Forty-year mortgages tempt first-time buyers on to the property ladder despite high costs

Halifax and Nationwide are two of the biggest names to make the extreme long-term offers

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

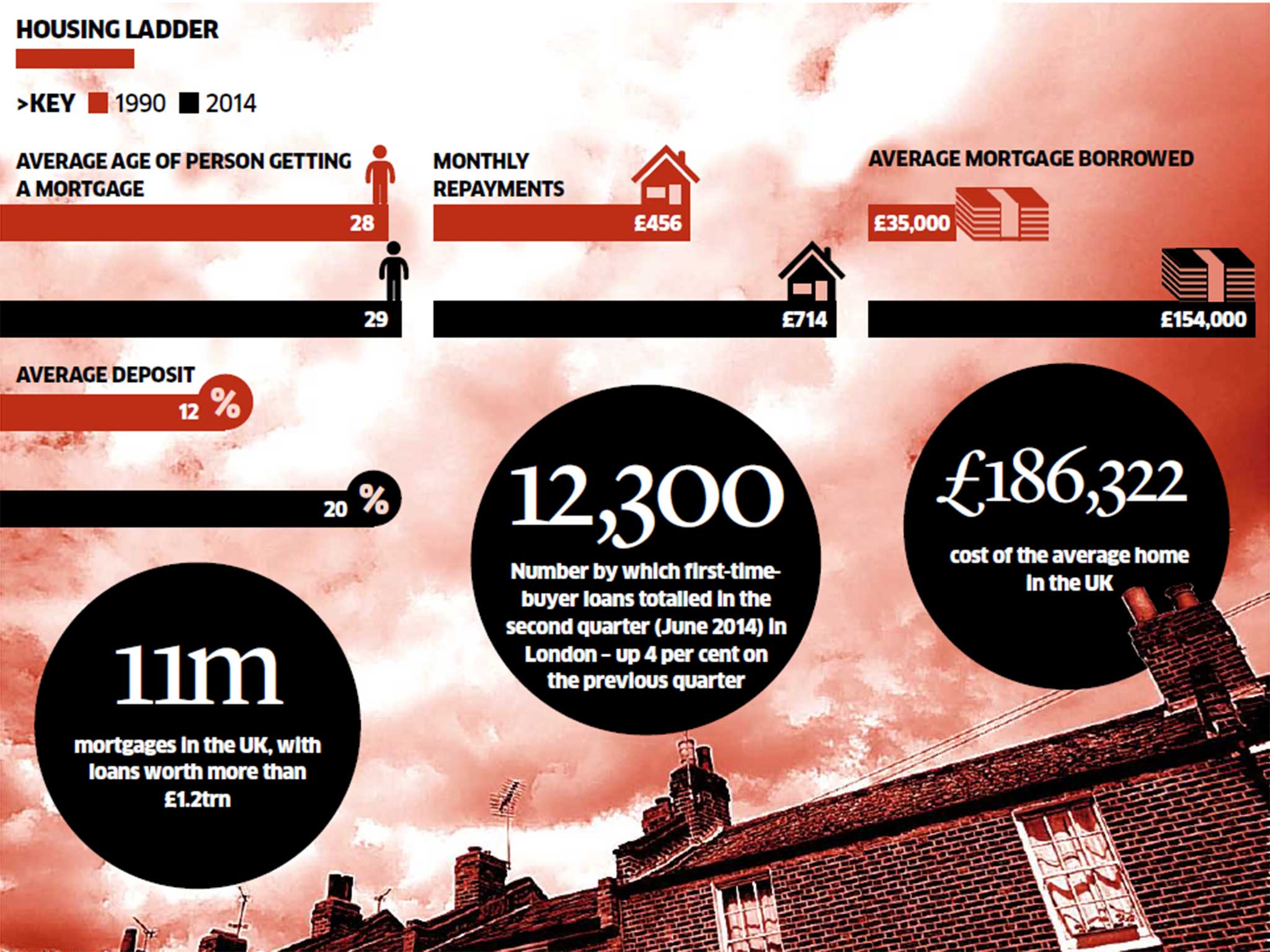

Your support makes all the difference.The number of first-time buyers prepared to pay double the cost of their home to get on the property ladder is soaring as more lenders begin to offer 35 and 40-year mortgages.

A combination of lower monthly payments and the chance to gain a foothold on the property ladder are proving too attractive a proposition to turn down despite the extra long-term costs buyers face.

Many are expecting to lower the length of their mortgage in the years ahead with the expectation that rising salaries will allow them to do so. Home-movers and those remortgaging are also taking up longer-term deals.

Anyone taking out a £200,000 mortgage spread over 35 years with an initial 4 per cent interest rate and £995 fee will end up paying back £373,781 at £890 a month. Over an extra five years, the total repayment cost exceeds £403,000 for only £50 a month less.

Halifax and Nationwide are two of the biggest names to offer 40-year mortgages, and figures from the Council of Mortgage Lenders show extreme long-term offers are being snapped up. Its latest figures for the second quarter of this year show that of the almost 80,000 first-time buyers, 22,600 (28.6 per cent) took out mortgages with longer than 30-year terms – an almost 10 per cent jump since 2010.

The number of "home-movers" doing the same more than doubled from 5 to 12 per cent. And 4,000 people remortgaged their property with a mortgage of more than 30 years – a fivefold rise since 2010.

UK house prices are expected to rise by about 10 per cent this year and by more than 25 per cent by 2018, according to a report published last week by Savills estate agents. Although the firm said it expected the London property market to flatline in 2016, young professionals are grabbing the chance of a mortgage while they can.

Linda Isted of the Debt Advice Foundation charity warned that it was impossible to predict anyone's financial situation in 35 years' time. "We would always caution people to think very carefully about any kind of credit which is due to run past their retirement age – or even to run into a time of their life when they might be thinking about perhaps cutting back on working hours," she said.

"We are increasingly hearing heartbreaking stories from older people who still face significant debts when they reach retirement age, and have no prospect of additional income to settle them. Whatever length of mortgage you are considering, the key is to look at your overall budget and to make sure that you really can afford the repayments."

Last month, Bank of England deputy governor Andrew Bailey warned that longer-term mortgages could create a problem for borrowers as a steady rise in wages is never guaranteed. "We have to watch this very carefully, because if mortgages extend beyond the point at which people's income falls off, then we have a long-term problem," he said.

Dominik Lipnick, director of Your Mortgage Decisions, said last month that it was clear there was a major shift in the mortgage market.

"Without a doubt, 30- or 35-year mortgages are becoming the new 20- and 25-year terms," he said.

"People will borrow for longer as house prices continue to rocket – which they will until the supply-side issues are seen to.

"The market certainly needs to reflect the fact that people are working for longer and living longer. Policymakers need to help the situation by actually building the extra houses they so often talk about."

Case study: 'The aim is not to keep it at 40 years for the whole term'

Lydia Hamilton, 23, took out a 40-year mortgage with her sister and the pair are about to exchange contracts on a £249,950, two-bed flat in Crystal Palace, south London.

Although they had a 45 per cent deposit, Ms Hamilton said the very long-term mortgage was the most attractive deal given their earnings as it enabled them to have monthly mortgage payments of £490. Similar properties in the area are available for rent from £1,200 a month.

Ms Hamilton said: "We've only just graduated so we decided that a 40-year term was the best one for us as it keeps the monthly payments relatively low and it gets us on the property ladder.

"The aim is not keep it at 40 years for the whole term. As our wages hopefully increase then we'll start paying off more and bringing down the length of the term."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments