Half of Britons fear for their mental health as figures show rising personal debt

Increase in County Court judgements is sign of financial anxiety reaching alarm levels as individuals struggle to keep debt from spiralling

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

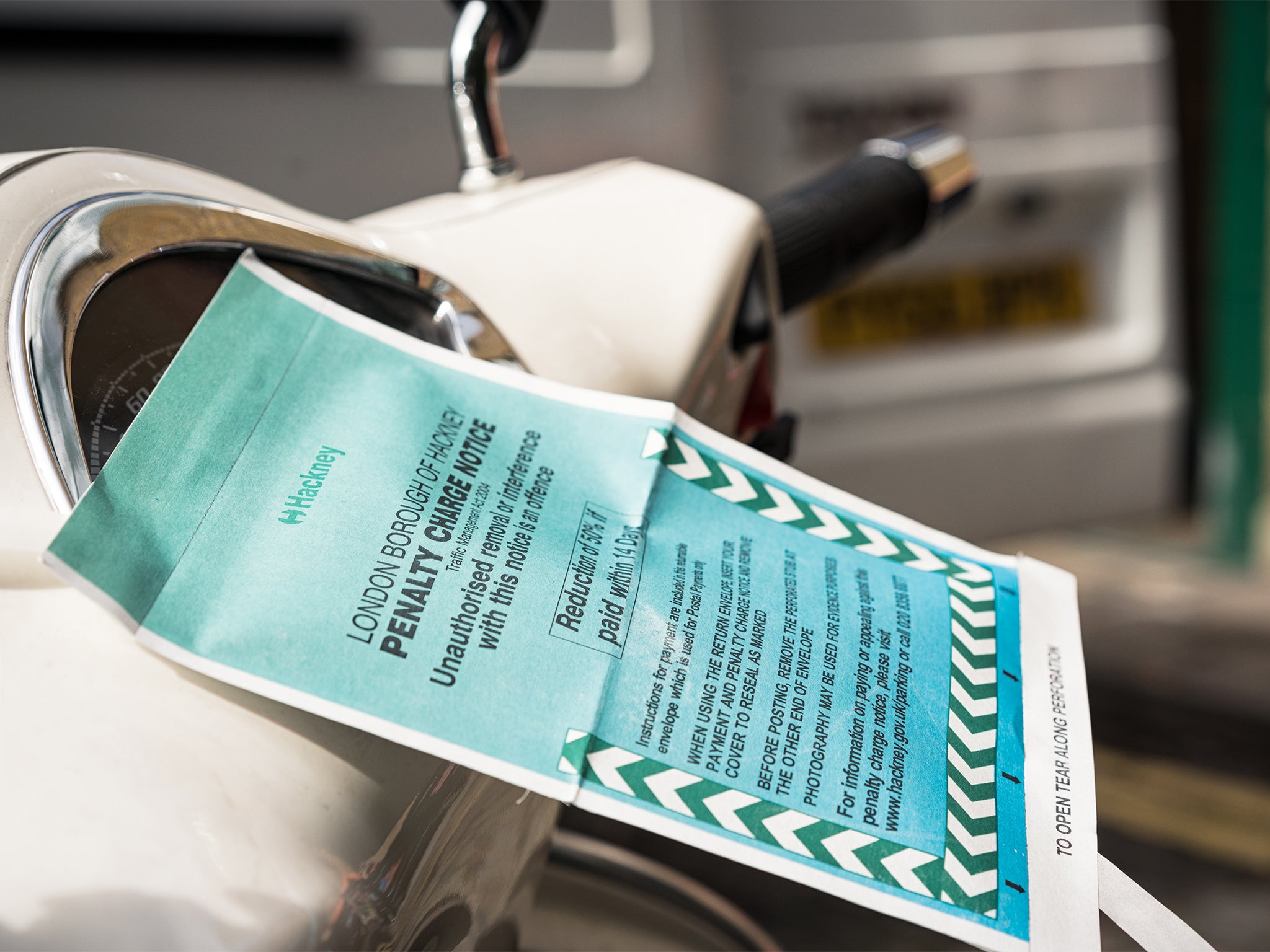

Your support makes all the difference.Jerome Rogers was aged just 20 when he got a second visit from bailiffs over two £65 parking fines in 2016.

The motorcycle courier was distressed to find that his bike had been clamped. Later that day his brother found his body in local woodland.

Rogers had applied for 15 payday loans in a bid to cover the spiralling problem. The initial debt, along with administrative charges and further penalties, totalled more than £1,000.

The tragic decision to take his own life and the circumstances around it are the focus of a BBC3 drama to be aired next week. An inquiry last year highlighted the conduct or bailiffs, the realities of the gig economy and the financial stress felt by young adults. Changes were demanded and promises were made.

But as research coinciding with Mental Health Awareness Week earlier this month shows, financial anxiety is on the rise as personal debt levels continue to increase throughout the UK and across all age groups.

Typically, people in the UK each owe £1,027 more than they did this time last year, according to The Money Charity.

Meanwhile, County Court Judgements (CCJs), brought against individuals who owe and fail to pay back money, are also up. With a CCJ against your name having serious implications such as the ability to get a mortgage or even secure certain jobs, they are now being raised by creditors for far smaller amounts than a decade ago.

Joanna Elson OBE, chief executive of the Money Advice Trust, the charity that runs National Debtline, said: “The relentless rise of CCJs in recent years highlights the precarious state of many households’ financial positions – and the need for more people to receive free debt advice at a much earlier stage.

“CCJs can have a significantly negative impact on credit ratings, and so the effects of this trend could be felt far into the future.

Today, with the average British adult each owing 114 per cent of their annual salary or £30,600 on everything from mortgages to store cards, new figures seen by the Independent suggest more than half of us are now unsure, nervous or concerned about the outlook for our personal finances over the next twelve months.

A study by investment platform Vanguard found that even the basic cost of living is a concern for more than three quarters of us. And among that group, half are, unsurprisingly, struggling with their general wellbeing.

Fear for your financial affairs and you’re far more likely to be dissatisfied with life in general than if you are confident about your personal finances.

“Life is full of emotional and financial stresses, but out of all other concerns, our study shows it is financial anxiety that has the most negative impact on peoples’ sense of wellbeing,”

James Norton, senior investment planner at Vanguard, says: “When it comes to these financial anxieties, just like in our wider lives, it makes sense to focus on what we can control, not on what we can’t control.”

Joanna Elson adds: “Supporting people in financial difficulty and making sure they receive the free debt advice they need has never been more important”.

And yet it seems we’re failing to seek that help when things get out of control. Despite the growing cases of serious debt, the number of people seeking debt advice from the Money Charity is actually down – by 13 per cent month-on-month.

Now more and more families are starting to catalogue signs of mental health problems linked directly to money worries.

Almost two thirds of adults report having been concerned about a friend, family member or colleague’s mental wellbeing, with signs of problems including mood and temperament changes, trouble sleeping, anxiety, stress or lacking confidence to tackle money worries head on, says the Money Advice Service.

The stress caused by money worries can affect anyone, but the research suggests that younger people are particularly at risk. For those aged 18-34, nearly three-quarters have at some point experienced mental health or wellbeing issues linked to money. Women are also much more likely than men to struggle.

The Money Advice Service has developed a checklist identifying the signs to look out for if you’re concerned that money worries are affecting your own or someone else’s mental health or wellbeing.

Sarah Porretta, financial capability director at the Money Advice Service, says: “Whether it’s finding everyday tasks hard, like keeping on top of bills and bank statements, or finding yourself missing payments, help is available.

“Talking to someone, and taking the time to focus on your own wellbeing, is a really difficult but hugely important first step. There is a wide range of guidance available on our website, including our Debt Advice Locator tool, or you can reach out to our mental health partners including Mind, the Samaritans, the Mental Health Foundation or Mental Health UK.”

Mental health alarms linked to money worries:

1. Change in mood / temper: 36%

2. Increased tiredness or lack of sleep: 31%

3. Being anxious, stressed or lacking confidence to directly contact the bank or financial service providers 22%

4. Spending more money than is available: 21%

5. Not opening bills or post: 19%

6. Feeling like there is a lack of control over my/their money: 18%

7. Avoiding talking about money: 17%

8. Being anxious about spending any money even though it’s available: 16%

9. Talking to you or others about their mental health or wellbeing or money issues: 15%

10. Avoiding answering the telephone: 14%

11. Not checking /their bank balance: 13%

12. Forgetting to pay bills: 12%

13. Changes in spending behaviour: 11%

14. Avoiding making important financial decisions: 11%

15. Unable to take in and process information about money: 11%

16. Taking time off work unexpectedly: 9%

If you have been affected by this article, you can contact the following organisations for support:

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments