A key inflation gauge jumped 6.6% in March, most since 1982

An inflation gauge closely tracked by the Federal Reserve jumped 6.6% in March compared with a year ago, the highest reading in four decades, further evidence that surging prices are pressuring household budgets and the health of the economy

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.An inflation gauge closely tracked by the Federal Reserve jumped 6.6% in March compared with a year ago, the highest 12-month reading in four decades, further evidence that surging prices are pressuring household budgets and the health of the economy.

Yet there were signs in Friday's report from the Commerce Department that inflation might be slowing from its galloping pace and perhaps nearing a peak, at least for now.

Excluding the especially volatile food and energy categories, so-called core prices rose 5.2% in March from a year earlier. That was slightly below the 5.3% year-over-year increase in February, and it was the first time that 12-month figure has declined since February 2021, before the inflation spike began. And on a month-to-month basis, core prices rose 0.3% from February to March, the same as from January to February.

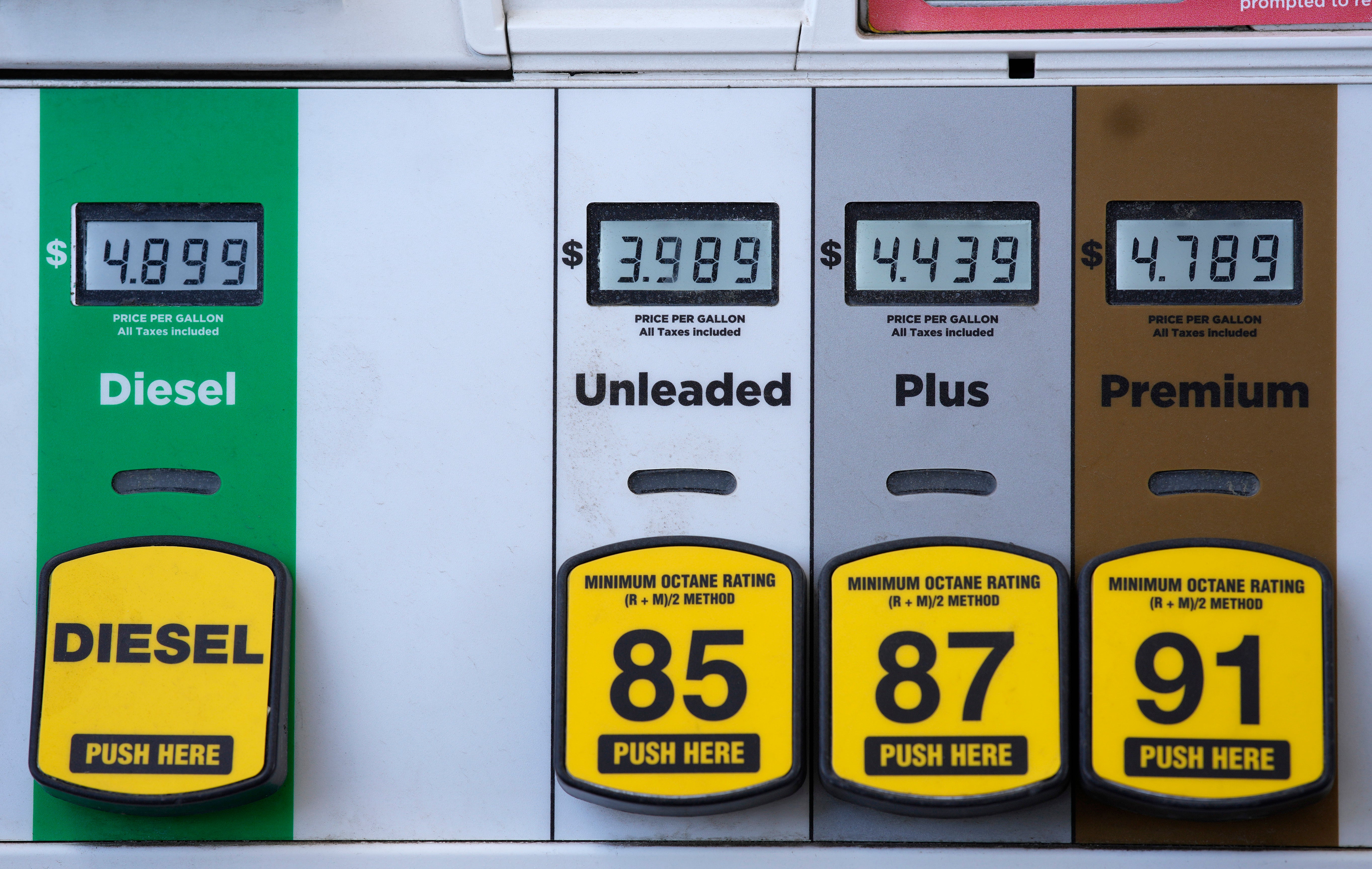

The report also showed that consumer spending rose at a solid pace last month, though the gain largely reflected higher prices at the gas pump, grocery store and other places where Americans shop for necessities. But even adjusted for inflation, spending rose 0.2%.

Still, inflation is eroding Americans' purchasing power and leading the Federal Reserve to plan a series of sharp interest rates hikes in the coming months.

At the same time, paychecks are expanding at a healthy pace, helping consumers keep up with some of the inflation spike. Employers are raising wages because many of them are desperate to find and keep workers. Job openings are near a record high, and the unemployment rate, at 3.6%, is just above the half-century low it reached just before the pandemic.

Still, inflation remains chronically high, and Americans are taking an increasingly negative view of the economy as a result. About one-third of respondents to a Gallup poll, released Thursday, cited inflation as the most important financial problem their family faces today, up from fewer than one in 10 who said so a year ago.

The gloom that has gripped public opinion as inflation has accelerated is posing a growing political threat to President Joe Biden and Democrats running for Congress. Biden has pointed to a strong job market and solid consumer spending as evidence that his policies have helped Americans. But that view absorbed a setback Thursday, when the government reported that the economy actually contracted in the first three months of this year at a 1.4% annual rate.

Even so, consumers and businesses increased their spending at a solid pace in the January-March quarter, even after adjusting for inflation, a sign that the economy is much healthier than Thursday’s dismal figure for the nation’s gross domestic product suggested.

How consumers respond to inflated prices — and much higher interest rates from the Federal Reserve — is one of the unknowns facing the economy this year. Moody’s Analytics estimates that the average household is spending $327 more each month to buy the same things they bought a year ago.

In addition to higher pay, some economists think that elevated savings, which many Americans built up from stimulus checks and other government aid during the pandemic shutdowns, could help sustain consumer spending in the coming months.

Economists have estimated that Americans have about $2.1 trillion more in savings than they did before COVID, with some of that cash in lower-income Americans’ bank accounts. Economists at Bank of America note that, according to the bank’s data on checking and savings accounts, Americans who earn under $50,000 a year had an average of about $3,000 in their accounts in February — roughly double the pre-pandemic level.