Will you get a good deal if lenders can read your mind?

Banks are turning to 'customer profiling' to identify high-risk borrowers.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Nervous mortgage lenders are wielding a new and invisible weapon in their quest to drive away "high-risk borrowers" – even if they are already loyal customers. This is according to new research from mform.co.uk, the mortgage information service, which highlights the growing use of customer profiling among lenders.

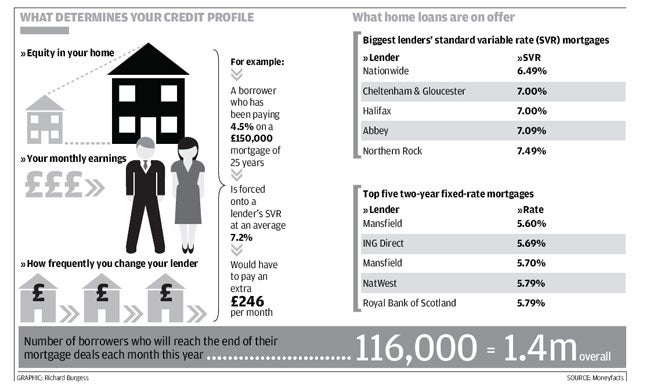

Customer profiling is when lenders use details they already know about borrowers – how much equity they have in their home, monthly income, how often they remortgage and so on – to predict their likely future behaviour.

This practice has big implications for the estimated 116,000 borrowers who will arrive at the end of their mortgage deal every month of this year. It will result in a growing proportion being refused another fixed or discounted-rate deal and thus being forced on to their lender's standard variable rate (SVR) – at an average 7.2 per cent. So a borrower who has been paying 4.5 per cent, on a £200,000 mortgage of 25 years, would have to find an extra £328 a month.

Customer-profile information is a separate tool to a borrower's credit rating – a numerical score held by credit-reference agencies such as Experian and Equifax and dictated by how well you manage your debts. A credit score can be viewed by a consumer and improved by recommended measures, but how a lender views a customer's profile is subjective and unquantifiable.

"A credit record looks backwards at what has passed, whereas customer profiling is a forecast that makes assumptions about what you might do based on other data collected," says Francis Ghiloni, business development director at mform.co.uk. "But the trouble with this approach is that it tends to penalise those already worst off.

"If you have significant equity, say, are a good credit risk and have a large income, you will be the kind of customer that a lender does not want to lose. They will be lenient with deals offered in order to retain your business. On the other hand, if you are a young borrower with low earnings and little equity, you are less likely to be offered another deal, which means going on to an expensive SVR."

Customer profiling is perfectly legal. It is even in line with the Treating Customers Fairly guidelines set by City regulator the Financial Services Authority. "But," says Mr Ghiloni, "this does not require that [lenders] offer the same products to everyone."

Neil Munroe, director at Equifax, says this kind of customer profiling was previously limited to credit cards and banking, but that mortgage lenders may now be taking the same approach. "There is a pick-up in the ongoing assessment of relationships between lender and borrower. It happened in the last recession and it is happening now."

James Jones, consumer affairs manager at Experian, adds that customer profiling is nothing new. "The majority of lenders use detailed internal data as well as credit information to assess a borrower's risk."

Homeowners should not assume the worst, though, says Ray Boulger, senior technical director at broker John Charcol. "Some lenders, such as Woolwich, Alliance & Leicester and Cheltenham & Gloucester, still operate policies under which existing borrowers will have access to the same deals as new customers – the key condition being that they are not in arrears. Other lenders offer 'retention rates' which, though priced higher than those available to new customers, are still designed to retain custom."

Even if your lender does not offer you another deal when your existing one expires, this does not have to be the end of the story. "While the borrower can think of the SVR as a 'backstop', they don't have to accept it," says Mr Ghiloni. "There are other lenders that may consider you for a new mortgage deal even if your current one doesn't."

But if you do manage to find a cheaper deal with a different lender, bear in mind that the value of your home may not be what you had assumed.

"Most lenders now have two or three tiers of interest rates and the best will be reserved for loan-to-values of 75 per cent or under," says Mr Boulger. "But the valuation may show your house is worth less than you thought; even if it's £10,000 over the 75 per cent loan-to-value threshold, you won't get access to the best deals with any lender."

Even if you do end up on the SVR, it's not the end of the world. This is because SVRs are priced roughly in accordance with the Bank of England base rate, which has fallen in recent months.

Finally, borrowers can hedge their bets as much as lenders. Last week, broker Savills Private Finance launched its Mortgage Rate Hedge offer. The deal runs to the end of June and offers customers the chance to book a mortgage rate six months in advance; if rates fall during that time, they are under no obligation to continue with the mortgage.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments