US starts fiscal year with record $31 trillion in debt

The nation’s gross national debt has surpassed $31 trillion, according to a U.S. Treasury report released Tuesday

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The nation's gross national debt has surpassed $31 trillion, according to a U.S. Treasury report released Tuesday that logs America's daily finances.

Edging closer to the statutory ceiling of roughly $31.4 trillion — an artificial cap Congress placed on the U.S. government’s ability to borrow — the debt numbers hit an already tenuous economy facing high inflation, rising interest rates and a strong U.S. dollar.

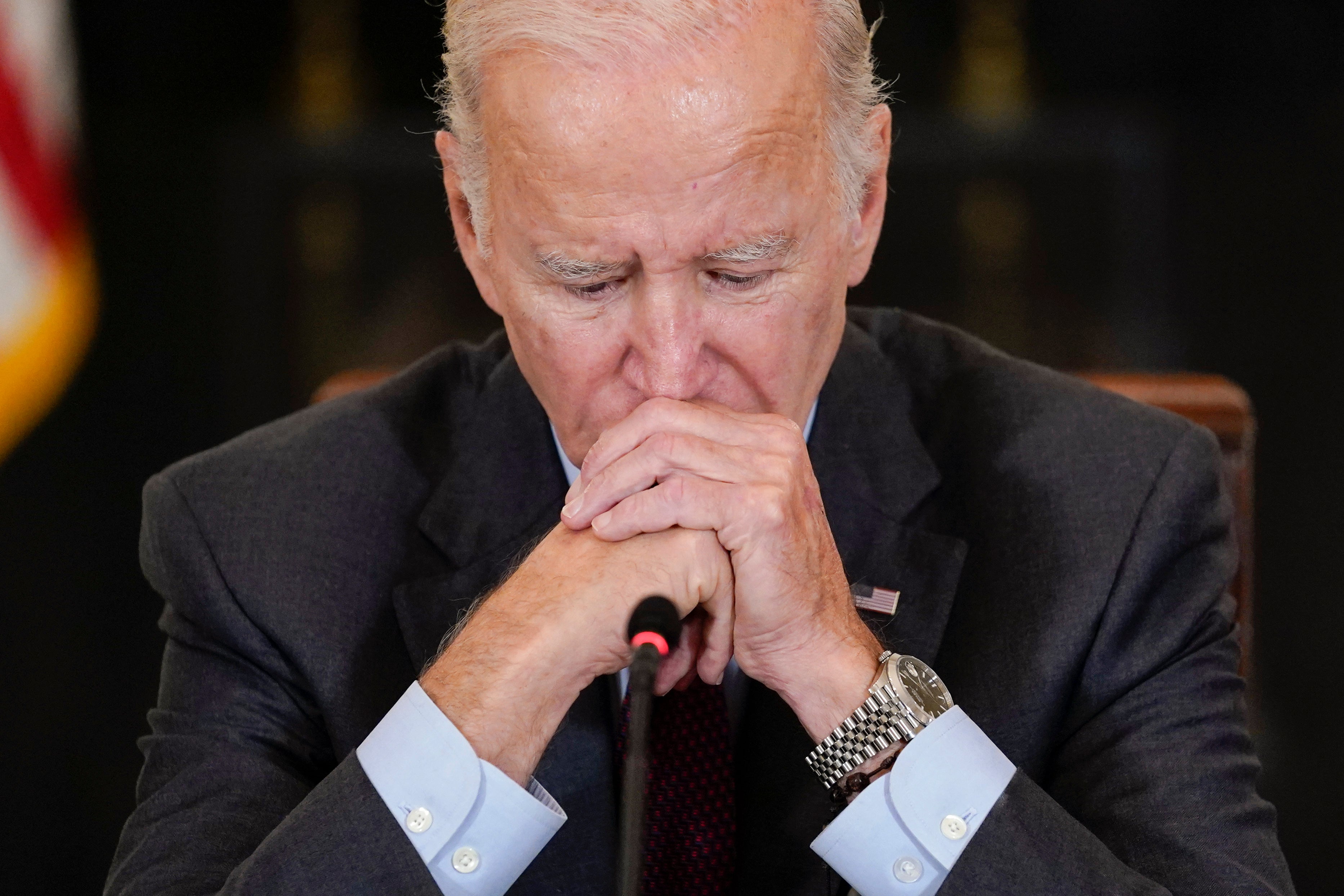

And while President Joe Biden has touted his administration's deficit reduction efforts this year and recently signed the so-called Inflation Reduction Act, which attempts to tame 40-year high price increases caused by a variety of economic factors, economists say the latest debt numbers are a cause for concern.

Owen Zidar, a Princeton economist, said rising interest rates will exacerbate the nation's growing debt issues and make the debt itself more costly. The Federal Reserve has raised rates several times this year in an effort to combat inflation.

Zidar said the debt “should encourage us to consider some tax policies that almost passed through the legislative process but didn't get enough support,” like imposing higher taxes on the wealthy and closing the carried interest loophole, which allows money managers to treat their income as capital gains.

“I think the point here is if you weren't worried before about the debt before, you should be — and if you were worried before, you should be even more worried," Zidar said.

The Congressional Budget Office earlier this year released a report on America's debt load, warning in its 30-year outlook that, if unaddressed, the debt will soon spiral upward to new highs that could ultimately imperil the U.S. economy.

In its August Mid-Session Review, the administration forecasted that this year’s budget deficit will be nearly $400 billion lower than it estimated back in March, due in part to stronger than expected revenues, reduced spending, and an economy that has recovered all the jobs lost during the multi-year pandemic.

In full, this year’s deficit will decline by $1.7 trillion, representing the single largest decline in the federal deficit in American history, the Office of Management and Budget said in August.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget said in an emailed statement Tuesday, “This is a new record no one should be proud of.”

“In the past 18 months, we’ve witnessed inflation rise to a 40-year high, interest rates climbing in part to combat this inflation, and several budget-busting pieces of legislation and executive actions," MacGuineas said. “We are addicted to debt."

A representative from the Treasury Department was not immediately available for comment.

Sung Won Sohn, an economics professor at Loyola Marymount University, said “it took this nation 200 years to pile up its first trillion dollars in national debt, and since the pandemic we have been adding at the rate of 1 trillion nearly every quarter."

Predicting high inflation for the “foreseeable future,” he said, “when you increase government spending and money supply, you will pay the price later."