Protect and survive in the global meltdown

Amid all the turmoil, James Daley assesses the issues for UK savers, investors and homeowners

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.British stock markets suffered their worst week on record over the past five days, finishing yesterday evening down more than 20 per cent from the levels at which they opened on Monday morning. Even the Government's £50bn bank rescue package, and a co-ordinated 0.5 percentage point interest rate cut by the British, European and US central banks, failed to stem the panic.

While the turbulent markets have wiped billions of pounds off investors' pensions and investments, it's not been all bad news for savers and borrowers. Here, we take a look at how the events of the last week may have affected you.

MORTGAGES

The Bank of England's base rate cut on Wednesday was great news for existing borrowers with tracker mortgages – rates on these loans were immediately cut by 0.5 percentage points. For someone with a £200,000 mortgage, that represents a saving of £1,000 a year. Unfortunately, those people with discounted mortgages, which are tied to lenders' standard variable rates (SVRs), may not have felt the benefit. David Holingworth of London & Country mortgages, the fee-free broker, said that banks such as Halifax, Royal Bank of Scotland, Woolwich and First Direct have cut their SVRs by 0.5 percentage points. Other big lenders such as Nationwide and Abbey, however, have yet to pass on the cut to borrowers.

For people looking for new mortgages, rates are not getting any cheaper, either. Abbey withdrew its tracker mortgages on Thursday, and replaced them with rates that are 0.5 percentage points higher, relative to the base rate. Other lenders are believed to be considering raising their tracker rates. Hollingworth said that borrowers who are thinking of taking out a tracker mortgage should move quickly. Meanwhile, fixed rates are starting to look slightly better value – but with base rates expected to fall further, trackers are more popular.

As ever, you'll need a deposit of at least 5 per cent – or much more if you want to catch the most competitive rates. You'll also need a clean credit history.

SAVINGS

Some banks were quick to use this week's base rate cut as an excuse to cut their savings rates. National Savings & Investments, for example, cut the rate on its direct ISA by 0.5 percentage points. Michelle Slade, of the comparison site moneyfacts.co.uk, said that several other companies pulled their most competitive fixed-rate savings bonds – including the AA, which had one of the best rates of more than 7.2 per cent.

With capital markets still jammed up, however, most banks are still keen to attract new deposits, and have kept their best rates. Bradford & Bingley, whose savings business is now owned by Banco Santander, offers one of the best instant-access accounts, paying 6.51 per cent – more than 2 percentage points above base rate. And if you're in the market for a one-year fixed-rate bond, there are still accounts paying over 7 per cent, from banks such as Anglo-Irish, which has the full backing of the Irish government.

As long as Libor – the rates at which banks lend to each other – remains well above the base rate, then it's likely that savings rates will remain high, too.

INVESTMENTS

The FTSE 100 fell more than 1,000 points this week, starting off at just below 5,000 and finishing down below 4,000, wiping 20 per cent off people's pensions and investments in just a few days.

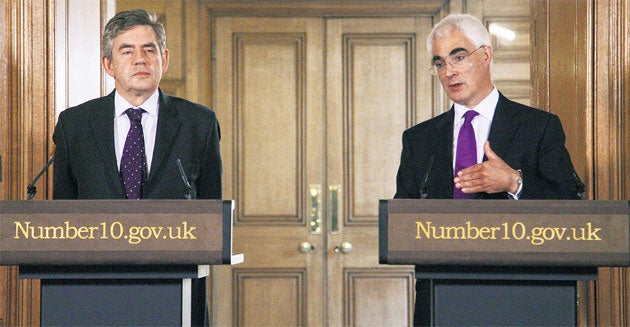

The sharp falls prompted calls from the shadow work and pensions secretary Chris Grayling to ask the Government to suspend the obligation for pensioners to buy an annuity at the age of 75, and the Chancellor, Alistair Darling, is believed to be considering this.

Nevertheless, many professional investors are claiming that we are close to the bottom of the market. In an interview this week, Neil Woodford of Invesco Perpetual, one of the UK's most respected fund managers, became the latest high-profile investor to claim that markets were approaching a floor.

Most important is that investors hold their nerve. Panicking and selling holdings now will only crystalise losses at their lowest point. As long as your pension fund and investments are well-diversified, financial advisers believe that the best course of action is to sit tight and wait for the storm to pass. Drip feeding savings into the market every month is a good way to take advantage of these cheap valuations. To find an independent financial adviser in your area, visit www.unbiased.co.uk.

HOUSE PRICES

British house prices recorded their biggest annual drop in more than 30 years over the 12 months to the end of September. According to new figures from Halifax, house prices were down 13.4 per cent in September, compared to the same month last year, having fallen 1.3 per cent that month alone. The average UK house price is now £172,108, close to the levels seen at the start of 2006.

Although the Government last month raised the 1 per cent stamp duty threshold from £125,000 to £175,000 until September 2009, the downward pressures on the housing market have far outweighed any positive effect that the change may have had. Mortgage approvals are down 70 per cent year-on-year, and this would indicate that the slump in the housing market still may have some way to go. If you're thinking of buying, it may be worth waiting.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments