The easiest way to become a millionaire by the age of 65

'Becoming rich is nothing more than a matter of committing and sticking to a systematic savings and investment plan'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.If you want to get rich, start investing — and start as early as you possibly can.

"Becoming rich is nothing more than a matter of committing and sticking to a systematic savings and investment plan," financial adviser David Bach writes in his book "Smart Couples Finish Rich."

"You don't need to have money to make money," he writes. "You just need to make the right decisions — and act on them."

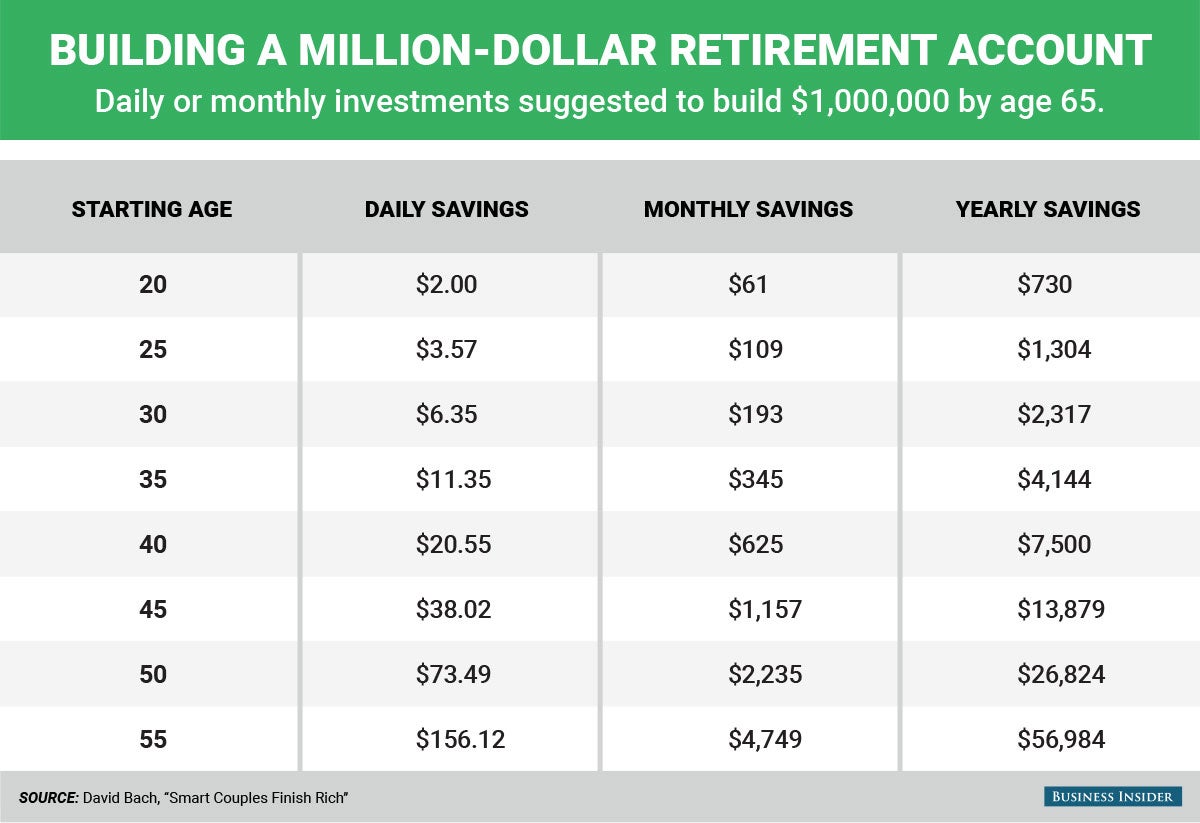

To illustrate the simplicity of building wealth over time, Bach created a chart (which we re-created below) detailing how much money you need to set aside each day, month, or year in order to have $1 million saved by the time you're 65.

The chart assumes you're starting with zero dollars invested. It also assumes a 12% annual return.

The simplest starting point is to invest in your employer's 401(k) plan, points out Ramit Sethi in his New York Times best-seller, "I Will Teach You To Be Rich." Next, he says, consider contributing money toward a Roth IRA or traditional IRA, individual retirement accounts with different contribution limits and tax structures.

While the numbers in the chart below are not exact (for simplicity, it does not take into account the impact of taxes, and 12% is a high rate of return), they give you a good idea of how coming up with a couple of extra dollars each day can make an enormous difference in the long run, particularly if you start saving at a young age.

Next time you consider running to Starbucks for a $4 latté, think about this chart and consider redirecting that coffee cash to your savings.

Read more:

• Here are the two most important pieces of technology at Arsenal FC

• A Muslim man was asked to leave a London Underground train after using an iPad

• Take a tour of the most expensive street in Britain

Read the original article on Business Insider UK. © 2015. Follow Business Insider UK on Twitter.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments