Tata Steel to cut 1,200 jobs as one in six UK steel workers set to be laid off this month

Overproduction by Chinese producers has triggered a global slump in the price of steel. Michael Bow reports on the latest casualty, as Caparo Industries calls in the administrators

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

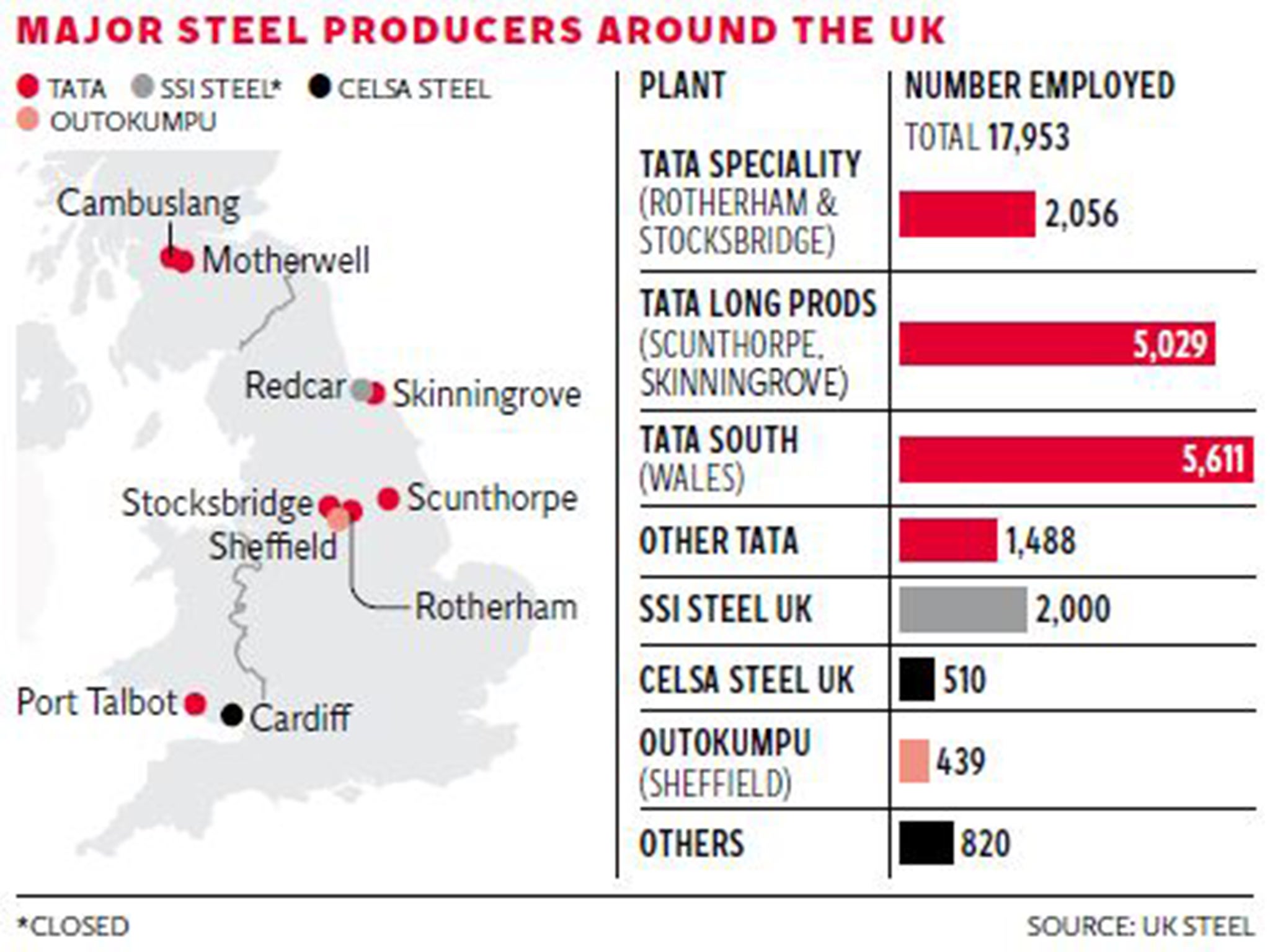

Your support makes all the difference.The scale of the crisis facing the UK steel industry is evident in figures showing that one in six UK steel workers are set to lose their jobs this month, with another 1,200 set to be laid off today as Tata is expected to shut sites in Scunthorpe, north Lincolnshire, and at Cambuslang and Motherwell in Scotland.

The closure of the Scottish site by the Indian conglomerate that bought the former British Steel in 2006 will effectively end 143 years of steel making in the country.

The Midlands-based steel group Caparo Industries, which employs 1,700 staff, became another casualty yesterday, as it called in administrators from PwC for 17 of its 20 subsidiaries. The group, which was founded by the Labour peer Lord Paul, will continue to employ staff at the company until it is either sold or wound up.

At the start of the month 2,200 jobs were lost when the Redcar steelworks owned by the Thai-based SSI went into receivership .

The 5,100 job losses this month come from a UK workforce of about 30,000.

The collapse of Redcar has been painted as a watershed moment for Britain’s steel industry. Yet developments this week threaten to make its failure look like the first salvo in much bigger and prolonged battle to save Britain’s steel industry from collapse.

The roots of the problem lie in China, and a tsunami of cheap steel currently being dumped on the global market by Chinese exporters, according to the trade body UK Steel.

Gareth Stace, UK Steel’s director, has urged the Prime Minister, David Cameron, to raise the issue with China’s premier Xi Jinping on his current four-day state visit to the UK, while Labour leader Jeremy Corbyn has also asked Mr Cameron to take Mr Xi to task. “As well as reinforcing the need for the EU to tackle unfair dumping of steel across Europe, Cameron’s intervention would send a powerful signal to Beijing that he is prepared to stand up for British steelmakers,” Mr Stace said.

China’s ambassador, Liu Xiaoming, said Britain should make “adjustments” to its industrial policy in response to the issue. “If you continue to stay with your old, traditional business, you’re losing money and opportunities … China is making adjustments – why not Britain?” he told ITV yesterday.

Yet the need for “adjustments” could also be levelled at Beijing.

Excess capacity in the Chinese market was 30 times as high as the UK’s entire annual steel production last year, with warehouses from Beijing to Shanghai piled high with mountains of unwanted steel.

Overproduction has led Chinese producers to export aggressively – global exports from China are already 29 per cent higher in the first half of 2015 compared to last year.

The wave of Chinese steel has subsequently triggered a slump in the price, with imports of bars from the country costing £309 versus a market average of £322.

UK importers, for example, have already boosted the purchase of basic steel products from the country by 23 per cent compared to last year. Industry veterans cast doubt on the amount of Chinese steel flowing into the market, but say the threat of cheaper Chinese prices is enough to spook the UK market.

“I’ve seen difficult times before but never for the particular reason we have now,” said Peter Fish, the managing director of the Sheffield-based steel consultancy Meps.

“The big problem is export prices, because the Chinese are driving them. It’s specifically the quantity of imports to the UK and the fact they are very cheap. I hope we have reached the low point of diminishing returns and the squeeze on prices eases. But if the pressure keeps coming and the price gets squeezed, that is when people close their factories.”

Sajid Javid, the Business Secretary, has moved to try to alleviate the crisis, promising to try to accelerate a package of measures to help the industry. These include speeding up the approval of a Treasury-led scheme called the Energy Intensive Industry Compensation scheme, which is mired in state aid rules at the European level, but could deliver a multimillion-pound benefit to the industry by reducing the impact of environmental levies.

Yet the Government’s overall stand faces criticism for not adequately supporting the industry for a number of years.

“The Government is looking to wash its hands of the industry,” Alex Flynn at the the trade union Unite said. “Government has adopted a very laissez-faire approach to the steel industry. They could have done a hell of a lot more.”

Ministers will be hoping they can stop more British steel plants tumbling into the history books.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments