Mark Dampier: It's time for investors to have a fling and fall in love with Europe again

The Analyst

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Europe seems to remain a perpetually unloved region with retail investors. I have made similar comments in this column many times. In recent years Europe's political and economic travails have discouraged investors. Yet many companies have prospered regardless and European stock markets have, on the whole, performed well.

Despite this, sentiment towards the region remains depressed. It is still possible to find high-quality, growing businesses, which you would normally expect to pay a premium for, trading at attractive valuations.

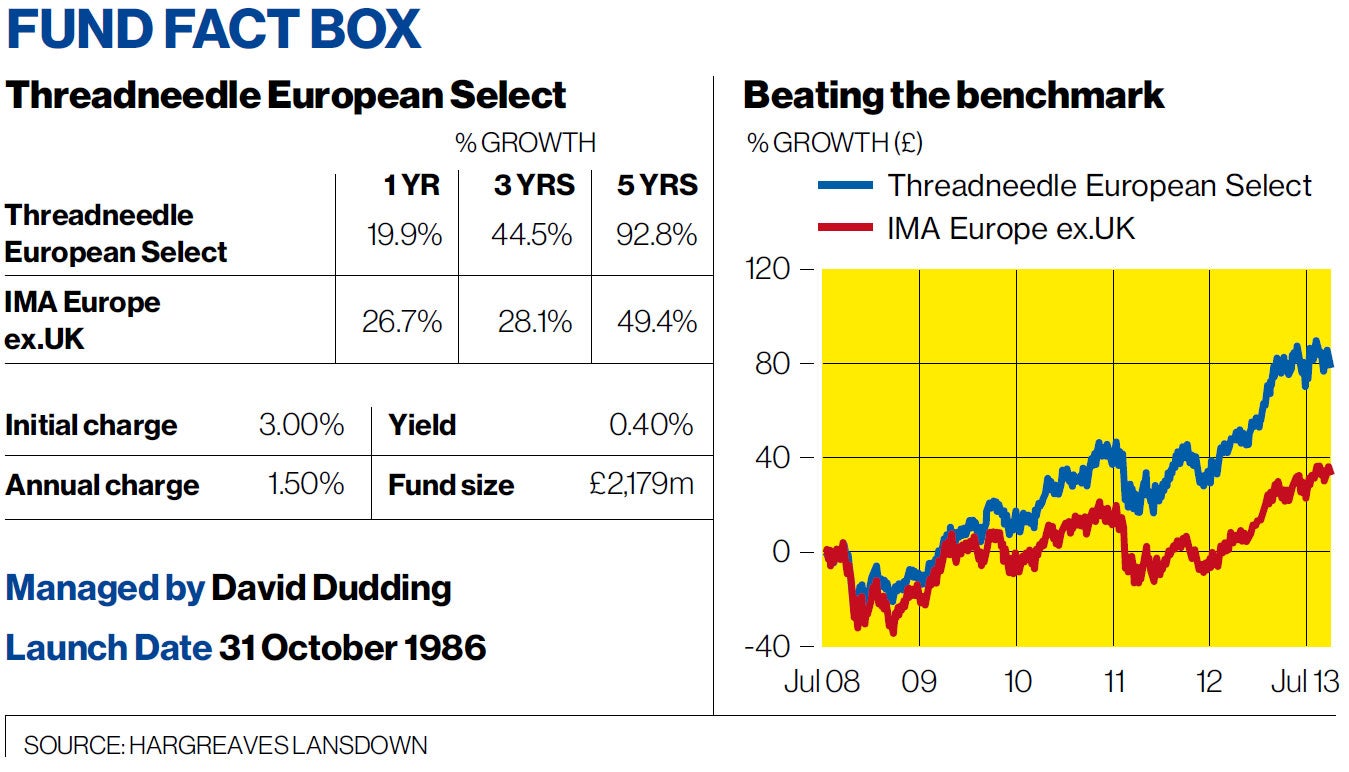

David Dudding, manager of the Threadneedle European Select Fund, has sought to create a portfolio of long-term winners. Many companies derive a large proportion of their earnings from overseas and are therefore not dependent purely on domestic European markets. Central to his analysis is a company's level of pricing power and degree of rivalry. Essentially he aims to assess how easily products could be substituted and how difficult it could be for competitors to take market share.

Mr Dudding spends little time studying the wider economic environment. He sees himself as a true stock picker. That said, he does admit to being pessimistic on the long-term outlook for European economies in general. Nevertheless, the continent remains home to some truly great companies. European firms are increasingly focusing on expanding into international markets. By not relying on earnings derived from a single geographical area they often exhibit an ability to survive and prosper even in volatile market conditions.

Nestle, for instance, is an example of a typical holding. It derives 75 per cent of its sales from outside Europe and owns some of the world's most recognisable brands. Brands can be extremely valuable assets which lead to a dominant market position. This forces out weaker competitors, improving the market share of the surviving companies. It also gives them pricing power, with control over what they charge for their products, rather than having to accept a price set by the market. This protects their profit margins.

Among financial companies Mr Dudding is focusing on those that survived the crisis and grown stronger since. He has bought UBS, the Swiss bank, noting it has stepped back from investment management, which he believes it was always rather poor at, and is concentrating on the wealth management side. It is a leader in this market and has grown into a strong, highly-regarded brand.

Elsewhere, Mr Dudding remains positive on Unilever despite its share price being down around 13 per cent from its peak earlier this year. This has partly been caused by slower sales in emerging markets, but he believes there is still a great opportunity for the company there over the long term. Another company he likes is Syngenta, an agricultural chemicals business, which has an outstanding growth franchise, carries little debt, yields 3 per cent, and has a return on capital of over 20 per cent.

In terms of areas Mr Dudding is avoiding, he believes an improving regulatory backdrop in the telecommunications sector is just short-term, and is not fond of utilities generally. He believes they are subject to too much government interference and don't always put shareholder's interests at the forefront. Overall, he likes to describe his fund as a concentrated portfolio of long-term winners. He refuses to follow the index and is the type of active manager investors should be looking for, as to outperform the index over the long term you need to do something different from it.

Overall, I view his style as relatively conservative given his focus on the sustainability of a company's earnings and cash flows. An emphasis on quality means the fund tends to lag a rapidly-rising market, although it has demonstrated an ability to offer protection in falling markets. The fund has also had considerably less volatility than its peers under his stewardship.

A region that is home to some of the world's most recognisable brands and companies with clear dominance on a global scale should not be ignored. Europe has more than its fair share of economic and political problems, but this is not a good enough reason to ignore the market. For many this fund could be a good starting point to obtain exposure to Europe.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments