Five crackers for investors to back this Christmas?

The companies behind this year's most popular presents may provide good investment opportunities, says Nick Paler

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The battle of the TV Christmas ads has begun and this year's must-have gifts are already flying off the shelves as we enter the most crucial time of the year for many retailers.

Christmas lists will no doubt be chock full of the latest gadgets, as everyone from children to adults asks Santa for gifts including the iPad mini and the Kindle Fire.

But can investors use these trends to their advantage? Some of the companies behind the most popular presents also make great investments themselves, according to leading fund managers.

Below are five popular gifts for the family in 2012, made by five companies managers think you should buy for the long-term, not just for Christmas.

Trench coat/Burberry

For those with a bit of cash to splash this year, the timeless classic Burberry trench coat – retailing at £1,195 – makes an ideal Christmas gift. While its merchandise is definitely high-end, Burberry's shares are a bargain at current levels, according to Aruna Karunathilake, portfolio manager at Fidelity in charge of its UK Select fund.

It has been a mixed year for Burberry, with shares falling sharply from the peak seen in April when they traded near £16. Now, with the price around 20 per cent cheaper, Karunathilake says the company looks attractive.

"Burberry is a strong franchise with an excellent management team and robust balance sheet," he says.

"Despite strong growth in recent years, the brand remains under-penetrated in many markets, so there is plenty of potential. Demand from developed markets has also held up well, thanks to the regressive nature of quantitative easing. QE has supported financial asset prices, which tend to be owned by the well-off – the people who spend more on luxury items."

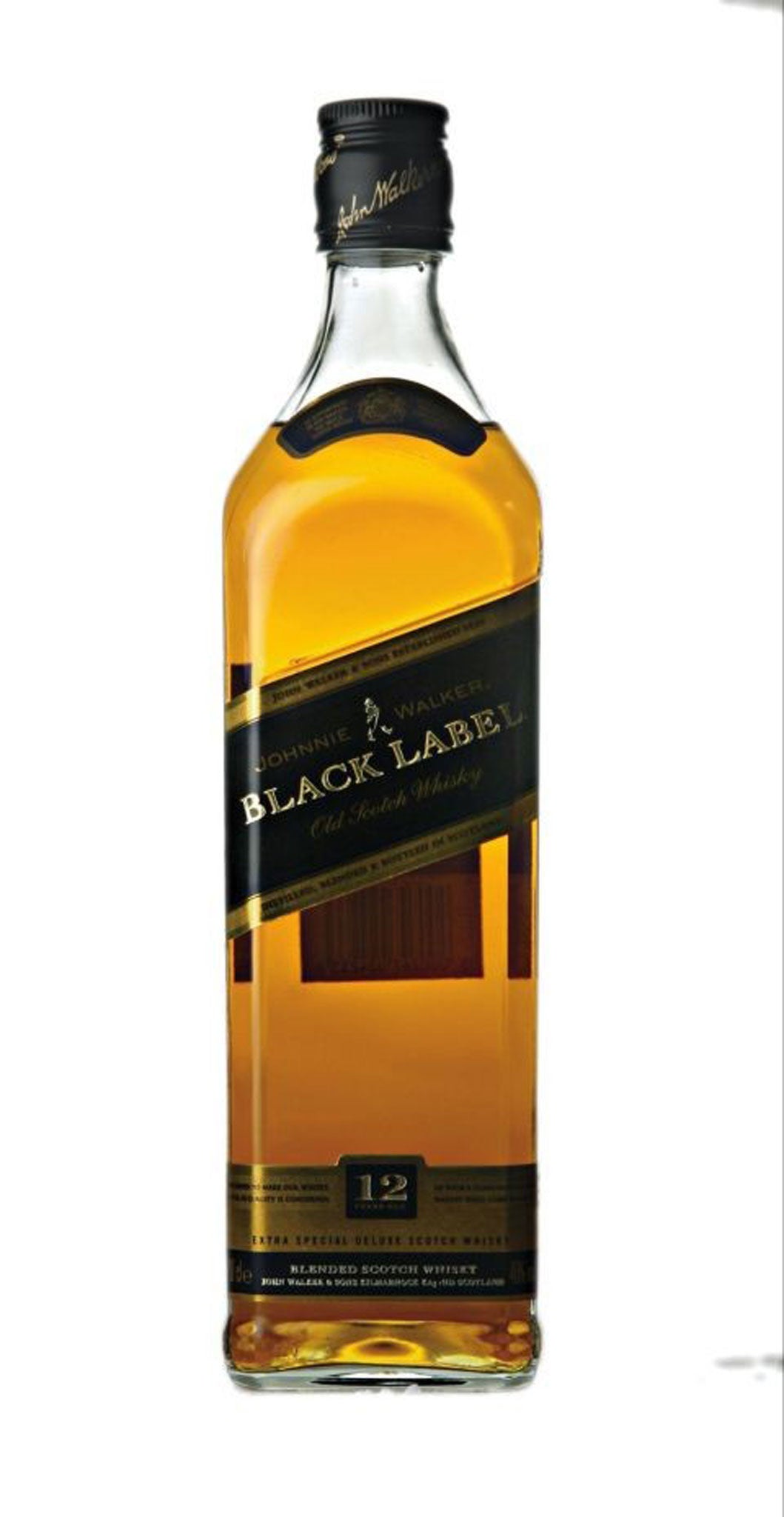

Johnnie Walker/Diageo

UK-listed drinks giant Diageo – the company behind some of the most popular spirits in the world including Johnnie Walker Black Label and Smirnoff Vodka – has also been one of the best investments you could have made this year, according to Karunathilake.

"Diageo has a superb global franchise in the beverages sector," he says.

"It has an excellent portfolio of brands and a strong sales outlook thanks to its extensive positions in emerging markets across Asia, Latin America and Africa."

Shares have risen 50 per cent this year as investors piled into safe havens, but Karunathilake says there should be more to come from the group as the global economic outlook remains bleak.

"It is a resilient business which is relatively immune to tough economic conditions," he said.

Kindle Fire/Amazon

Amazon's e-readers and tablets are top sellers this year, with the hugely popular Kindle Fire selling twice as many units on "Cyber Monday" alone as it did on the same day in 2011.

James Thomson, manager of the Rathbone Global Opportunities fund, says the world's largest online retailer not only offers popular products, but also the chance to make some decent returns.

"The management team is constantly investing in launching the site in new countries, expanding distribution facilities and offering new products, such as the Kindle Fire," he said.

Its shares have climbed 45 per cent this year, as e-commerce goes from strength to strength, and Thomson expects this festive season to be another successful spell for the company, which should help boost shares.

Louis Vuitton handbag/LVMH

Buying gifts for your partner is always hard, but for those to whom money is no object luxury retailer LVMH – Moët Hennessy Louis Vuitton – could be right up your street this Christmas.

The Sunshine Express Collection at Louis Vuitton is one of its top-selling ranges this year, or if you are feeling flush, the North-South Handbag from the Royal Collection is a snip at £16,800.

Thomson says luxury goods giant LVMH – also home to mega-brands including Marc Jacobs, Veuve Cliquot and Dom Pérignon – has excelled despite fears the global economy is cooling-off, and he expects it to continue to thrive during this key quarter for retailers.

"Despite fears of a slowdown in label-hungry China this year (which represents 25 per cent of all global luxury spend), LVMH still managed to post 15 per cent total sales growth last quarter, and the shares are up 25 per cent this year," Thomson says.

Gourmet dog-treat maker/PetSmart

One of Thomson's favourite stocks in his current portfolio, he expects the US company to shine this Christmas thanks to its innovative gourmet dog-treat maker, which sells for $29.99 (£19).

The gift allows pet-owners to make bone-shaped snacks for their dogs, and while it may be a treat for man's best friend, investors who back the company could also make a decent return thanks to PetSmart's unique position in the market.

Thomson said: "PetSmart is the US's largest and only listed pet-oriented chain, enjoying earnings growth of over 25 per cent in each of the last three years.

"It has over 1,200 stores in the US, where it sells bowls, leads, jumpers, kennels, food, even some live pets, and offers vet services. It also runs nearly 200 pet hotels, which look after pets when their owners go on holiday."

Thomson said if the company can meet its goals – it expects to open a further 40 to 50 stores in the US, including more hotels – the strong earnings growth investors have already enjoyed should continue.

"Shares are up 38 per cent and we believe this stock represents a resilient area of consumer spend, as pet-care continues to defy austerity," he said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments