Poverty-hit pensioners miss out on cash lifeline

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Half a million poverty-hit pensioners could be put back on a firm financial footing simply by taking up the state benefits they are eligible for, a leading charity has claimed. Age Concern and Help the Aged says older people are turning down £5.4bn-worth of extra cash that is rightfully theirs. The money is made up of means-tested benefits and allowances that pensioners fail to claim.

Michelle Mitchell, charity director for Age Concern and Help the Aged, says: "These figures show just how badly the means-tested benefits system, which was supposed to lift older people out of poverty, is bogged down. The increase of 1 percentage point in the number of pension credit claimants still means one in three pensioners is missing out on this benefit. Even in the grip of a recession, eligible pensioners are still not claiming an average of £31 a week of pension credit alone."

Pension credit is a means-tested top-up available to those aged 60 or over. It guarantees a single person a weekly income of at least £130 and £198.45 for a couple. The average pension credit payment is £50 a week, so individuals could be missing out on £2,000 a year.

On top of that, two-fifths of people don't get their council tax benefit, which means they're turning down an extra £13.30 a week. And almost 350,000 people aren't claiming housing benefit, leaving them £39.50 a week worse off. "There are hundreds of thousands of pensioners missing out on cash that is rightfully theirs," says Mitchell. "That could be a lifeline in times of recession like this."

She says the charity can help make it easy to claim the money that people are owed. "We have benefits advisers available throughout the year to provide expert help. We would urge all older people to get in touch to find out if they can claim." Last year, the charity helped older people to claim more than £100m, but why aren't more of the population asking for what they are entitled to?

Some may be too proud to claim for state benefits or feel embarrassed about it. That's partly because they are part of a generation that may feel shameful about needing to take handouts. Others simply don't know that they are entitled, or are worried about the complexity of the process.

According to Age Concern and Help the Aged research, more than half of older people are cutting back on essentials such as heating and food‚ and one in 10 of the poorest pensioners has been forced into debt by the rising cost of living.

That means it is essential people currently missing out find out what they are eligible for and where and when to claim. Children or grandchildren of older people can help family members check their eligibility or to persuade them to claim. They can even take over responsibility for energy bills through a new scheme launched by E.ON this week. Under the firm's "Peace of Mind Payments" campaign, people can register to pay the energy bills of older family members.

Children don't need to go as far as that, but they can go a long way to improving the situation by helping their parents realise that it's simple common sense to use the money which is rightfully theirs, rather than thinking of it as a handout from the Government.

Janet Davies, joint managing director and founder of Symponia, a specialist financial advice network for those over the age of 65, says: "Getting older is not always a bad thing; in addition to the wisdom and calmer outlook that age often brings, there are also financial advantages as well. The trick is for older people to know what they are entitled to and to not be too proud to ask."

Ed Bowsher, Head of Consumer Finance at financial website lovemoney.com agrees. "Pensioners have worked hard and paid taxes throughout their adult lives, so they should claim every benefit they can get," he says. "And make sure you don't forget the lesser-known benefits such as free loft insulation. Once you've got the insulation, you could save up to £200 a year on your energy consumption."

Heating bills can be one of the biggest financial drains on a pensioners' income, but there is plenty of help available from the Government to ensure that every older person can afford adequate heating. The Winter Fuel Payment, which is handed over to everyone aged over 60, is worth doing: the payment is £250 and rises to £400 for those aged 80 or over. There's a September deadline to claim for the current 2009-2010 allowance to get the cash by Christmas, when it is most needed. Those who delay claiming won't get the cash until after September, while if pensioners don't claim by next March, they will lose their entitlement altogether.

Anyone already receiving the Winter Fuel Payment is on the system and should automatically get this year's money as long as their circumstances haven't changed. However, they must tell The Pension Service if, for example, they have moved house or switched bank accounts.

People should also automatically receive the cash if they're getting a state pension or other benefit, although that doesn't include housing benefit, council tax benefit or child benefit. Anyone else should call the Winter Fuel Payment helpline on 0845 915 1515, Monday to Friday from 8.30am to 4.30pm, or download a claim form from www.thepensionservice.gov.uk

When bitter winter weather strikes, people may also be in line for a Cold Weather Payment, which gives £25 when the average temperature where people live is recorded as, or forecast to be, zero degrees Celsius or below over seven consecutive days during the period from 1 November to 31 March. The payment is, however, means-tested.

Older people may more immediately be eligible for the Warm Front grant, which pays out from £2‚700 to £3‚500 for customers on the gas grid‚ and up to £6‚000 for those off the gas grid towards the cost of work needed to improve the energy efficiency homes.

As well as Government financial help, there is a range of other things older people can claim for, explains Janet Davies of Symponia. "Once you reach 60, you can get free bus travel anywhere in England, for instance," she says. "If you have not yet applied for an England-wide pass, all you need do is apply to your local pass provider."

Older travellers aged 80 or more can apply for a free 10-year passport. In April, free swimming for the over 60s was introduced across 289 councils in England. Prescriptions are also free for older people. To qualify you just need to complete the declaration at the back of the prescription form and sign it when you collect your prescription. Those over 60 are also entitled to free eyesight tests.

Everyone aged 75 or over can get a free TV licence for their main home. The licence also covers other household members living at the same address. If you're 74, you can apply for a short-term licence that will be valid until the end of the month before your 75th birthday.

"Looking at the consumer angle, several pub chains give concessions to senior citizens on certain weekdays," says Janet. "DIY shops may have special deals and most museums, heritage sites and other places of interest will have special rates for the over-sixties."

Cash in hand: Can you claim?

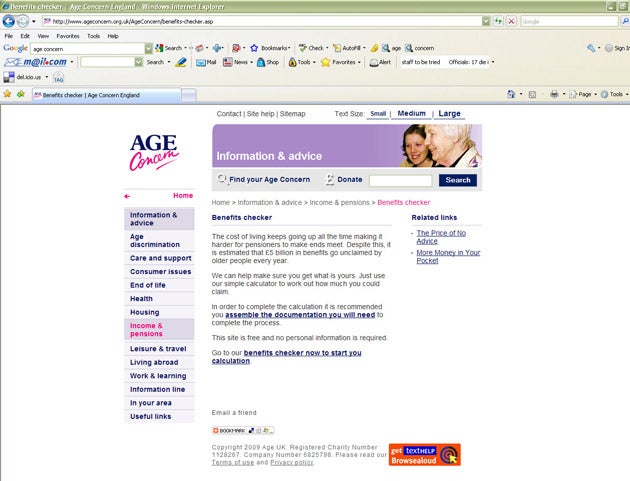

* Age Concern and Help the Aged has a benefits calculator online that people can use to get an idea of what they might be entitled to: www.ageconcern.org.uk/ageconcern/benefits-checker.asp.

* Call Age Concern and Help the Aged on 0800 00 99 66 or 0808 800 6565 for advice.

* The Government's website, www.direct.gov.uk/en/over50s/benefits/index.htm, lists all the benefits you can claim for and explains how to claim.

* To find out more about E.ON's Peace of Mind Payments service call 0845 302 4341 or visit www.eonenergy.com/ peaceofmind.

Financial crisis: Over-65s hit hardest

Struggling pensioners are being forced into bankruptcy faster than the rest of the population, according to accountants Wilkins Kennedy. The firm said the number of retired bankrupts has climbed 164 per cent over the past five years, almost three times faster than the average rate across all age groups.

It analysed data from the Insolvency Service to discover that the number of bankrupts aged over 65 has leapt from 983 to 2,595. The overall number of personal bankruptcies in England and Wales rose by 89 per cent from 35,700 to 67,500 during the same period.

The accountants warned the trend is set to worsen as more people go into retirement with higher levels of unpaid debts as they try to cope with the impact of the financial crisis.

Anthony Cork, director at Wilkins Kennedy, says: "While the number of personal insolvencies has been climbing relentlessly, the finances of those aged over 65 are deteriorating faster."

He blames the property boom of the last decade for adding to the problem. "Many people remortgaged their homes to withdraw cash, which has resulted in a growing number of pensioners being left with substantial mortgages. Pensioners may also have outstanding credit card debts that were taken on during the credit boom, so they find themselves unable to meet repayments when their incomes shrink on retirement."

A recent study by Help the Aged and Barclays revealed that one in four people approaching state retirement age have outstanding consumer credit commitments, owing four times as much as their counterparts did 10 years ago. With the prospect of having to fork out for expensive health-care as they age, the future for today's pensioners looks bleak, says Cork. "Sometimes people are forced to sell their house to afford private health-care."

Maximising retirement income by taking up benefits becomes even more crucial in such circumstances.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments