A flicker of optimism for the fall guys of investment

Some funds are improving their performance and bonuses look secure, finds Cherry Reynard. So should you rethink if you're heading for the exit?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.With-profits funds have had a bad name for a long time. They were supposed to navigate the ups and downs of stock market investment performance by holding back money made in good years so it could be paid out in bad ones – the so-called "smoothing effect". However, the concept did not stand up to the market storm that followed the bursting of the dot-com bubble at the turn of the millennium, with many providers cutting bonuses to the bone and imposing a "market value adjuster" (MVA) – in effect, a pen-alty for selling up.

But in the wake of nearly five years of market growth, are with-profits worth looking at again, even just holding on to? Or are they, as one expert puts it, products "past their sell-by date"?

The next few weeks should provide some clues. It is with-profits season, when providers announce their annual bonuses – that is, the amount of cash they will pay into investors' funds, akin to interest on a savings account. Sadly, with-profits watchers suggest they are not going to pull up any trees.

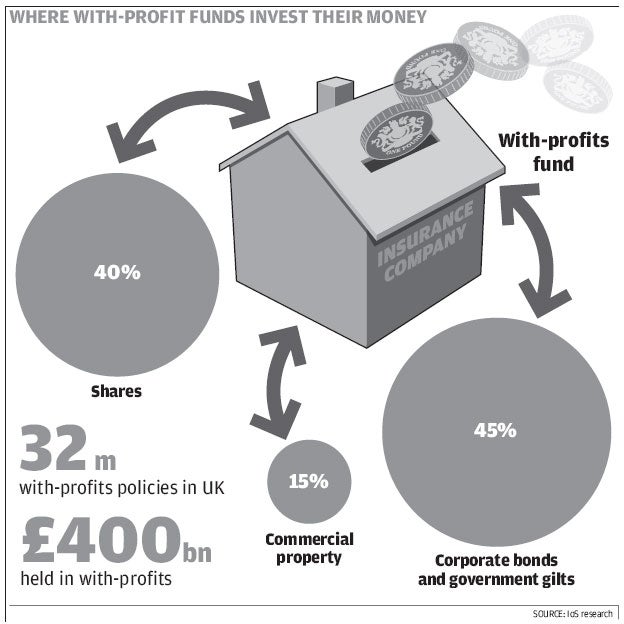

"We are likely to see flat performance figures for the funds as it has been a mixed year for the constituent parts," says David Carrington, sales and marketing director at Policy Plus, which trades endowments. "The commercial property market is uncertain, the bond market has seen falls and the equity market is only up 3 per cent."

But he adds that bonus cuts are unlikely as pro- viders have used some of the money gained from market growth between 2003 and 2006 to rebuild reserves. That will allow them to continue to pay bonuses even during a year when the underlying investments have not done well.

So in the light of this, should investors give with-profits another chance? Again the answer is far from clear. Looking at the long- term returns, with-profits can be seen to have held their own against some of the riskier stock market investments. Transparency has also improved, with providers giving investors more data on performance.

Ned Cazalet, principal of Cazalet Consulting, says many investors who may consider bailing out should sit tight: "A lot of money has been flowing out of with-profits that shouldn't be leaving. Just because an annual bonus is zero doesn't mean you shouldn't keep paying in, as the guarantees [such as the set payment at the end of the policy's life] can be very generous."

Crucially, though, performance varies across the sector. The more successful funds tend to invest heavily in shares, which have done well since 2003. Mr Carrington lists Prudential, Aviva (which includes Norwich Union), Scottish Widows, Clerical Medical and L&G as examples of funds well placed for growth in the years to come.

But some funds are simply weak. These are the ones that have been forced to hold lower-risk assets such as corporate bonds to meet guarantees made to investors, and have therefore not benefited from the rising stock market.

As a result, some experts want to call time on with-profits. "It is an historic product and past its sell-by date," says Bruce Wilson, managing director of financial adviser Helm Godfrey. "The returns looked smooth until people wanted to cash them in and MVAs were applied. Really smooth returns are hard to achieve."

Sheriar Bradbury, managing director of financial planner Bradbury Hamilton, says investors considering a move away from with-profits should look at the track record of the fund in paying both annual and terminal bonuses.

More importantly, they should look at the split of assets. A low weighting towards shares may be suitable in the current difficult markets, but is unlikely to serve investors well in the long term.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments