£1,430,000,000,000 (that's £1.43 trillion): Britain's personal debt timebomb

Average household debt is now £54,000 - double the level a decade ago, despite record low interest rates, and ministers fear that failure to pay back loans and credit will leave thousands at risk of losing their home

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Britain faces a timebomb as the cost of living crisis forces more people into crippling debt they will not be able to repay, according to a major study published today.

The Centre for Social Justice (CSJ) think tank, founded by Iain Duncan Smith in 2004, warned that two of the flagship policies he is implementing as Work and Pensions Secretary - the “bedroom tax” and universal credit - could plunge more people into debt. It revealed that more than 5,000 people are already being made homeless each year because they cannot pay their mortgage or rent.

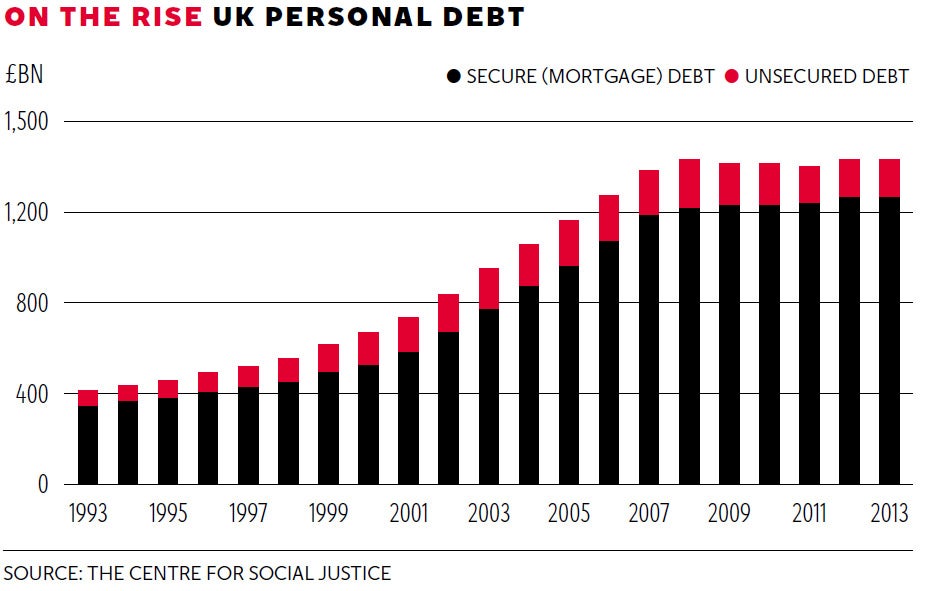

The study, “Maxed Out,” said that despite the return to economic growth, personal debt in the UK totals £1.43 trillion, close to its all-time high. Average household debt stands at £54,000 - almost twice the level a decade ago. Although much of it stems from mortgages, the report warned that poor people were hit hardest as unsecured consumer debt almost tripled in the last 20 years to nearly £160bn.

According to the CSJ, households owe the equivalent of 94 per cent of the UK's economic output last year. Only Ireland has a higher ratio of personal debt to GDP amongst European countries.

Privately, ministers are worried that, while interest rates have been held at a record low of 0.5 per cent, less personal debt has been repaid in the UK than countries like the United States. The Bank of England will consider raising rates when unemployment falls from its current 7.6 per cent rate to 7 per cent, triggering a rise in mortgage rates for millions of home-buyers.

The CSJ said more than 26,000 UK households have been classed as “homeless” by local authorities in the past five years, and warned that the number could increase if interest rates rises. Some 3.9m families do not have enough savings to cover their rent or mortgage for more than a month.

Another timebomb is the number of people retiring before they have paid off their mortgage. About 40,000 interest-only mortgages are due to mature each year between 2017 and 2032 where the householder will be over 65. Between now and 2020, a third of the shortfalls on endowment mortgages will amount to more than £50,000.

Although the CSJ backed the principle of the “bedroom tax” imposed on tenants in public housing, it said the “spare room subsidy” should not have been removed unless they had refused a “reasonable offer” to “downsize” or work longer hours. It warned there had been “genuine confusion” about the impact of the change and discovered that some local authorities are failing to fully allocate their share of the £25m set aside for discretionary housing payments.

“The potential short-term impact of removing the spare room subsidy on rent arrears is concern in relation to the threat of problem debt,” said the report. There was evidence of some “property swaps” being put on hold until tenants had paid off all their rent arrears, which risked more debts piling up.

The CSJ, which originally proposed the merging of benefits into a universal credit, expressed concern that switching to monthly payments might fuel debt problems. Pilot schemes found that 17 per cent of tenants got behind with their rent and the CSJ warned: “Unnecessary and unmanageable debt would severely undermine the important principle behind this welfare change.”

Christian Guy, the CSJ's director, said problem debt has “taken root in the mainstream of British society.” He added: “Years of increased borrowing, rising living costs and struggling to save has forced many families into a debt trap that is proving very difficult to escape. Some of the poorest people in Britain are cut off from mainstream banking and have no choice now but to turn to loan sharks and high-cost lenders.”

Today's study found that payday lenders have grown their business from £900m in 2008-09 to more than £2bn. The number of people using illegal loan sharks has risen to more than 310,000 each year. “Their use of violence and intimidation terrorises people and communities, enforcing a 'veil of silence' that allows them to escape detection,” said the report.

Warning that debt is rising “at an alarming rate”, the CSJ concluded: “Unless proactive steps are taken, problem debt in the UK will continue to grow unabated. The current levels of debt are worrying because they not only have severe financial implications,but also more wide-ranging impacts on people's mental health, family stability, and ability to work. These are especially pronounced amongst low-income households and the vulnerable.”

Dr John Sentamu, the Archbishop of York, said yesterday that food banks will “not go away any time soon” amid a “new and terrible” rise in poverty. He told the General Synod of the Church of England that the number of people being admitted to hospital with malnutrition is a “dark stain on our consciences.” The Independent revealed on Monday that the number of cases treated at NHS hospitals has almost doubled since the economic downturn.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments