Support for when benefits aren't enough

The welfare system is under review, and it might be worth looking at income protection insurance. Chiara Cavaglieri reports

Radical changes to benefits come into play on Monday after the biggest shake-up to the welfare system in decades. With various tweaks and a new benefit cap which could hit households with a loss of £93 a week, it's more important than ever that individuals take steps to support themselves – and for the working population, that means income protection.

The controversy surrounding payment protection insurance (PPI) has made many people wary of all protection policies in the market, but income protection (IP) is an entirely different product and one that all employees should consider taking out.

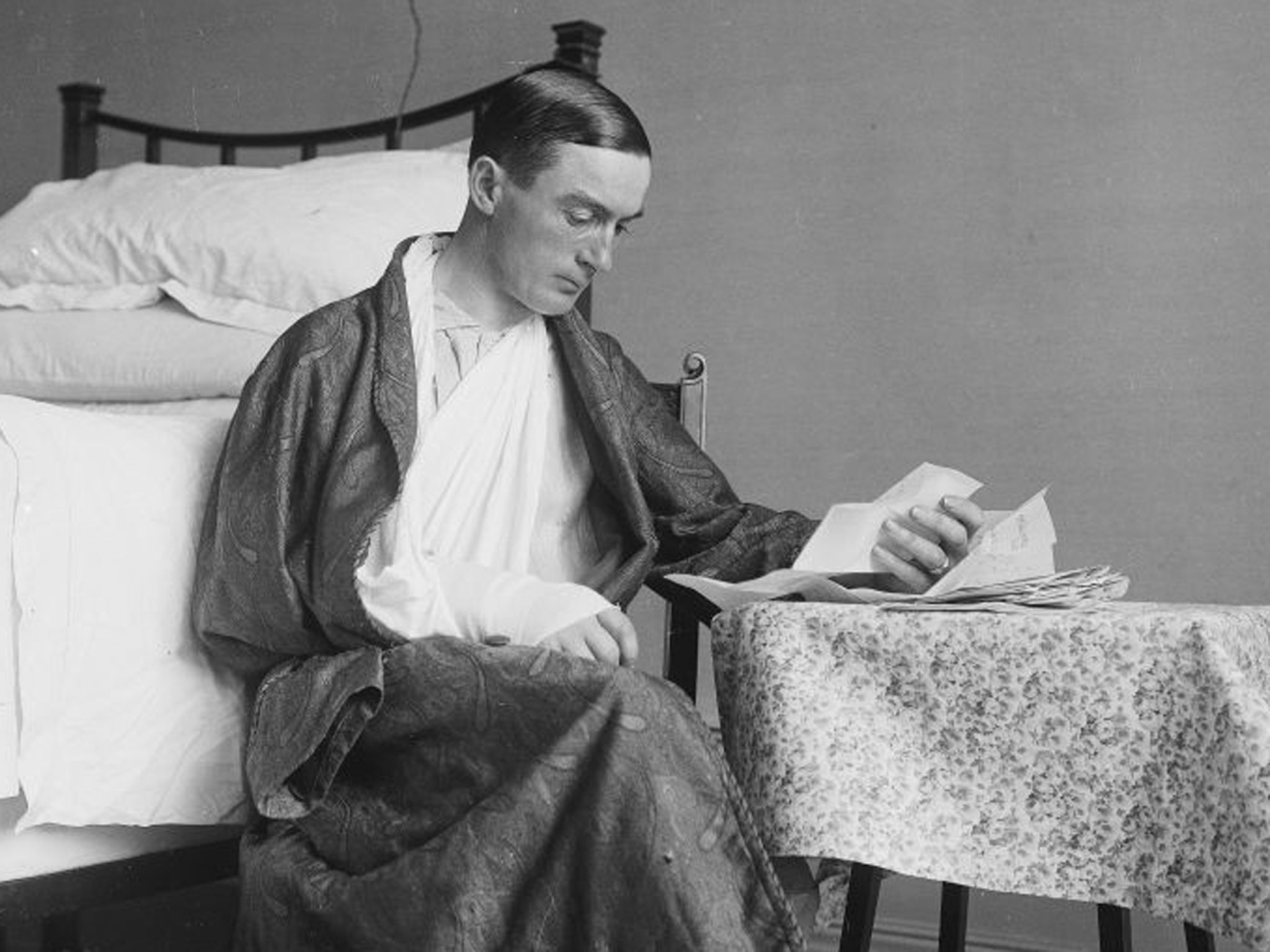

There is a widespread lack of awareness about how IP works, but it actually does what it says on the tin – it covers a person's income should they be unable to work due to illness or injury. As well as being refreshingly straightforward, many providers pay more than 90 per cent of claims so it could be a welcome and reliable safety net.

"With further cuts being made to benefits it is clear that state support in the event of long-term incapacity or ill-health is not guaranteed and it is increasingly up to each individual to take responsibility for their own financial situation," said Karen Barrett at the advice website Unbiased.co.uk.

"Income protection is designed to provide an income should you be unable to work and ensures that you will still be able to pay for the mortgage and the everyday essentials should something happen to you."

Being out of work and unable to cover bills and the cost of living is potentially disastrous; legally, employers are entitled to statutory sick pay for up to 28 weeks, but after this you must depend on state benefits. Constant changes to the benefits system make it almost impossible for individuals to rely on the state. If you're lucky, your employer may have group income protection in place, so check the sick pay arrangements in your contract.

There are a few things to watch out for when buying IP, particularly the definition used by the insurer to measure whether you can work. While critical illness cover is determined by a list of conditions – if it's not on the list, you're not covered – IP cover is determined by the insurer's definition of "incapacity". Avoid policies that pay out only if you can't do "any occupation", as you'll have to be completely incapacitated to claim. Cover based on "activities of daily working" can also be very tricky because under these policies you can only claim if you are prevented from carrying out various work-related tasks, such as walking and communicating.

Kevin Carr at Protection Review said: "The one you want to look for is 'own occupation' which means you cannot do your own job, the one you're trained for. It will pay you a tax-free monthly income until you are well enough to return to work, or you retire."

An IP policy typically replaces between 50 and 70 per cent of your salary. You will usually have to wait for a specified period before you can claim – anything from four weeks to two years – but it makes sense to arrange for the policy to kick only after you have benefited from any employer and statutory sick pay, because the longer the deferral period, the lower your premiums.

Ray Black, the founder of money-minder.com, said: "Beware the very cheapest policies which instead of offering long-term cover may only pay out for a defined and usually quite short period, sometimes for only a year. If you have a serious long-term illness or condition this type of policy probably won't provide the cover you need."

You can buy IP directly from an insurance company, or through an independent financial adviser who may be better equipped to find the right policy. Various factors affect the premium, including your age, your health and the riskiness of your job.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments