‘Loyalty penalty’ paid by home and motor insurance customers comes to end

New rules mean that insurers will be required to offer renewing customers a price that is no higher than they would pay as a new customer.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Motor and home insurance customers will stop paying a “loyalty penalty” when their deal comes up for renewal from January 1.

New rules mean that insurers will be required to offer renewing customers a price that is no higher than they would pay as a new customer.

But those who regularly shop around for a cheaper deal, who are often younger customers, could end up paying more, with discounts potentially becoming smaller.

Many firms have increased prices for existing customers each year at renewal in a practice known as “price walking”. This has distorted the market as new customers may have been offered below-cost prices by firms to attract them in and then ended up paying more over time if they renewed their insurance.

Regulators have found that millions of customers were being unfairly charged higher prices, including an extra £1.2 billion in 2018 alone.

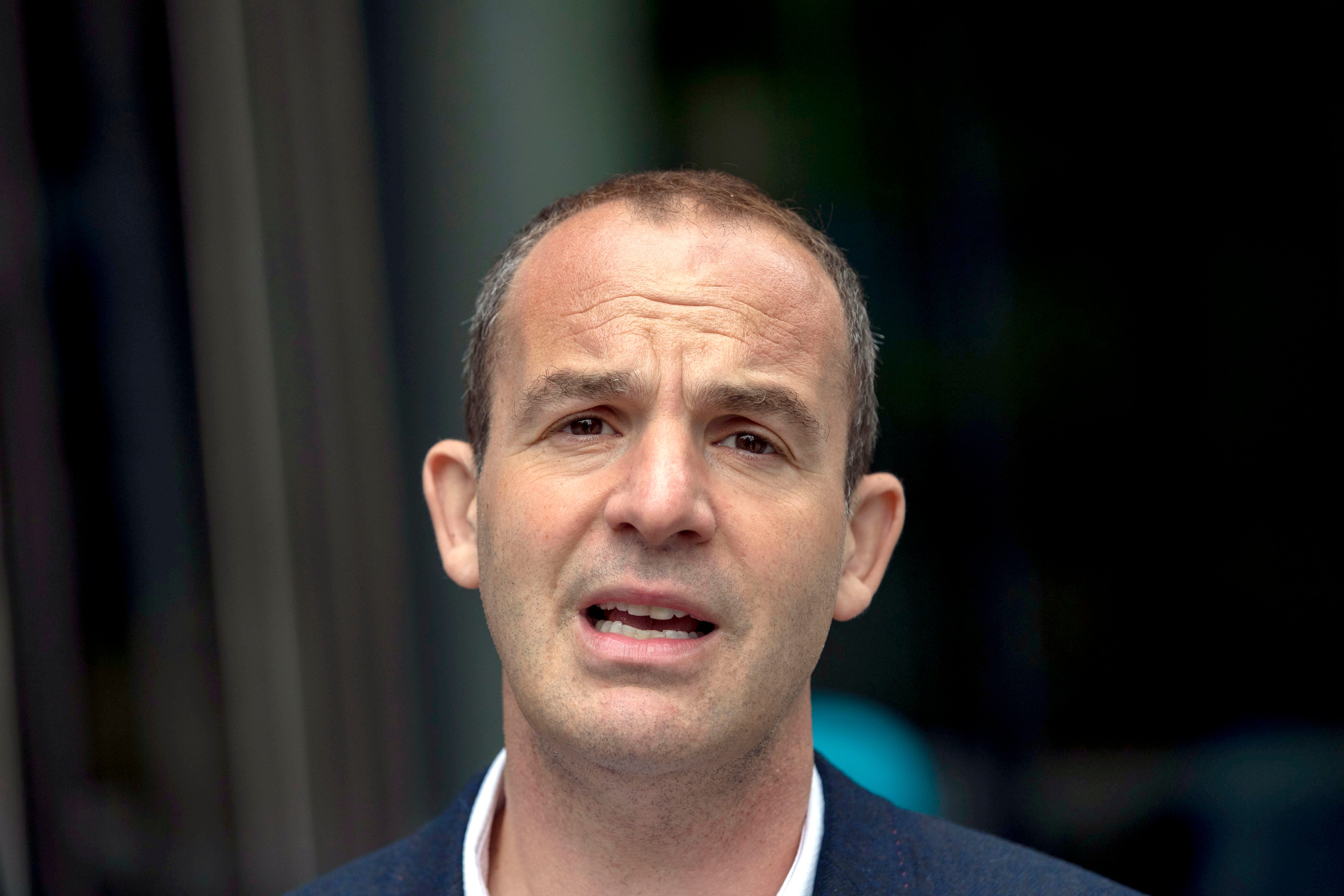

Writing previously on MoneySavingExpert.com the website’s founder Martin Lewis warned: “In the short run this change could see a spike in prices for switchers.”

Mr Lewis wrote: “My best guess is firms won’t just cut renewal prices to match those for newbies – rates will meet nearer the middle (as happened in 2012, when insurers were barred from gender price discrimination). This will mean savings from switching will likely relatively reduce.”

Giving general tips for finding insurance on the website, Mr Lewis said that timing matters when buying insurance – and 23 days before renewal is the “sweet spot” for car insurance, while for home insurance it is 21 days.

He also suggested checking at least two comparison websites; comparing these deals to Direct Line and other deals that comparison websites do not include; seeing if a multi-car policy would be cheaper; and checking cashback websites.

People may also want to try haggling with their existing provider and seeing if comprehensive cover could be cheaper than third-party motor insurance, he suggested. Some insurers will view customers as lower risk if they opt for comprehensive motor cover.

Those struggling to find cover may also want to check the British Insurance Brokers’ Association’s website at insurance.biba.org.uk/find-insurance.

The Financial Conduct Authority (FCA), which has introduced the measures, has said they are likely to bring an end to unsustainably low-priced deals to some customers.

But officials said that overall, people will save £4.2 billion over 10 years.

The new rules will also make it easier for customers to cancel automatic renewal of their policy and require insurance firms to do more to consider how they offer fair value to their customers.

Insurers will also have to send data to the FCA so the regulator can monitor the market more effectively.

Sheldon Mills, executive director, consumers and competition at the FCA said: “Our interventions will make the insurance market fairer and make it work better. Insurers can no longer penalise consumers who stay with them. You can still shop around and negotiate a better deal, but you won’t have to switch just to avoid being charged a loyalty premium.

“We are keeping a close eye on how insurers respond to our new rules, to ensure that the benefits of a better insurance market are delivered to consumers.”

The impact of the shake-up will be reviewed in 2024.

These rule changes will lead to a re-balancing of premiums between new and existing customers

The Association of British Insurers (ABI) believes firms will still be able to offer competitive deals to new customers, with a range of different policies at different prices, albeit that prices could increase for some who shop around regularly.

Previous research by the ABI found motorists paid £429 on average for a policy in the third quarter of 2021 – marking a fall of nearly £40 (£39.47) during that year.

Fewer claims made during the coronavirus lockdowns have helped to keep motor insurance costs relatively low, although there are pressures around repair costs.

Malcolm Tarling, spokesperson for the ABI, said: “These significant rule changes mean that when existing home and private motor insurance customers renew their insurance policy, the price charged by their insurance provider cannot be more expensive than the price that they charge to an equivalent new customer for the equivalent policy. These rule changes will lead to a re-balancing of premiums between new and existing customers.”

The regulator must continue to monitor insurance firms to ensure they don't find new ways to exploit customers' loyalty, and it should be prepared to take further action where necessary

Ryan Fulthorpe, car insurance spokesperson at comparison website GoCompare, said: “It’s important to remember that a renewal price will only be from one insurer, offering that particular deal. There are still hundreds of other insurance companies who will all provide different and potentially more competitive quotes.

“So, while your current insurance company could offer you one price, it’s still important to shop around and see the other prices that are out there.

“We are already seeing slight increases in the cost of car insurance as people get back to pre-pandemic driving habits and there are subsequently more claims being made.”

He said insurers’ price calculations may include the vehicle make, model and age, the customer’s age and driving experience, repair costs and addresses and postcodes.

Gareth Shaw, head of Which? Money, said: “Insurance companies have been getting away with luring customers in with low prices before hitting them with huge price hikes and premiums for far too long, so it is good to see the FCA taking action to prevent these unfair practices.

“The regulator must continue to monitor insurance firms to ensure they don’t find new ways to exploit customers’ loyalty, and it should be prepared to take further action where necessary.”