NatWest makes banking app available on Apple’s Vision Pro headset

Personal banking customers of NatWest and its sister brands, Royal Bank of Scotland and Ulster Bank, will be able to use the technology.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

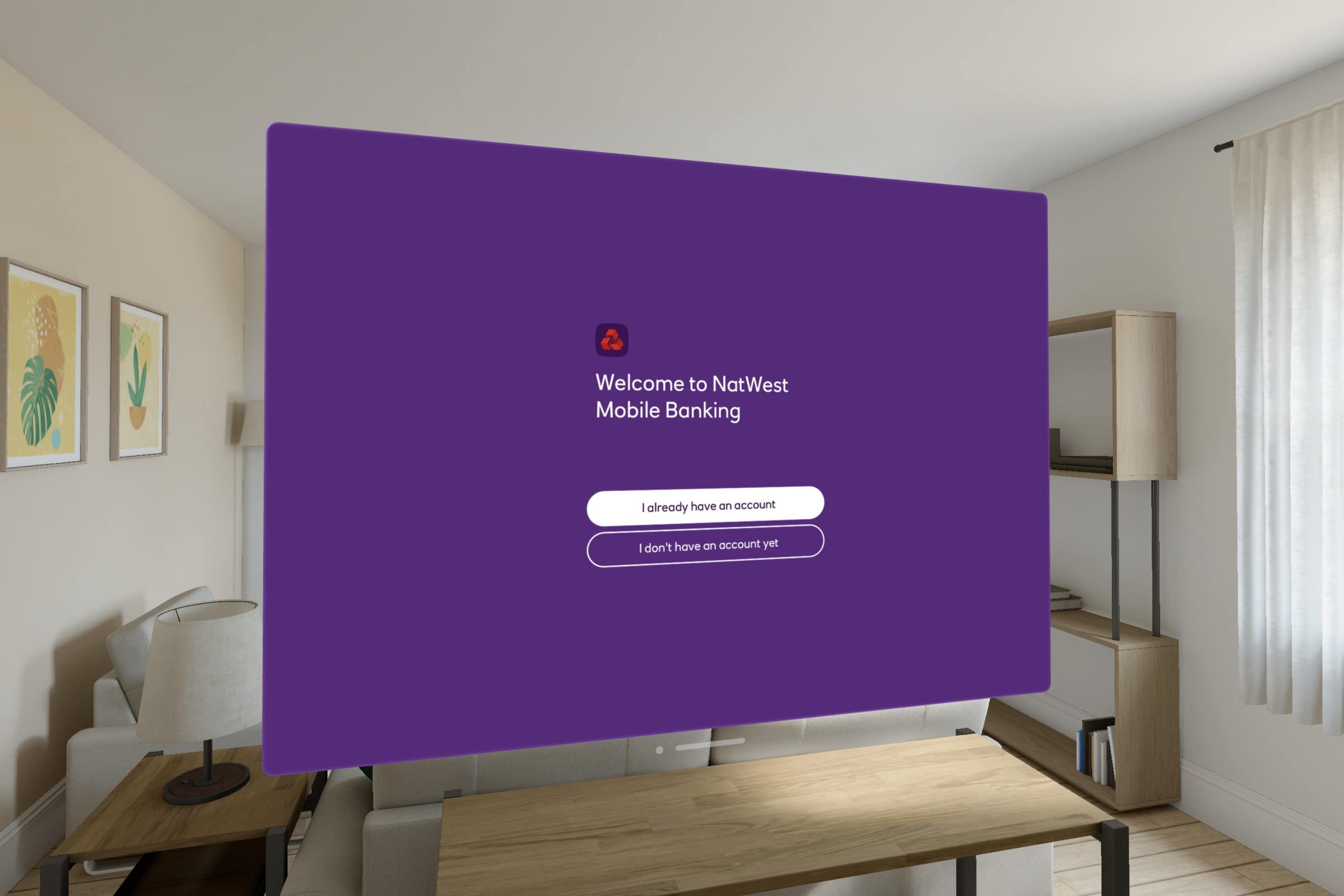

Your support makes all the difference.NatWest is making its banking app available on Apple’s Vision Pro headset, which blends the real world with digital content in front of the wearer’s eyes.

The bank said that its retail banking app is available on Apple’s new device, enabling customers to access day-to-day banking needs through spatial technology.

Personal banking customers of NatWest and its sister brands, Royal Bank of Scotland and Ulster Bank, will be able to view balances, make transfers and managing direct debits through a “secure and immersive experience”.

Apple’s Vision Pro headset, which is in essence a wearable computer that overlaps apps and other content on top of the real world, retails at £3,499 and is controlled by the user’s eyes, hands and voice.

It's just one insight into how the future of banking could look in the future

It went on sale for the first time in the UK earlier this month, with eager fans queuing outside Apple’s flagship Regent Street store in London to get a first taste of the new technology.

The Vision Pro offers more than 1,000 apps specifically made for the device.

Users will be able to visualise their financial world on a large canvas, NatWest said, making use of the bank’s existing app features such as viewing credit scores, managing spending and exploring insights.

NatWest said the move makes it one of the first banks globally to have its app feature on the Apple operating system, VisionOS.

Intuitive gestures allow users to interact with apps by looking at them, tapping their fingers to select, flicking their wrist to scroll, or using a virtual keyboard or dictation to type.

NatWest said it has made security changes to keep customers safe and secure when banking on the new device.

The bank said it will use the opportunity to build on the new technology and gather insights into how spatial computing could allow customers to visualise their finances in a more immersive format.

It will use insights from usage of the app on the new device to improve its product and service design for digital features.

Customers will be able to access NatWest’s digital assistant, Cora, which uses generative AI for “a more intuitive, conversational customer experience”, the bank said.

NatWest’s banking app reached 10 million users in 2024.

Wendy Redshaw, chief digital information officer at NatWest Group, said: “It’s great to be a first-mover with such exciting new technology.

“We’re very pleased to now offer our excellent retail banking app through an immersive new experience.

“It will be interesting to take learnings, understanding how customers use the app in this new technology to deal with their finances, and to understand how we can create bespoke propositions to serve them even better.

“It’s just one insight into how the future of banking could look in the future.”