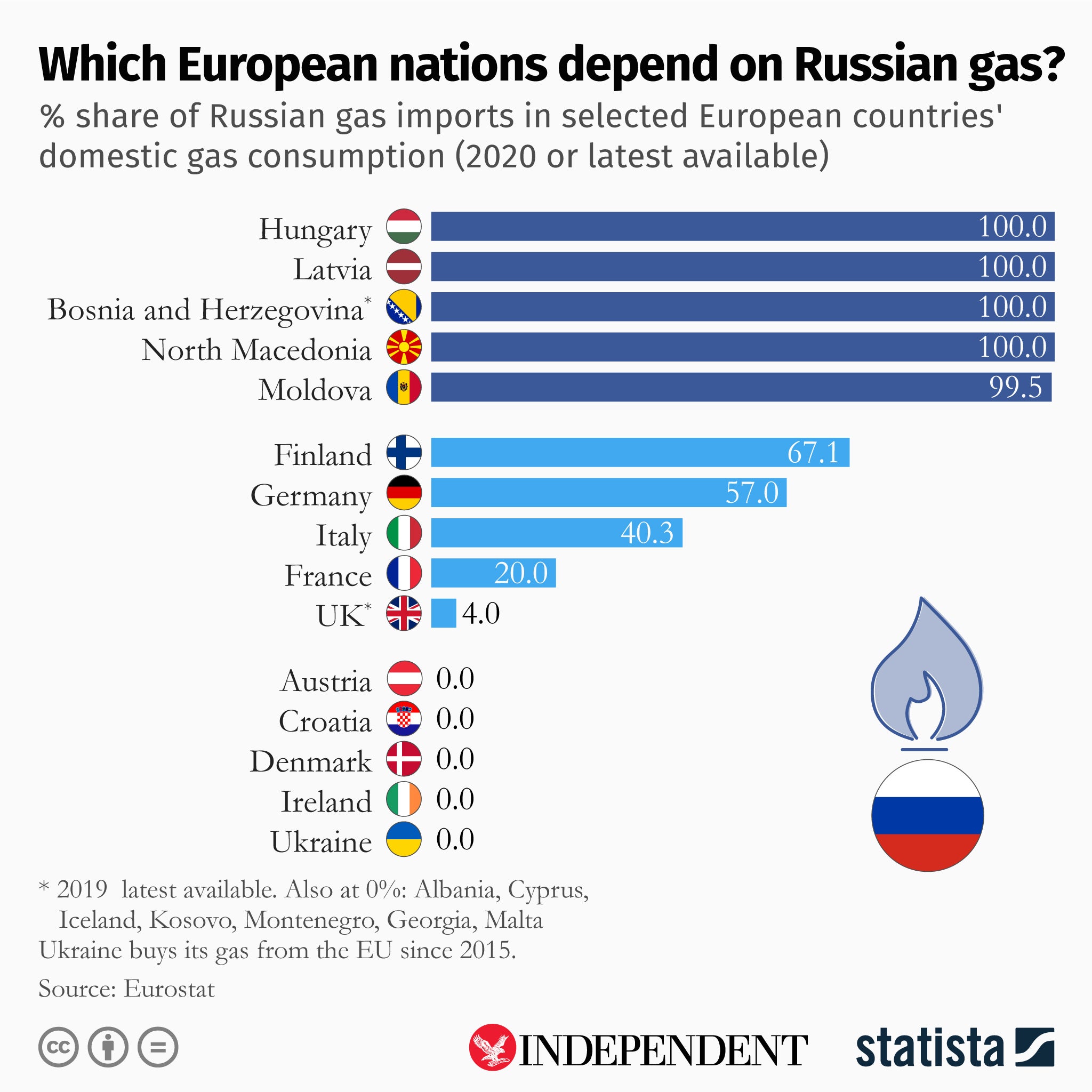

Yet several of the bloc’s largest economies are especially dependent on Russia for their energy needs.

Plans to cut these ties of oil, coal and gas by 2027 will be presented in May, according to a statement from Ursula von der Leyen, EU commission president, after a summit of EU leaders in Versailles on Friday.

Amid rising alarm at the humanitarian disaster orchestrated by Russia’s president Vladimir Putin, the pressure to turn off the energy taps is unlikely to ease anytime soon. It’s about when, not if.

In terms of economic barriers, there’s a doubling down by both sides that is so profound it is hard for economists to grapple with.

However, given the sheer scale and pace of the decoupling at present, the impact will last for at least a decade, likely more, they warn. In simple terms, Russia will now face a deep recession, and the EU, higher living costs.

Some of Russia’s more extreme moves against western companies, such as allowing asset seizures from foreign firms’ operations, might not have an immediate calculable impact. However, Elina Ribakova, deputy chief economist at the Institute for International Finance, tells The Independent that they will kill off inward investment just as much as sanctions.

“In practical terms, it is unlikely to offer any help to the Russian economy. It might allow some control over the amount of currency that companies can take out [of Russia],” she says.

“To me, it’s a very important sign that they are not planning to come back to the global economy anytime soon. The current regime, the current authorities, have no plans for reintegration. You do measures, expensive measures like this because you know you’re not coming back.”

Meanwhile, the EU has committed to phasing out Russian oil and natural gas imports within five years.

It’s long enough to avoid a significant economic blow, but perhaps not enough to stop the flow of significant amounts of money into Russia from energy exports.

There’s also a degree of skepticism about the short-term drive the EU announced in recent days – to cut Russian gas imports by two-thirds in this year.

“We think that to achieve a two-thirds cut this year, more emphasis will need to be given to dirtier fuels and nuclear, which are conspicuously absent from the Commission’s proposal,” explains Daniel Kral, senior economist at Oxford Economics, in a new analysis.

If 2022’s ambitions prove hard to reach, then 2027’s may prove as elusive. But the idea of a five-year plan is at least realistic from an economic perspective, says Holger Schmieding, chief economist at Berenberg Bank.

“This is a gradual phase-out, which I think can be achieved without major upsets. It is a marginal long-term drag. It does mean that governments and the private sector will need to invest more in alternative energy production. That’s doable,” Schmieding says.

“If it was 2024, then I would say this is a struggle, this is something that ordinary people on the street will notice. If it was a commitment to do it this year, then it would have been a risk of recession,” he adds.

One of the hardest sticking points for going harder and faster on energy imports from Russia is that not every state is affected equally, not just in broad terms of total economic input or dependence, but also in the political sensitivity of the areas concerned.

Russia accounts for between 80 per cent and 100 per cent of gas supplies in some central and eastern European countries (CEE), but only around five per cent in Spain, Portugal and the Netherlands, according to Oxford Economics’ Kral. Those CEE countries’ populations are also the most exposed to fuel poverty. Germany, Italy and Austria are among the most exposed major economies.

The place of use also matters in political considerations. In Finland, natural gas is little used in domestic heating but rather in industrial settings, according to Kral. However, in the Netherlands, gas is used to generate around half the country’s electricity.

Ultimately, he believes that the EU is likely to fall short of its ambition to cut its import of gas by two-thirds in 2022. Green aims and infrastructure challenges prevent the bloc from simply switching to coal or other energy sources.

In an absence of alternatives, the target would likely require energy rationing among households and industry, with the severe consequences that entails.

Breaking up with Russia’s economy is hard to do, and the EU is, at present, not prepared to shoulder the hurt from an energy embargo.

Still, the signal is clear from both sides: the economic divorce papers have been signed.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments