Boeing's aircraft deliveries and orders in 2024 reflect the company's rough year

Boeing delivered less than half the number of commercial aircraft to customers than its European rival in 2024, The American aerospace giant reported on Tuesday that it supplied 348 jetliners during the year

Boeing delivered less than half the number of commercial aircraft to customers than its European rival in 2024 as the American aerospace giant's output suffered under intensified government scrutiny and a factory workers' strike, according to data released Tuesday.

Boeing said it supplied 348 jetliners during the year. That was more than a third fewer than the 528 the company finished for airlines and leasing outfits in 2023 and less than half the number of jetliners that Airbus delivered last year.

Deliveries are an important source of cash for plane manufacturers since buyers typically pay a large portion of the purchase price when their orders are fulfilled.

More than three-quarters of the planes that Boeing furnished were 737 Max jets, a stark reminder of how integral its best-selling airline model has been to the company's fortunes and challenges. Boeing has lost money since 2019 following the crashes of two then-new Max jets that killed 346 people.

The company expected to ramp up production in 2024. Instead, a panel called a door plug blew off a 737 Max shortly after takeoff from Portland, Oregon, in early January. In the wake of the incident aboard an Alaska Airlines flight, the Federal Aviation Administration capped production of Max jets until Boeing could convince federal regulators it had corrected manufacturing quality and safety issues.

The hit to the company's finances and reputation extended to sales of new aircraft. Boeing received no 737 Max orders for at least two months and ended the year far behind Airbus in total net orders for commercial planes, an indicator that factors in cancellations.

Airbus had 826 net orders, while Boeing had 317.

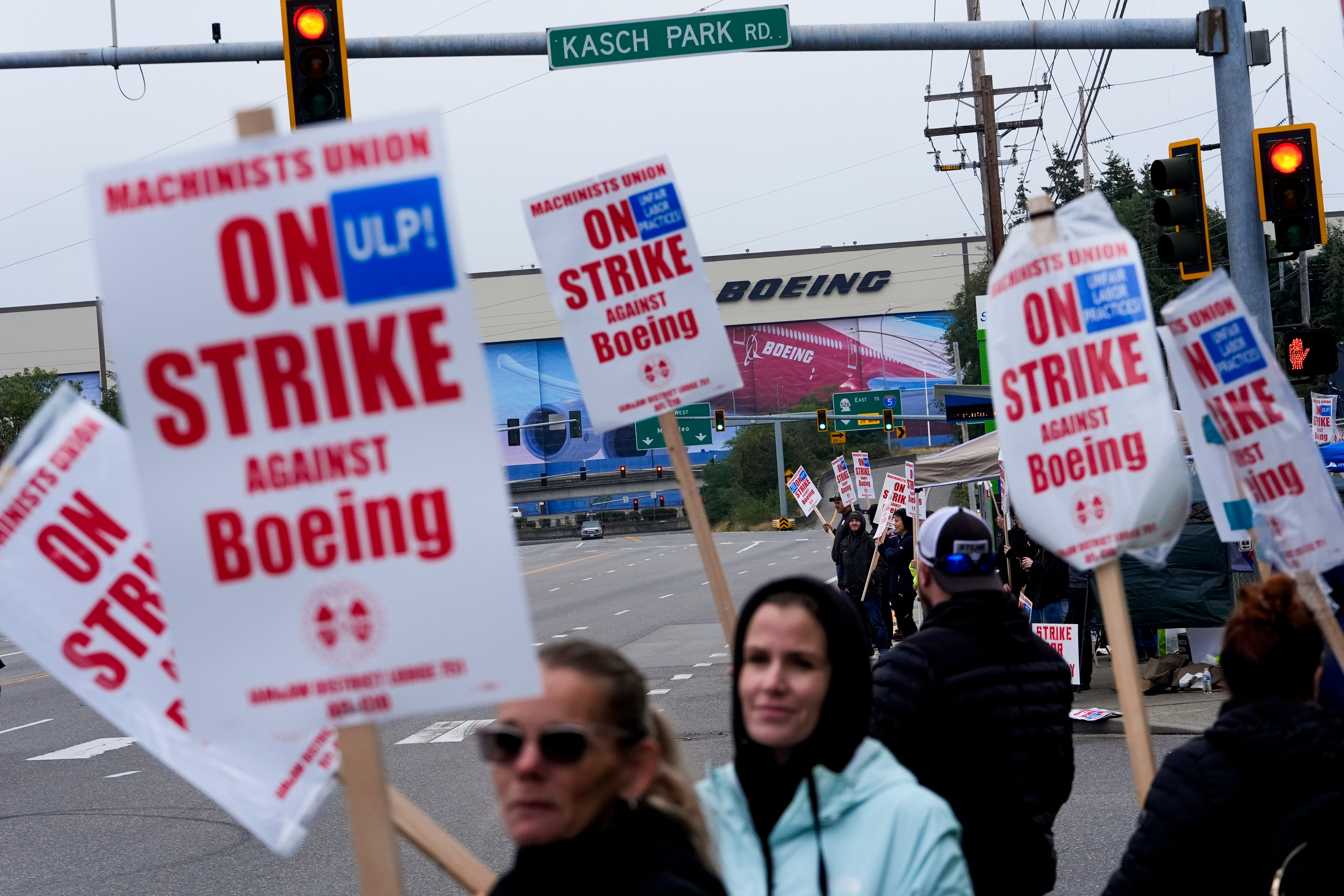

A strike by the machinists who assemble the 737 Max, along with the 777 jet and the 767 cargo plane at factories in Renton and Everett, Washington, halted production at those facilities and hampered Boeing's delivery capability.

The walkout ended after more than seven weeks when the company agreed to pay raise and improved benefit demands.

Boeing has been losing money since 2019, after two Max jets crashed, killing 346 people. It needs the cash it earns from delivering new planes to begin digging out of a deep financial hole.