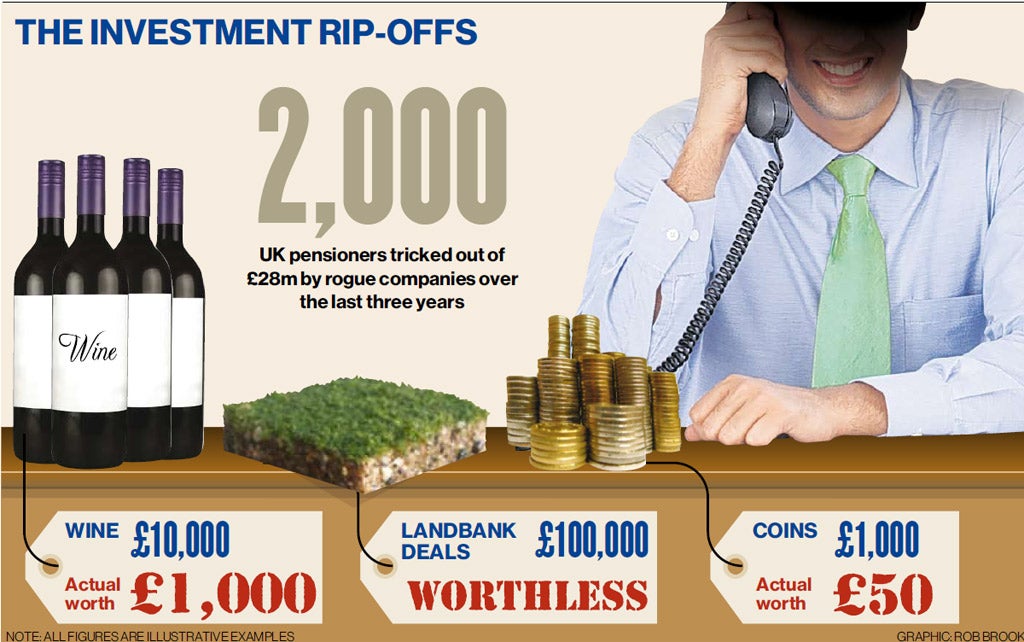

Crooks targeting the old in £28m scam

Elderly are being flogged worthless wine and coins, and tempted into dodgy property land-bank deals

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Around 80 rogue companies that raked in more than £28m through dodgy investment deals in the past three years may be just a small part of the growing army of crooks preying on vulnerable, older people.

The oldest person targeted by the scamsters was 92, according to the Insolvency Service. One in 10 firms it shut down between April 2009 and March 2012 was involved in profiting from schemes designed to trick people into handing over their life savings.

Almost 50 of the rogue firms were involved in land-banking – the outlawed scheme that involves selling plots of land for "building" that either didn't exist or were on protected, green belt land.

Other companies sold wine stocks or other forms of investment that did not yield any profits. Six of the rogue businesses sold products that were either unsuitable or at highly inflated prices, including burglar alarms, mobility scooters, "heritage" coins and stair-lifts.

Robert Burns, head of investigation and enforcement for The Insolvency Service said: "We have observed a number of companies which have been targeting older people in recent months. These scams are particularly unpleasant because they target the most susceptible members of society; older people who may be unsure how to seek advice or afraid to say no. They can destroy lives at a time when those targeted should be taking a break from worry and enjoying life after working hard."

The scams typically use the telephone equivalent of "door-stepping". Crooks phone older people and often refuse to come off the phone until they have closed a sale.

"Victims are paying for something and getting nothing," warned Mr Burns. "The worst aspect is the callousness with which the fraudsters go about their business; ignoring the obvious fact that because of their age, most victims will never be able to make good their loss."

Business Minister Norman Lamb lambasted the crooks: "These scams are especially bad as they target the most vulnerable members in our society. Older people have grown up trusting other people. To take advantage of this trust, and then exploit it, is both manipulative and deceitful."

Although scammers tend to concentrate on older people, anyone can be taken in, so people shouldn't be embarrassed to report a crime, advised Michelle Mitchell, charity director general at Age UK.

"If you feel you have been a victim speak to the police, a family member or friend."

Crooks don't just go for older people – each year around 28 million consumers are targeted and lose about £1bn.

To protect yourself or your family, always be wary about giving personal information to anyone you don't know or haven't checked out, unless you're 100 per cent confident that the recipient is genuine.

In particular, be wary of "boiler-room" share scams, where smooth-talking salespeople flog worthless investments. If anyone cold-calls you, check out their credentials properly and be aware of how easy it is to set up bogus websites these days.

If you think you've been the victim of an investment scam, contact the Financial Services Authority's consumer helpline on 0845 606 1234.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments