Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Lloyds has become the first UK bank to set aside hundreds of millions of pounds in case it has to compensate car finance customers, amid a major investigation into whether people overpaid on their loans.

The banking group revealed a provision worth £450 million to cover potential costs relating to the issue.

Here, we look at what is being investigated and what could happen next for banks and consumers.

What is the car finance issue and why is it being investigated?

The UK’s financial regulator, the Financial Conduct Authority (FCA), launched a review last month into historic commission arrangements in the motor finance market.

It said it followed a high number of complaints from customers to car finance firms.

In January 2021, the FCA banned selling practices known as discretionary commission arrangements.

It stopped lenders allowing brokers, including car dealers, to increase interest rates on car loans so they get more commission.

Research suggested it led to higher finance costs and was unfair on consumers.

What could happen next?

The FCA said if it finds consumers have lost out because of widespread misconduct, it will make sure they get compensation in an orderly and efficient way – indicating it could set up a formal redress scheme.

The watchdog is expected to set out its next steps by the end of September.

MoneySavingExpert.com has created a tool to generate a template email for people who think they might have been overcharged interest on a car, van or motorbike bought on finance before January 28, 2021.

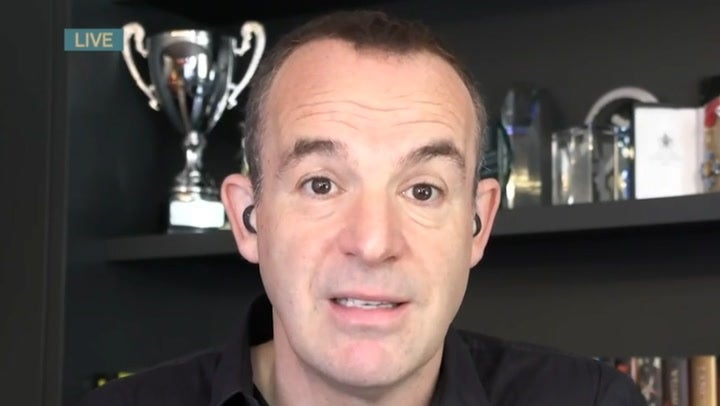

Consumer champion Martin Lewis, who founded the website, said some 262,500 complaint emails were sent after just one full day of the tool being launched.

What has Lloyds said about the issue?

Lloyds has come into the spotlight because it is one of the biggest motor finance providers in the UK through its brand Black Horse.

The bank said it is too early to say what the scale of any potential redress could be, and that it welcomed the regulator’s investigation to get clarity on the issue.

Matt Brizman, an equity analyst for Hargreaves Lansdown, said the £450 million charge is “less than some had feared but there will be question marks around how Lloyds has come to that figure”.

He added: “Lloyds has been honest in saying the outcome of the review is largely unknown.

“What we do know is that Lloyds is one of the more exposed banks should the FCA deem there was misconduct and customer loss.”

Are other banks involved?

Santander said it had received “a number of county court claims and complaints” about the issue following the FCA’s review, and it is possible it could receive more.

But the bank said: “In view of the inherent uncertainties, it is therefore also not possible to estimate the extent of any financial impact.”

Barclays acknowledged the review in its full-year results published this week, but did not give any further details or estimated costs.

Alex Neill, co-founder of consumer rights group Consumer Voice, said: “All car finance providers that used discretionary commission should be setting aside money to give customers back what they’re owed.

“It’s only right that all of the people who have been charged too much for their loan are compensated.”