Ask Annie: Pensions, pensions everywhere, but what will I have to live on?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.I am nearing retirement and would like guidance on how much income I am likely to enjoy. I am a widower and have worked in many different jobs, acquiring lots of pensions both large and small.

My first question is, what state pensions and benefits can I expect at 65 and am I right in thinking I can defer my state pension in return for a cash lump sum?

As for other pensions, I have some workplace and private money-purchase schemes. My biggest, a Friends Provident fund, is worth £50,000. I have another plan with Prudential worth £15,000 and a few small final-salary pensions from many years ago; I'm not sure of the exact figures but I think they're currently set to pay around £1,500 a year.

What are my options for this money when I reach retirement, and if I convert them into an annuity, what kind of income can I expect? What alternatives are there to buying an annuity?

PS, Chester

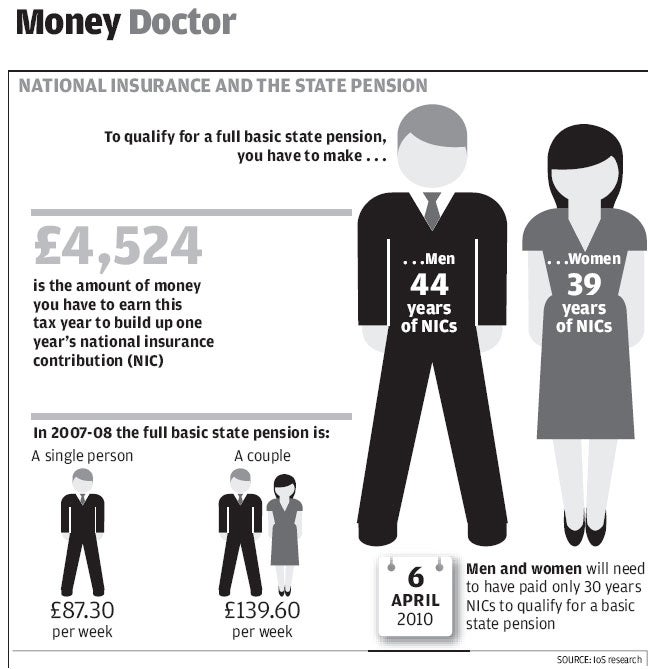

There are a number of issues raised by your letter. First, your state pension is payable from your 65th birthday, when you should be entitled to £87.30 a week, provided you have made 44 years' worth of national insurance contributions.

You may also be entitled to the state second pension (S2P), formerly known as the state earnings-related pension. Once again, the exact figure will depend on the amount of national insurance you have paid during your working life. It doesn't matter that you have had many job changes.

Nigel Callaghan, pensions analyst at independent financial adviser Hargreaves Lansdown, says: "You can defer taking your old-age pension. Currently, the Government will add interest of 7.5 per cent a year [2 per cent plus the base rate] to each full year's state pension that you defer. This is a pretty good return and it's a safe option. If you take the lump sum, income tax will be payable on it at the same rate as on your normal income. On its own, it will not push you into the 40 per cent bracket."

Call the Pensions Service on 0845 300 0168, and request a projection of how much you will receive in terms of the state pensions. The service is free and it can also trace any old company schemes that you might have lost track of.

Turning to your finalsalary pensions, Mr Callag- han says: "It's unlikely you should look to do anything with them, other than take the pension offered with open hands. They will typically increase each year. A potential downside is that they usually offer a widow's pension, which is of no benefit to you."

To secure your income in retirement, Mr Callaghan recommends you use your private pensions to buy an annuity. "The golden rule is to deal with a specialist annuity broker, who will scour the market on your behalf. Some insurers offer lousy deals, but by shopping around you could get a retirement income up to 30 per cent greater."

Make sure you mention any medical or lifestyle issues, such a smoking, as they may entitle you to an even bigger income – as much as 60 per cent more.

"At present, a 65-year-old with a total pension fund of £65,000 would receive an income, with no annual increases, of almost £3,600. This is after you take the maximum tax-free cash lump sum entitlement of 25 per cent of the fund – approximately £16,250."

Mr Callaghan adds that there are alternatives to annuities. You could, for instance, leave your money invested for another few years, drawing an income from it to live off. But income drawdown is risky – investments can fall in value – and only a good idea for people who have large savings, usually over £250,000.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments