Get the right deal to finance your new car

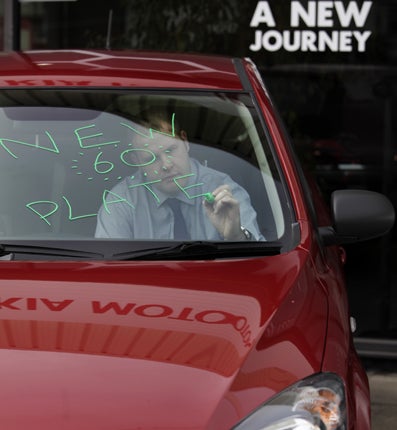

Maryrose Fison reports on the options available If you want a car with the new '60' number plate

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The new "60" registration plate is upon us this week. But as buyers head to the nearest dealer, it is important to tread carefully when it comes to car financing.

Of the estimated one million "60" plate cars that will be sold, only 20 per cent will be paid for in cash. The remaining 800,000 will be bought on car finance. And it is just as important as ever to get the right deal to suit your personal finances.

There are three main options: a personal loan from a bank, building society or social lender such as Zopa; a plan from a dealership; or a car leasing scheme.

Finance from a dealer

Dealership loans are the most popular option, with more than half of car financing taking place inside the garage last year, according to comparison website FinanceACar.com.

There can be advantages to organising finance through a respectable dealership. Plans can be tailored to your needs and a car can be bought the same day. However, it is vital to watch how car dealers present their offers and essential to shop around before agreeing to a plan. Mark Huggins, the financial services director at the Automobile Association, says the wording used by some dealers can leave consumers bewildered.

"Most garages will offer finance, but a common tactic is to quote for a loan at a flat interest rate that sounds attractive. It is important to know the APR – annualised percentage rate – which tells you the total amount of money you'll pay each year including any set-up fees."

As a rule of thumb, flat rates usually translate into an APR roughly double the stated value. So don't be surprised if a 6 per cent quoted flat rate translates into an APR of 12 per cent – considerably more than on offer available elsewhere.

Mr Huggins also recommends reading the small print. "Some garages may also offer a 0 per cent finance deal. But check if additional fees apply, such as loan insurance, set-up or documentation fees and what happens when the deal comes to an end. You may also need to pay a hefty deposit of up to 40 per cent."

However, not all deals from vehicle manufacturers lack transparency. Peugeot, for example, is currently running a special offer on car financing called "Just Add Fuel". The deal will appeal to young people or those with points on their licence as it offers free comprehensive motor insurance, servicing, breakdown cover, road tax and a warranty for only £207 per month on a Peugeot 207. It's a good deal for young drivers in particular who may find insurance costs prohibitive.

Personal loans

Personal loans vary, but the advantage of this type of finance can be a more competitive rate than available in a dealership and the option of keeping your finances in one place.

One deal which may appeal to those looking for car funding is the Nationwide FlexAccount. From 7 September, the building society is offering this account for loans worth between £7,500 and £14,999 and charges an APR of 7.7 per cent for up to five years. The AA, which offers loans in conjunction with the Co-operative Bank, charges 12.9 per cent APR on loans up to £7,500 and 8.9 per cent for loans above £7,500.

However, some banks will offer loans only to their existing customers while others may demand early redemption fees. Stephen Sklaroff, the director general of the Finance and Leasing Association, says prospective car owners will also need to consider their banking track record as this will be taken into account.

"Personal loans can offer competitive rates but will usually be available for the whole of the cost of the car. But customers will need a good credit rating to get the best rates and the finance will not be tailored to suit a car purchase in the way dealer finance is."

Social lending

However, banks are not the only option when it comes to personal loans. Social lending sites such as Zopa are becoming more popular among people seeking competitive rates without the charges that normally apply to bank loans. Zopa offers loans worth up to £15,000 and rates vary from 8.5 per cent to 15 per cent depending on the amount borrowed and the credit grade of the borrower.

Giles Andrews, the co-founder and chief executive officer of Zopa, says this kind of deal has advantages. "Zopa loans can be repaid or partly overpaid at any time without any penalty. We simply charge the interest applicable for the capital outstanding at any time," he says.

"Applicants can get a definitive quote for free and we use a quotation search which doesn't register on their credit file until they accept the quote and actually apply. This is obviously a key benefit for applicants when they are looking for a loan."

Leasing

As the biggest cost of buying a car is depreciation, many drivers are now considering car leasing. Essentially, this type of car financing is a long-term rental agreement which provides the use of a car for a given amount of time for a monthly price. The cost of this type of arrangement varies enormously depending on the type of car you choose, and the downside is that you don't own the car at the end of the period. Defaulting on a single payment can also carry severe consequences, such as the company reclaiming the car. A variant on this is a personal contract plan (PCP). You pay an initial deposit, hire the car for three or four years and then have the option of either handing the car back with nothing owing or paying a final fee – normally 30 to 40 per cent of the initial on-the-road price – to own the vehicle outright. The Peugeot 207 Just Add Fuel scheme is a type of PCP.

But whichever type of loan you go for, the most important thing is to compare prices from different providers. New comparison website FinanceACar.com compares one million prices for 6,000 different cars, providing consumers with a range of options from dealerships, banks, lease schemes and, soon, the social lending site Zopa as well.

Expert View

Stephen Sklaroff, Finance and Leasing Association

The main options that people use to finance a car are dealer finance, personal loans, spending savings, and – in rare cases – extending a mortgage or using a credit card. Dealer finance is the most popular of these. In June 2010, 50.6 per cent of new cars bought by consumers were bought using dealer finance.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments