Missouri lawmakers back big expansion of low-interest loans amid growing demand for state aid

Persistently high interest rates have led Missouri lawmakers to significantly expand a state loan program for farmers and small businesses

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Missouri lawmakers gave final approval Thursday to significantly expand a low-interest loan program for farmers and small businesses, in a move that reflects strong consumer demand for such government aid amid persistently high borrowing costs.

The legislation comes as states have seen surging public interest in programs that use taxpayer funds to spur private investment with bargain-priced loans. Those programs gained steam as the Federal Reserve fought inflation by repeatedly raising its benchmark interest rate, which now stands at a 23-year high of 5.3%.

Higher interest rates have made virtually all loans more expensive, whether for farmers purchasing seed or businesses wanting to expand.

Under so-called linked-deposit programs, states deposit money in banks at below-market interest rates. Banks then leverage those funds to provide short-term, low-interest loans to particular borrowers, often in agriculture or small business. The programs can save borrowers thousands of dollars by reducing their interest rates by an average of 2-3 percentage points.

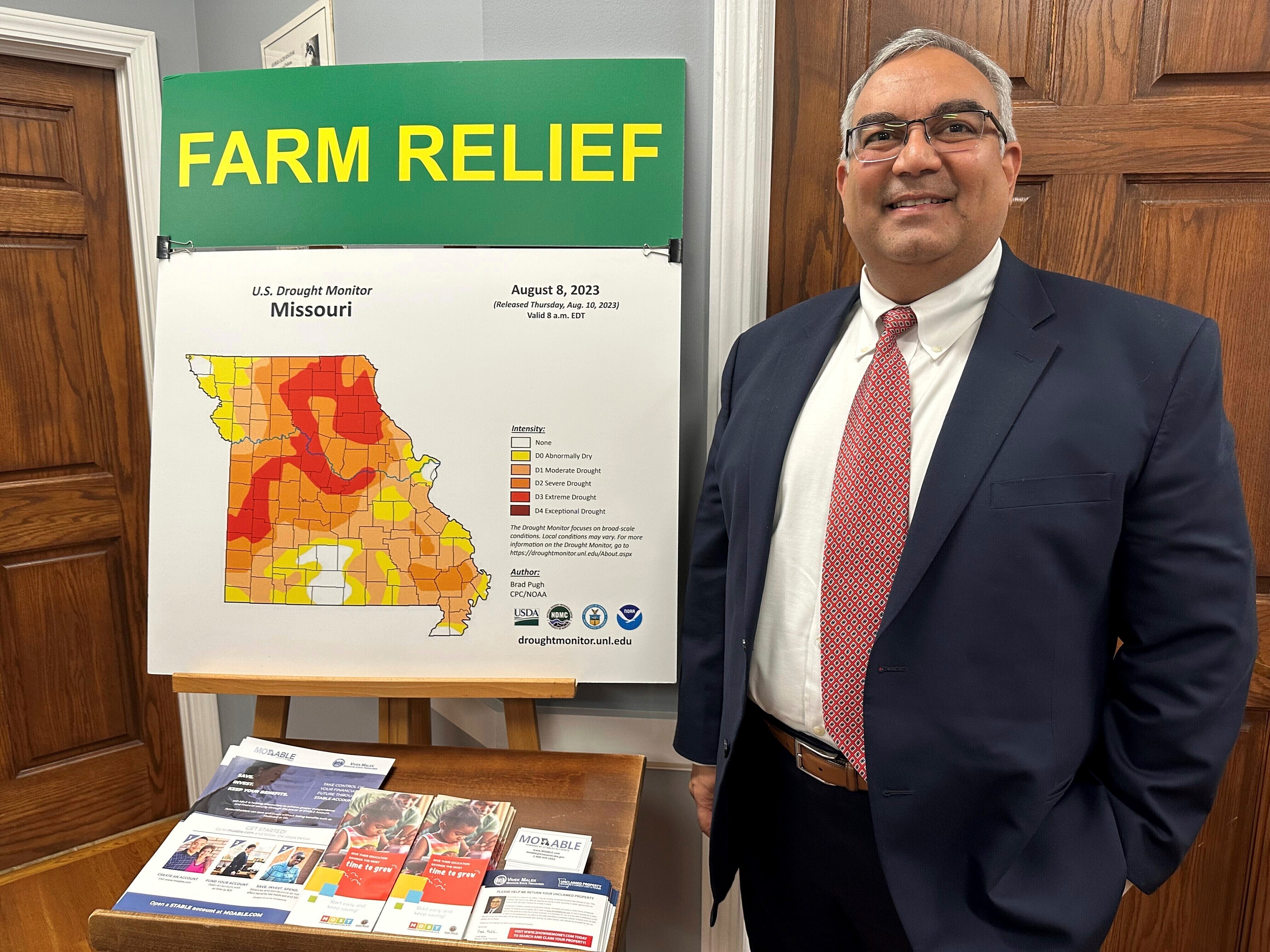

When Missouri Treasurer Vivek Malek opened up an application window for the program in January, he received so many requests that he had to close the window the same day.

Malek then backed legislation that would raise the program’s cap from $800 million to $1.2 billion. That bill now goes to Gov. Mike Parson.

“The MOBUCK$ program has skyrocketed in demand with farmers, ranchers and small businesses, especially during these times of high interest rates," Malek said in an emailed statement Thursday praising the bill's passage.

The expansion could cost the state $12 million of potential earnings, though that could be partly offset by the economic activity generated from those loans, according to a legislative fiscal analysis.

Not all states have similar loan programs. But neighboring Illinois is among those with a robust program. In 2015, Illinois' agricultural investment program had just two low-interest loans. Last year, Illinois made $667 million of low-rate deposits for agricultural loans. Illinois Treasurer Michael Frerichs recently raised the program's overall cap for farmers, businesses and individuals from $1 billion to $1.5 billion.