China's new boss Xi Jinping holds the key to the next decade for investors

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Meet the new boss, same as the old boss. That was the view expressed by Pete Townsend in the Who's classic Won't Get Fooled Again. It's a view that many spout about China. Leaders come and go, it is said, but the song remains the same.

But with China having become the world's second-largest economy - behind the US - the anointing of a new leader is something that will affect all investors. Even if you don't have any Chinese or Asian funds, more western companies are tying their future to China's growth which means your portfolio may depend on how well the new boss performs.

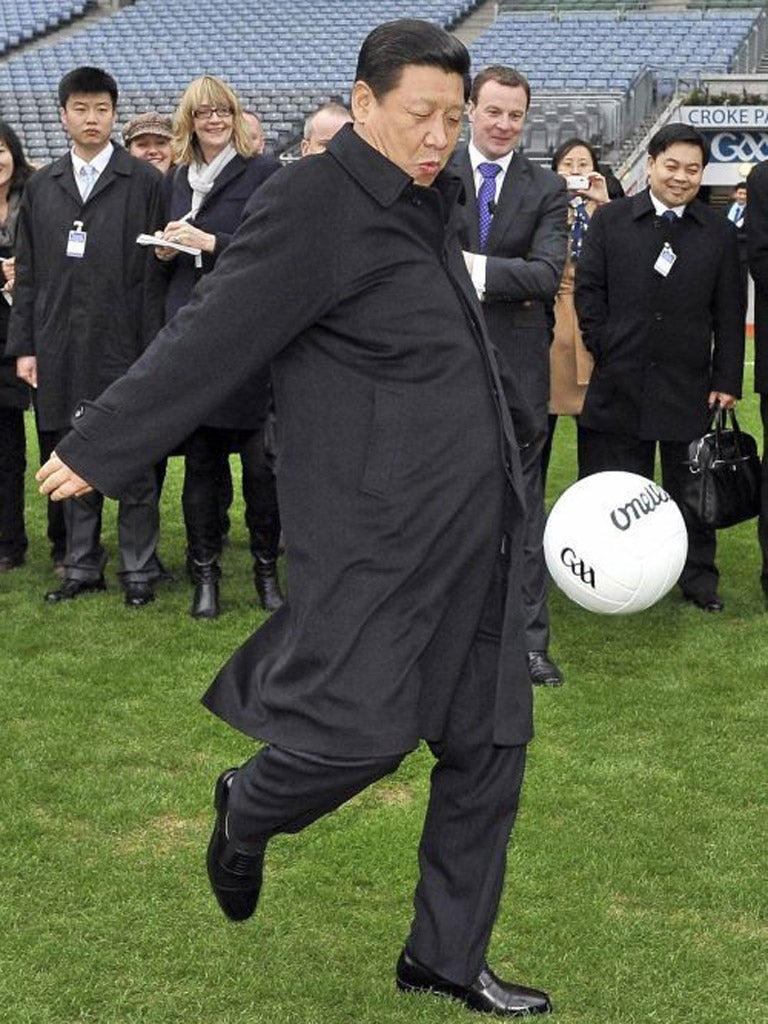

The new man in charge is Xi Jinping. The road to becoming the new President of China begins next Thursday 8 November, when the Chinese Communist Party's 18th Congress meets.

It should culminate in him being rubber-stamped as chief at the annual meeting of China's National People's Congress next March. He will hold office for 10 years, as the current incumbent has.

So what will the change at the top mean for investors? "The leadership change is an historic event and one that will help further cement China's place among the world's great economic powers," says Martha Wang, portfolio manager of the Fidelity China Focus fund.

"It will remove the political shackles that have been holding back the markets. The new leadership will focus on the quality rather than quantity of growth. This means a continued focus on the domestic consumer and further enforces the structural growth opportunities in consumer related stocks."

Virginie Maisoneuve, head of global and international equities at Schroders says the completion of the current leadership transition in China is key to the global economy.

"Beyond 2017, there's expected a slowdown in China due to its size and demographic trends. So many argue that a democratisation of the governing party of China would be wise in order to maintain stability in a country where communication modes have changed dramatically. Will the new leadership team bring China closer to democracy? Global investors will be wise to watch closely," she says.

Gigi Chan, manager of the Threadneedle China Opportunities Fund believes the ending of political uncertainty in the country will being rapid benefits to investors.

"The key for investments is certainty and after months of policy paralysis more clarity on the top leadership will be positive for markets in the short term," she predicts. "The incoming leadership can focus on pushing through policies once their power base is consolidated."

She believes that there will be political change in China with Xi Jinping looking to head a Politburo Standing Committee that is more pro-reform. "Looking further out, this has to be positive for investments. For the past decade or so the consensus has been that political change in China is unlikely. In fact political and economic reforms have gone backwards.

"The scenario that the pendulum might swing back is now increasingly likely," says Chan. "Certainly the new leadership realizes the importance of structural changes to maintain longer term economic growth. There has been more talk of reforms – to deregulate industries and introduce more market driven policies."

She warned that the reforms may not be positive for big blue caps such as banks and other large-listed state-owned enterprises. "But they will be positive for the economy as a whole longer term, as well as for the private sector. The main risk here is one of execution."

Any stability brought by the new leadership will be seen as a positive, says Juliet Schooling Latter, head of fund research at Chelsea Financial Services. "The economy has slowed, but growth is still at a respectable rate and the envy of all developed markets.

"The market has been oversold and it is one of the cheapest in emerging markets, so for long-term investors it offers opportunities and we could well see an up-tick in growth next year if the fiscal cliff is avoided and eurozone worries are kept under control."

Ahead of the change in leadership, Chinese equities enjoyed a bounce in October although they have been one of the worst performing sectors year to date, says Robert Morgan, investment analyst at Hargreaves Lansdown.

Neptune China was the top-performing fund in October - up 7.95 per cent - with eight other Chinese funds making up the top 10 over the month according to figures from Lipper.

Juliet Schooling Latter recommends the First State Greater China fund and, for more diversified plays, Fidelity Emerging Asia - which is 30 per cent weighted in China – and JP Morgan Global Emerging Markets which is 20 per cent weighted in China.

But the potential opportunities in the region should not mean just snapping up local-focused funds or shares, says Virginie Maisoneuve.

"Investors should not focus only on Chinese- or Hong Kong-listed securities to tap into Chinese economic growth, but look for streams of earnings in global and local companies, wherever they are listed."

"Some of the best ways to play the on-going changes in Chinese society and growth opportunities remain in the insurance, consumer and selected commodities areas," she says.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments