How to take advantage of the latest market ‘melt-up’

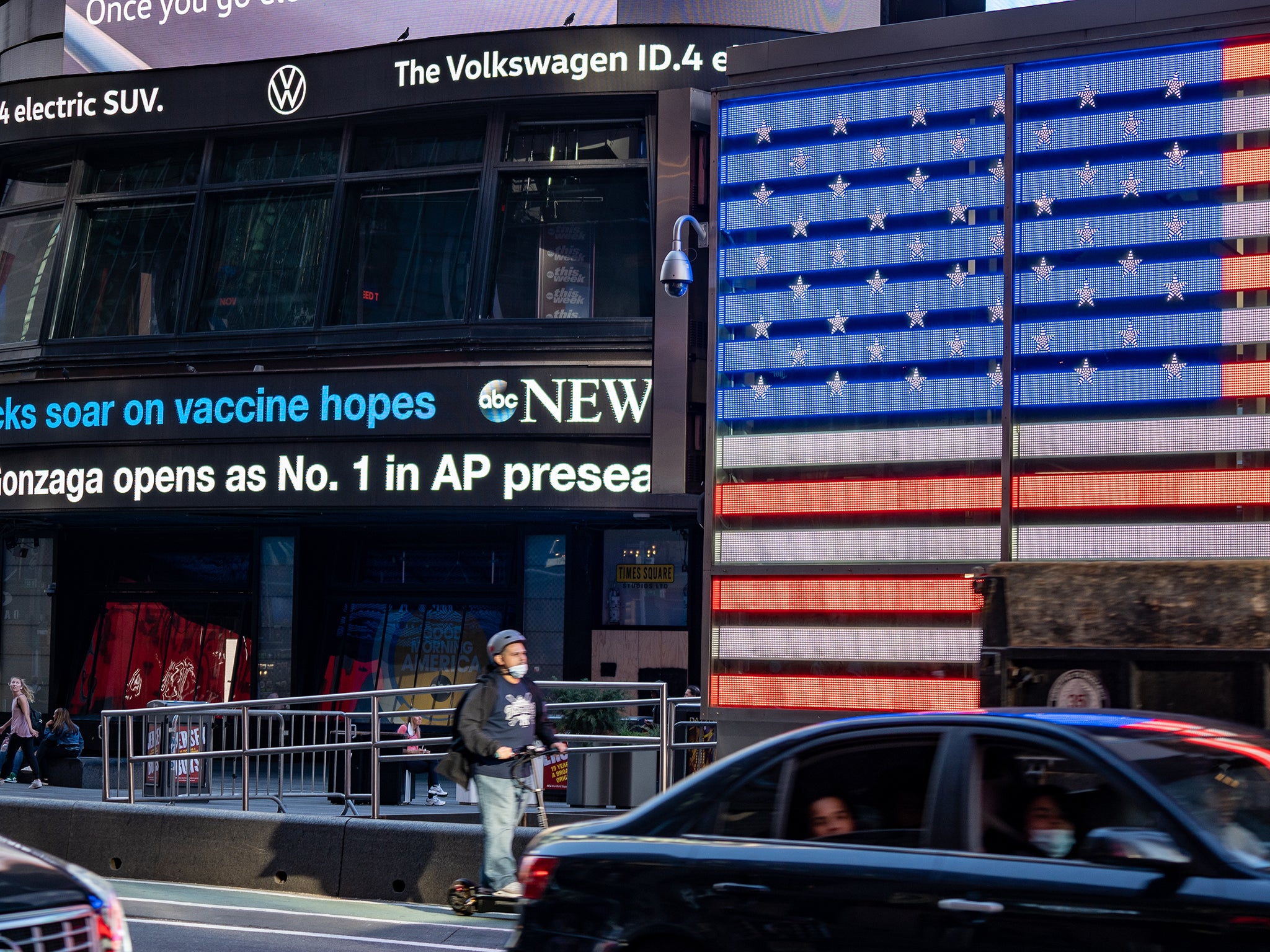

A Biden win and a vaccine breakthrough send investors’ hopes soaring

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.We’ve been craving good news for months and now, inevitably, two big global events have come along at once.

The world and its stock markets have responded to a Biden victory over a golf club owner with dancing in the streets, carefree exchanges on social media and some “exuberant rallies”.

Not to be outdone by global politics, barely 24 hours later came the even greater game-changer – the prospect of a 90 per cent successful Covid-19 vaccine.

It all begs one question: with such massive shifts on the horizon across every arena of life – from public health and economic recovery to climate change action - how should investors respond to the Biden Bounce and the glimpse of a vaccine-shaped recovery?

Relief rally

Stock markets all over the world made their feelings on the US presidential result clear as they opened after the “projection” – by a TV company no less – that Joe Biden had finally secured his place in the history books.

But it was tempered, notes Susannah Streeter, senior investment and markets analyst for Hargreaves Lansdown.

''Stocks in Asia continued an exuberant rally, on hopes a Biden presidency would thaw trade relations, and that appears to have had a knock-on effect on the FTSE 100 which has seen a post-election bounce. But gains are likely to be held back as the focus returns to Brexit, with a trade deal still yet to be agreed,” she says.

It’s worth bearing in mind that an incoming Biden administration won’t offer an easy path to a trade deal between UK and the US and could even determine the shape of relations between Britain and the EU.

“Joe Biden has already expressed disapproval of proposals for the UK to potentially break international law on certain aspects of the withdrawal agreement, which is likely to concentrate minds at No 10,” Streeter warns.

The struggle faced by European governments in stopping the rampant spread of Covid-19 is also likely to be put on lid on gains, with many industry sectors struggling under the burden of enforced closures.

At home, this may appear to have been a decisive vote against Trump, but it wasn’t a rejection of the Republican Party. Democrats don’t have control of the Senate, so Biden may struggle to push through plans such as tougher regulation of the big tech firms and higher tax plans for corporates and high-earning individuals.

Though hopeful that Biden’s experience working across the aisle with Republicans will put him in good stead, many commentators acknowledge the structure of the Senate could also mean big budget plans for healthcare, infrastructure and tax reforms.

New world

The state of the Senate could also put Biden’s headline-grabbing green deal under pressure too – a pledge that amounts to a “transformative shift in climate policy” that, if it got through unscathed, would mean huge investments in sustainable infrastructure, clean energy, a harder line on fossil fuels and just as it leaves, a swift re-entry into the Paris Agreement.

With a target of achieving 100 per cent reliance on clean energy and net zero emissions by 2050, the Biden administration is also planning a “major diplomatic push encouraging countries to set and follow through with more ambitious emissions-reduction targets, rallying the global community to meet the threat of climate change with all the tools at its disposal,” says Bram Bos, lead portfolio manager for Green Bond strategies at NN Investment Partners.

In total, Biden’s climate and environmental justice proposal amounts to federal investment of US$1.7 trillion (£1.2 trillion) over the next decade, leveraging additional private-sector, state and local investments to total more than US$5 trillion (£3.7 trillion).

In other news

But while this is all very interesting, incredibly it’s not the biggest talking point in town.

“It’s unthinkable that a piece of news could eclipse the result of a US presidential election, but Pfizer’s vaccine results have done just that,” says Laith Khalaf, financial analyst at AJ Bell.

“The stock market is experiencing a serious melt-up, and safe havens like gold and bonds have sold off.

“In the UK we’ve seen that shares of Carnival and easyJet [were] up more than 35 per cent and one of the biggest risers, SSP Group, which operates food and beverages at travel locations, was up more than 50 per cent in a day,” notes Darius McDermott, managing director of investment research agency FundCalibre.

“Leisure has also done better, with the likes of Cineworld up 40 per cent, while banks were up 10 per cent.

The million-dollar question now is whether this value rally will continue or if it will be short-lived.

“If the vaccine news flow remains positive, which I think it will [the value rally] could do well now until the end of the year,” says Khalaf.

“If the vaccine news flow remains positive, which I think it will [the value rally] could do well now until the end of the year,” says Khalaf.

But though the glimpse of a return to normality has swum into slightly sharper focus, investors shouldn’t get carried away. This may be extremely positive for markets and businesses but the pandemic has not been wiped out on the news alone and the economic impact is still a very real and present problem, not least here in the UK.

“Drip feeding money into the markets regularly remains a sensible course of action for investors, to take advantage of any dips, and to keep a lid on market risk in case of an unforeseen setback,” says Khalaf.

“Investors should also consider unloved areas of the market which may now start to recover. In particular the [FTSE] could stand to benefit as markets reappraise the prospects of the cyclical oil and financial stocks which make up such a large part of the index.

“If the vaccine result heralds a new wave of risk taking in markets, safe havens like bonds and gold will fall behind. Safe haven assets still offer important diversification benefits and shouldn’t be discarded entirely, but their size in portfolios may have become bloated as the pandemic has unfolded,” he warns.

“It’s wise for investors to take stock.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments