Don't be fooled by a scammer

Fraudsters have ruined the lives of thousands, but, says Emma Dunkley, forewarned is forearmed

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Open a letter, an email from a stranger or pick up the phone and you are in a scammer's the line of fire. Conservative estimates suggest that hundreds of thousands of Britons fall prey each year to cons and the result is always the same: You lose, the criminal wins.

So concerned is the Financial Services Authority that last week it contacted 76,000 people to tell them they are on a "sucker list" and are at heightened risk of being targeted.

"Fake prize draws, get-rich-quick investments and bogus training courses are just some of the tricks scammers use to con people out of money," says Gillian Guy, the chief executive of Citizens Advice. "Rogues use a range of ways to lure people into scams from text messages to emails, as well as through the post. Some even turn up at your front door."

With a recent academic study putting the cost of fraud in the UK at a staggering £85bn, and Scams Awareness month upon us, you should take note of some of the biggest frauds out there.

Boiler rooms

It starts with a cold-call pitching a sure-fire share investment. But if you buy these shares, you could find the company does not exist, or that they are worthless and impossible to sell.

Jonathan Phelan, the head of unauthorised business at the FSA, says: "We get 6,000 people a year telling us they have been contacted by boiler rooms. Around 700 of these are victims and lost around £20,000 each. But only 10 per cent of victims ever report the crime."

Fake prize draws

"A consumer receives an official looking letter or email notifying them that they have won a large cash prize," says Louise Baxter of the Trading Standards Institute. "To claim, the consumer must send between £5 and £30, to process the win. However, no large sum materialises."

Land banking

"Someone tries to sell you a plot of land for an enhanced value, on the suggestion that one day it'll get planning permission and will then be worth a lot more," says Mr Phelan. Often this land will never receive such permission. "Victims have lost around £200m in total over the past five to six years." adds Mr Phelan.

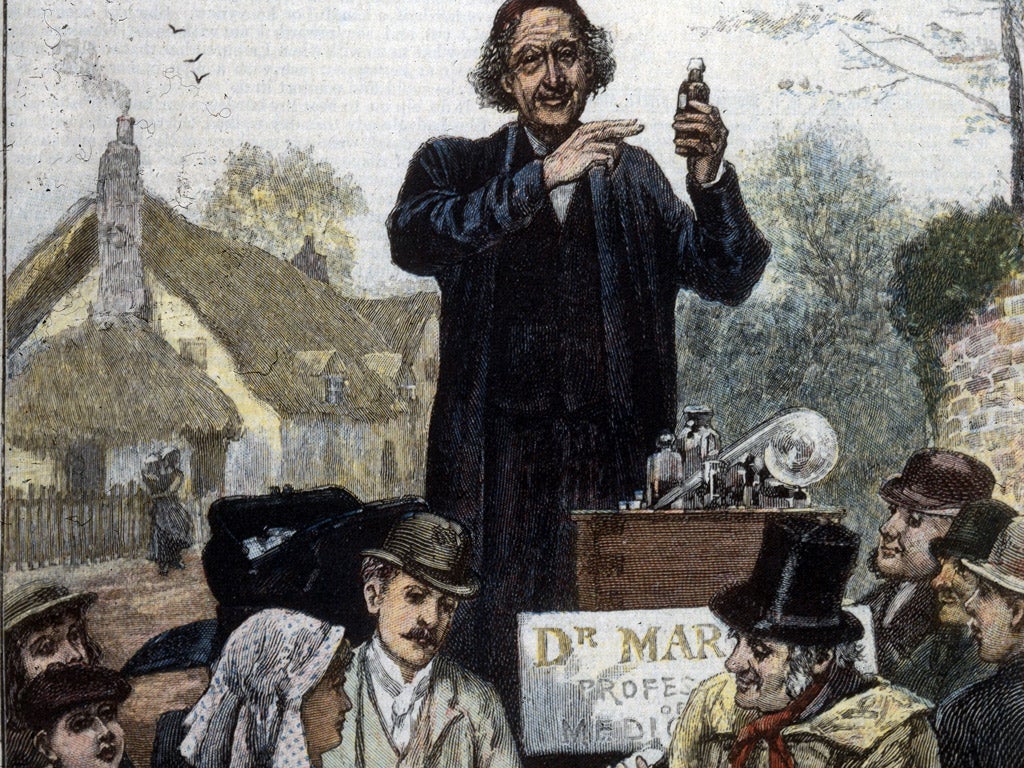

'Miracle' health cures

Scammers offer products such as pills or lotions, to help solve arthritis, diabetes, cancer, or help you lose weight. The seller often offers a "money-back guarantee" or a free trial. There can also be fake endorsements from "happy customers" or "medical professionals". "It is unlikely that they have been properly tested; some might even be dangerous," says Ms Baxter.

Pre-payment meter fraud

Fraudsters turn up on the doorsteps of people who pay for electricity by a pre-payment meter, and offer a "fake key" loaded with credit, but costing less than it would to recharge their key at a PayPoint. Christine McGourty of Energy UK, says: "If you buy an illegal top-up, you'll end up paying twice: once to the criminal and then to your energy company. "

Advanced fee scams

These con artists make you pay money up-front and "promise" to send goods or money at a later date, but these never materialise. Citizens Advice says examples include offering huge fees in exchange for helping someone transfer money out of a war-torn country. You could also be asked to pay up-front fees for loans or credit cards that you do not receive.

Get-rich-quick schemes

You give a fraudster money, which they have pledged will earn 30 per cent a year, for example. When you first ask for the interest it is handed over, so encouraging you to put more cash in and more people to invest. But it's a classic Ponzi scheme. "These schemes can carry on for years," says Mr Phelan. "But they inevitably collapse because more people want to take their money out than there is money flowing in."

Job and training scams

You are offered an exciting new career, in return for an up-front payment to cover non-existent training, warns Citizens Advice. There are also advertisements offering home-based work, after you have paid an initial fee. However, you could then find there is no work, or that you only get paid if other people sign up. You could even end up doing the work before finding out you are not getting paid anything.

Cloning and phishing

Fraudsters claim to be from a bank or other financial institution and set up fake websites, in an attempt to get you to disclose your personal details. This will allow the scammer to steal your identity or raid your accounts.

If you receive a call from someone saying they are from your bank or other institution, Mr Phelan says, you should phone the firm's switchboard and ask to speak to the person to check their authenticity. He adds there have been 450 cloning cases in the past 12 months.

Identity fraud

A scammer, using your personal details, can access your bank account, get credit cards, loans, passports, and state benefits in your name. Your information can be taken from documents you throw away or by contacting you under the guise of a real company.

Combating the conmen

If you have come across a scam or have been scammed yourself you can report it to Action Fraud on 0300 123 2040 and get advice from the Citizens Advice on 08454 04 05 06 or from your local bureau.

The FSA says if you are offered unsolicited investment advice or face high-pressure sales tactics, you should take the following steps before handing over any money:

Be very wary if called out of the blue and offered investment advice.

Check the FSA register to ensure the organisation is authorised.

Use the register details to contact the firm and let the FSA know of any issues.

Consider independent financial or professional advice.

Remember: if it sounds too good to be true, it probably is.

If you use an unauthorised firm for any investments you will not have access to the Financial Ombudsman Service or Financial Services Compensation Scheme if things go wrong.

Emma Dunkley is a reporter at Citywire

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments