Chinese police detain wealth management staff at the heavily indebted developer Evergrande

Police in a southern Chinese city say they have detained some staff at China Evergrande Group’s wealth management unit in the latest trouble for the heavily indebted developer

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Police in a southern Chinese city said they have detained some staff at China Evergrande Group’s wealth management unit in the latest trouble for the heavily indebted developer.

A statement by the Shenzhen police on Saturday said authorities “took criminal coercive measures against suspects including Du and others in the financial wealth management (Shenzhen) company under Evergrande Group.”

It was unclear who Du was. Evergrande did not immediately answer questions seeking comment.

Media reports about investors’ protests at the Evergrande headquarters in Shenzhen in 2021 had listed a person called Du Liang as head of the company’s wealth management unit.

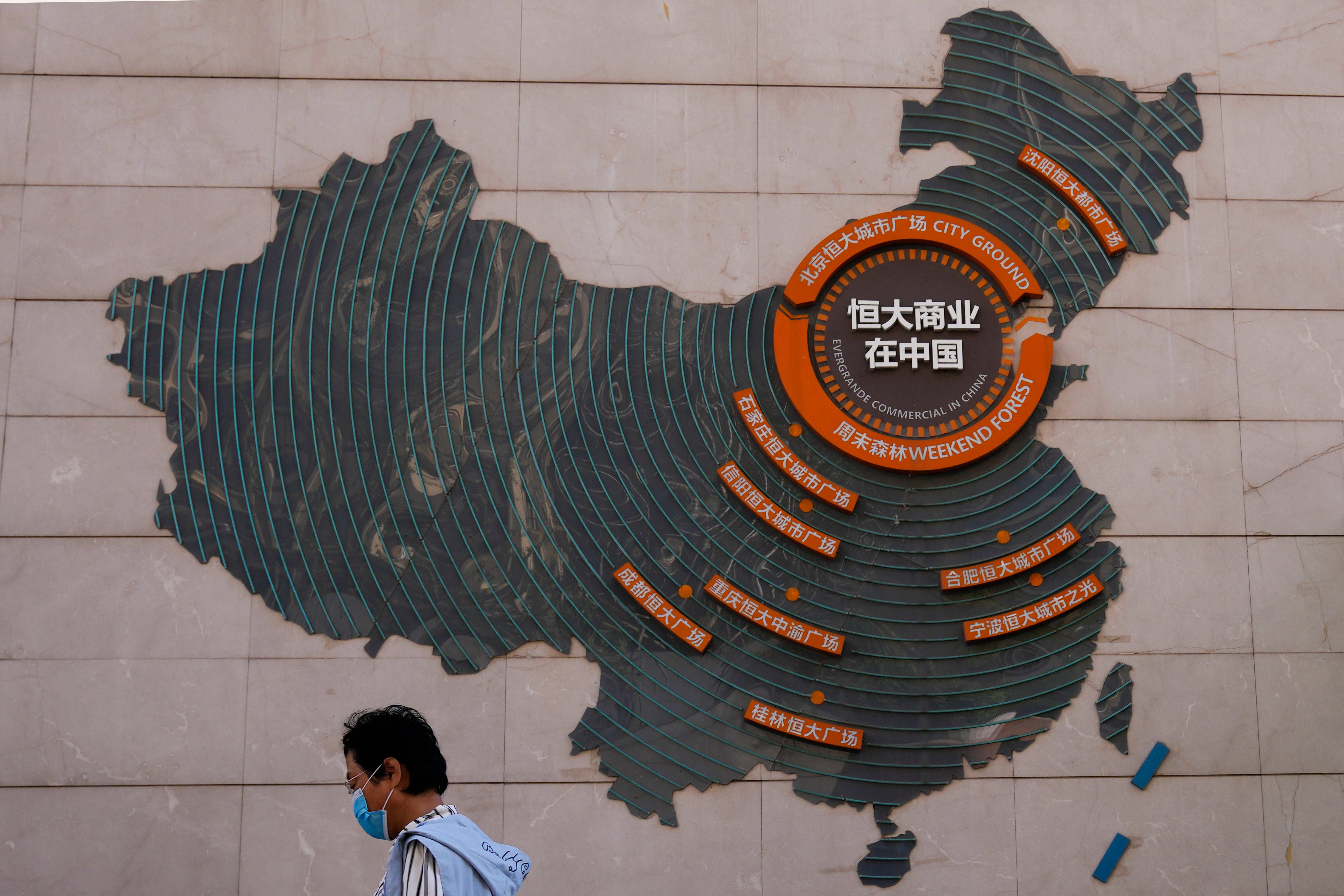

Evergrande is the world’s most heavily indebted real estate developer, at the center of a property market crisis that is dragging on China’s economic growth.

The group is undergoing a restructuring plan, including offloading assets, to avoid defaulting on $340 billion in debt.

On Friday, China’s national financial regulator announced it had approved the takeover of the group’s life insurance arm by a new state-owned entity.

A series of debt defaults in China’s sprawling property sector since 2021 have left behind half-finished apartment buildings and disgruntled homebuyers. Observers fear the real estate crisis may further slow the world’s second-largest economy and spill over globally.