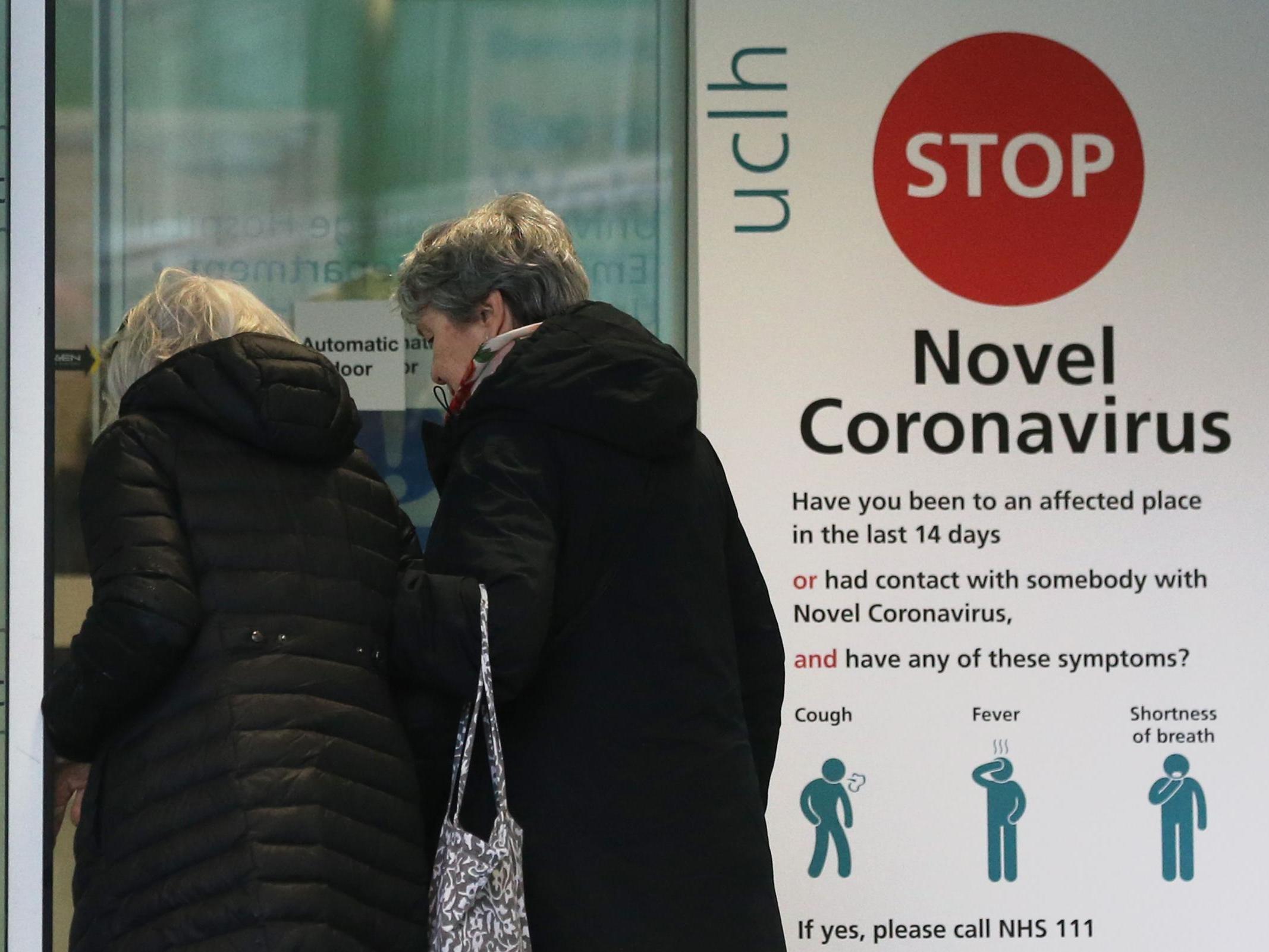

Coronavirus: Will life insurance, income protection and critical illness cover pay out?

In these unsettling times we want all the protection we can get, so what are different insurers doing?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Many of us choose to buy insurance policies such as health, critical illness cover and income protection to give us peace of mind in uncertainty. And it’s hard to think of any time more uncertain than 2020.

Europe is now the epicentre of Covid-19, which has spread to 123 countries, according to the World Health Organisation (WHO).

So it’s unsurprising that travel insurance providers have taken steps to limit their exposure, with several now refusing to sell travel insurance to new customers.

That’s unfortunate because the crisis has concentrated the minds of many travellers, and there has been a surge in the number of enquiries about travel insurance.

However, there are still some policies available that will cover the cost of any disruption. Just make sure you read the small print and understand the limitations of any policy you take out – for example, will it cover virus-related medical costs? And if you are quarantined while abroad, will the policy be extended until you are safely home?

Understanding exactly what your policy protects you for is always important, but even more so in a time of global pandemic.

It’s vital to take out insurance at the same time as making any plans – it’s too late to do so once the disruption has been announced. And if Covid-19 has shown us anything, it’s that events and circumstances can move fast.

But how much can customers rely on their other insurance policies in this strange, unknown time we find ourselves in?

Life insurance and critical illness cover

If you have any questions about your policy in a time of coronavirus, then the first place to visit is your insurer’s website.

Most have published clear Q&As for worried customers, and that will provide the information that is most relevant to your policy.

If you’re currently in the process of applying for life cover, then the insurer may ask about your recent travels and potentially postpone accepting your application until they are satisfied you are not at increased risk, but that will vary between providers.

The insurers that we checked with say they will not pay out on critical illness cover as a result of coronavirus because it is not a specified illness on their policies and because most people who contract it go on to make a full recovery.

Customers who are left with lasting lung conditions following the illness – a rare event – are likely to be able to make a claim, but this will depend on the wording of the policy.

In those rare and sad cases where people die as a result of the illness, their life insurance should pay out.

Income protection insurance

The broker website ActiveQuote reported a 15 per cent increase in calls about income protection insurance in the last week of February.

This increase is no surprise given the growing unease about the economic fallout of the disease, with some businesses laying off contractors and putting staff on extended leave.

Some insurers are adjusting what is covered in light of the coronavirus situation, so it is even more essential to check what is covered by a policy if you are taking one out now.

Few insurance policies will cover for risks you are already aware of, so if you know that your employer is about to terminate your contract, then this kind of policy may not be worth taking out now – check carefully before you apply.

Existing customers who are forced to stop working, perhaps because an employer has laid them off or because they have been told to self-isolate, should claim on any suitable policies as soon as possible.

Income protection insurance, payment protection insurance, mortgage payment protection insurance, or any kind of unemployment cover can take time to process and there may be a waiting period before you qualify.

However, many policies require a minimum of four weeks off before they start paying out, so if you are only out of pocket for two weeks of self-isolation, you may not receive anything.

But as soon as you think you may need to claim, you should act fast to ensure you are at the top of the queue.

What about my wedding?

If 2020 was going to be the magical year that you tied the knot, then you almost certainly have an extra concern.

Even if you had not been planning a trip abroad to marry, you may be worried about gathering together all your friends and loved ones, including older people who may be more vulnerable.

Many wedding insurance providers have suspended applications for wedding policies while they assess the increased risks.

Others may not be willing to reimburse costs unless, and until, there is a reason beyond the couple’s control, such as a closed venue or a government command to stay home where possible.

If you have an existing policy and an imminent wedding, then it is a very good idea to contact your insurance provider and find out under what circumstances you would be able to cancel and make a claim.

Testing times for insurers

Insurance is a vital product, giving people some control over the unknown. However, some commentators are worried there is a risk that the fallout from the coronavirus case could be that people trust providers less and so decide not to take out cover.

That would not be good for insurers or the customers who can usually rely on them.

Daniel Pearce, senior insurance analyst at GlobalData, says: “Consumer sentiment will also be negatively impacted in the long term.

“The industry will undoubtedly have to work hard to rebuild consumer confidence or face the prospect of longer lasting impacts.”

A pandemic could change how many people and workplaces operate. It would be a damning legacy if in the future more people decide not to insure themselves against unknown risks.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments