Experts warn of hidden legacy after yet more bank blackouts

Glitches can damage customers’ ability to be accepted for financial products in future

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.As a basic rule, if you entrust your money to a bank or building society, you should be able to get to it. To manage it and use it at the touch of a button or click of a mouse.

Right now that seems far from guaranteed.

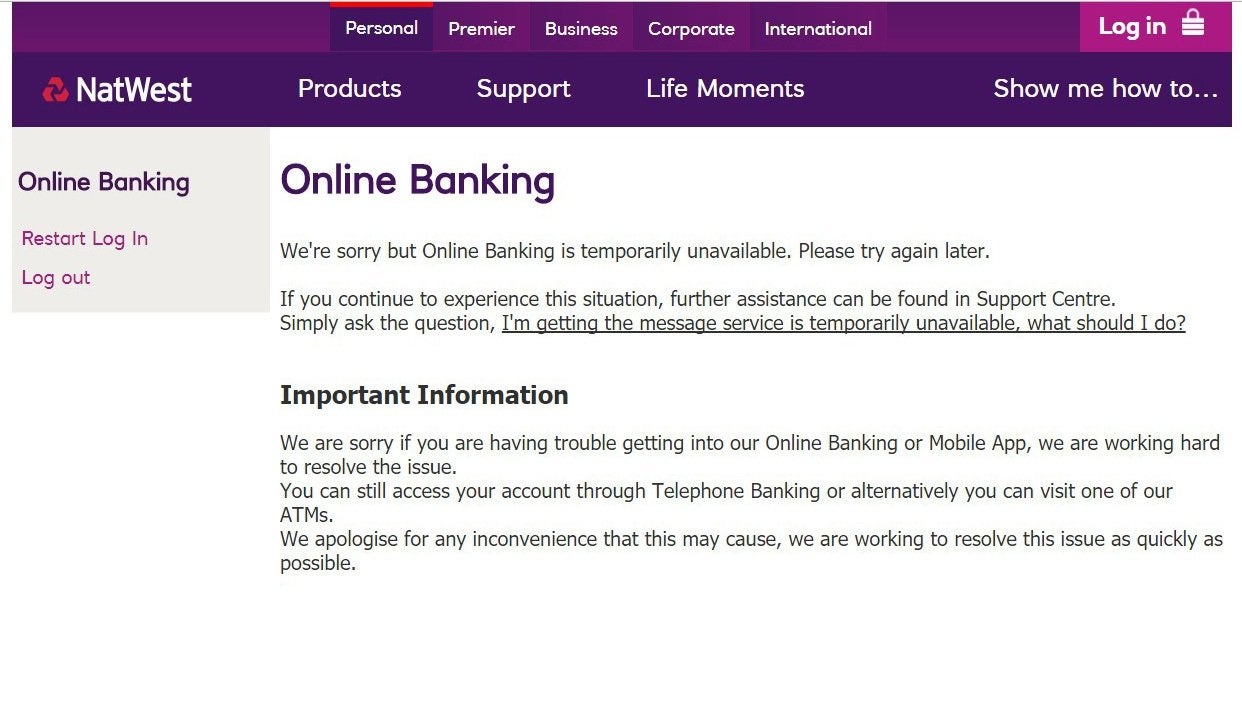

This week, access to the NatWest/RBS websites failed yet again after seemingly premature claims to have “fixed” their IT issues.

The glitches prevented customers from accessing or managing their cash online and left the banks scrambling on to social media to suggest people call them if they have any immediate problems.

“It seems as though hardly a week goes by without a high street bank failing its customers by experiencing an IT outage for some reason or other,” Aashna Shroff, personal finance specialist at money.co.uk said.

“It’s just not acceptable that consumers can’t rely on their banks to give them access to their money when they need it.

“If you are out of pocket as a result of NatWest and RBS being offline – for example, because you couldn’t make a critical payment – the banks should ensure you are not penalised with additional charges for late payments or interest, either cancelling the charge or refunding the amount if another bank charged you.

“If there’s any quibble about any of this, you can always take your case to the Financial Ombudsman, whose website is up and running…”

Figures from the Financial Conduct Authority show the UK’s banks suffered more than one IT shutdown each and every month in 2018, including a nine-month period when Barclays had 41 blackouts and Lloyds had 37. The situation is simply unacceptable.

But while the immediate impact on our bank balances is fairly clear, and resolution equally straightforward, the hidden, long-term problems could have far greater effects on our financial lives.

These outages can mean scheduled payments don’t go through or that consumers can’t access their accounts to make payments, which can have a negative impact on their credit report. This can damage their ability to be accepted for financial products in future, like a mobile phone contract or even a mortgage. It could mean they only have access to higher interest rates, which increases the cost of credit.

A missed payment can be one of the most negative factors on your credit report, and multiple missed payments can lead to a default – the most damaging factor possible, warns ClearScore.

A missed payment might also have further negative consequences – for example, if the late payment fees incurred from the missed payment took you over your agreed credit limit, this would damage your credit score even further.

“It might take several weeks for a missed payment to show up on your credit report so many only found out they’ve been a victim when they’re turned down for a financial product like a mobile phone contract or a mortgage,” warns Justin Basini, chief executive and co-founder of ClearScore.

Two-thirds of consumers who have checked their credit report after a bank IT failure have uncovered errors that could affect their creditworthiness, including missed payments that weren’t their fault, the credit checking service has found, but only a quarter of those whose bank had a major IT outage checked their report for errors.

How to fix credit report mistakes fast

1. Talk to the company

If you spot a mistake, let the company or lender know. They may well be happy to amend it immediately or you may need to go through their official complaints procedure.

Either way, they should send updates to all the credit reference agencies they use, so you won’t have to submit a request to each individual agency.

2. Talk to the credit report provider

Your credit score belongs to you and you have a right to make sure it’s accurate.

All credit scoring agencies should have a process for putting mistakes right so a few minutes of proactive emailing could fix the issue fast.

3. What if the company doesn’t agree?

If you believe there’s an error on your report but you can’t get it fixed, then you can add a Notice of Correction to your file.

A Notice of Correction is essentially up to 200 words explaining what happened and why it doesn’t reflect your normal financial behaviour. That’s not necessarily just for bank errors, it can also be used to explain any negative marks on your score.

So, if you had a period of ill health, for example, which means you fell behind on your bills, you can leave a note to explain.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments