Unhappy returns on with-profits

The trend among life assurers of cutting payouts looks as if it's here to stay. Esther Shaw reports

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Millions of savers who hold with-profit investment bonds, pensions or endowments are in the process of finding out how well their money is performing as insurers announce the bonuses they are adding to policies.

The big life assurance companies have been making their annual with-profits announcements over the past few weeks, with Scottish Widows and Zurich among the first to declare, and Prudential and Phoenix among the last.

While many people have cashed in their endowments, millions still have significant sums invested in these often-failing with-profits funds, and are now facing the all-too-familiar news that insurers are cutting bonuses again.

"A with-profits fund is designed to produce steady long-term growth by smoothing out the returns of the underlying investments," says Scott Gallacher of adviser Chartered Financial Planning. "The investments are usually a mix of shares, fixed interest and property."

With the smoothing process, fund managers will retain profits in good years and place them in reserve so that ongoing returns can be sustained in lean years by taking money from that reserve.

However, instead of investors benefiting from the actual return of these underlying holdings, they are rewarded by a series of bonuses that are decided upon and paid by the life assurance company.

"When making their announcements, companies will declare how their underlying with-profits fund has performed," says Patrick Connolly from adviser AWD Chase de Vere. "They will also set out how this translates into the ongoing bonuses they will give to policyholders – and the actual level of payouts which will be made to those whose policies are maturing."

The annual bonuses on these funds may vary, and can fall. There is also no guarantee the insurer will declare an annual bonus at all. "Several endowment providers have paid a 0 per cent annual return each year since 2001," says Helen Howcroft of adviser Equanimity. "There are several reasons for insurers cutting payouts, such as the fund not having been run well, or the asset allocation of the fund meaning it has not benefited from stock market growth."

Mr Gallacher adds that in the past, many insurers declared very high annual bonuses in a race to win business. "These bonuses were too high, leaving many insurers, such as Equitable Life, financially weak, as the bonuses were in effect a liability on the fund," he says. "When investment returns disappointed, these companies did not have sufficient reserves and this led to various collapses and takeovers. Since then, insurers have arguably gone other way."

Advisers agree that despite 2012 being a decent investment year, the trend of cutting payouts has continued. Kim Barrett of adviser Barretts Financial Solutions says growth rates and returns will vary considerably, ranging from active funds to zombie ones.

"A zombie fund will undoubtedly be overweight in fixed interest as an asset class, and have hardly any active management, so returns will be pitiful," he says. "Examples include Sun Alliance and Scottish Provident where the providers have been rolled into the likes of Resolution Asset Management or Phoenix. Good fund managers, such as Prudential, and some parts of Aviva, are far more active."

Prudential announced bonuses of £2bn across its with-profits policies during 2012, as its funds delivered returns of up to 6.3 per cent. The provider says around £800m of this has been paid through annual bonuses, and that it expects to pay out £1.2bn in final bonus payments.

"The payouts from Prudential compare favourably against other stronger with-profits providers such as Aviva and Legal and General (L&G)," says Mr Connolly. "Its payouts are also hugely superior to the weaker providers such as Scottish Widows."

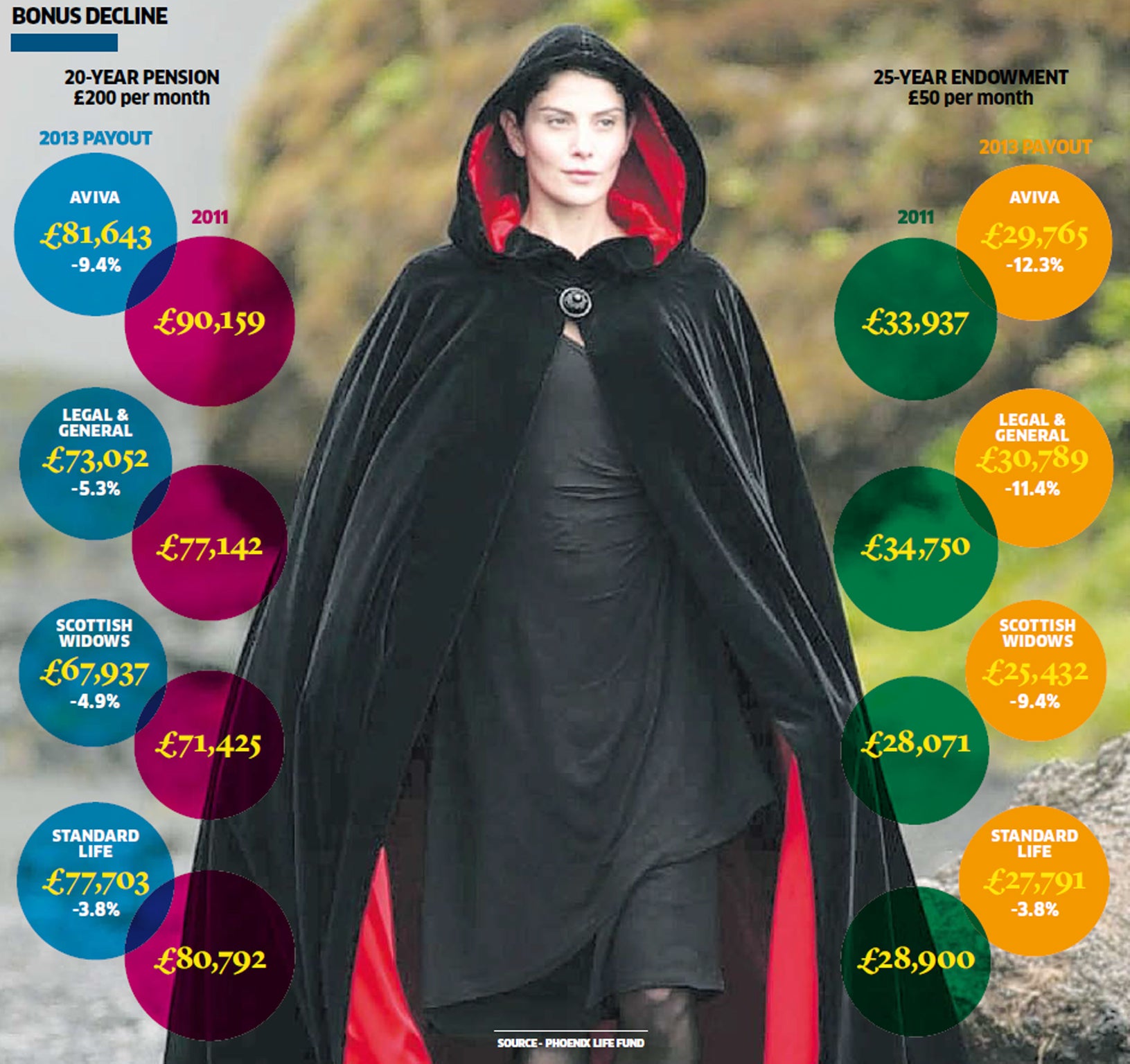

For example, Prudential's 20-year £200-a-month pension payout of £85,774 compares with Aviva at £81,643, Standard Life at £77,703, L&G at £73,052 and Scottish Widows at £67,934. Prudential's 25-year £50-a-month endowment payout of £32,528 compares with L&G at £30,789, Aviva at £29,765, Standard Life at £27,791 and Scottish Widows at £25,432.

"L&G's with-profits fund performed well in 2012, producing a return of 10.6 per cent," says Mr Connolly. "But even as one of the stronger providers, it struggled to generate much cheer for policyholders, with further payout cuts compared with last year's maturities."

This same story of low bonuses is repeated across much of the industry. "Despite a positive return from Standard Life's underlying with-profits fund of 7.9 per cent last year, we have seen further payout reductions and bonus rate cuts," says Mr Connolly. "Elsewhere, Phoenix, [a closed with-profits consolidator] says its annual bonus rates this year are 'low or nil' as it focuses on paying final bonuses."

Advisers say with-profits is an outdated funding model. "Hardly anybody saves into with-profits any more, as it has gone past its sell-by date," says Mr Barrett. That said, while policyholders may not be feeling particularly enamoured with their investments, it is vital they take an objective viewpoint. "There is a huge difference between the returns and the future prospects of the strongest with-profits providers, such as Prudential, and the weakest providers," says Mr Connolly.

Some with-profits investments have valuable guarantees such as minimum bonus rates, guaranteed maturity values or attractive guaranteed annuity rates. "Investors in these policies need to fully understand what they would be losing before considering stopping their policies," says Mr Connolly.

Equally, some policies have high exit penalties – known as market value reductions (MVRs) – which means policyholders could lose out if they try to cash in.

"MVRs were designed to ensure that continuing investors are not adversely affected by paying investors who cash in more than their fair share," says Mr Gallacher. "In the past, many insurers used to guarantee not to apply an MVR on a certain date, such as the 10th anni-versary. However, these MVR-free guarantees have not been offered for a number of years – except for on pensions – meaning with-profits are no longer the low-risk alternative they once were."

The key is not to make any rash decisions, as while bonus rates and payouts may still be falling, there could still be reasons to retain your existing policies.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments