Interest rate rise will hit the hard-up - but they don't know it

Many are ignoring government warnings to prepare for a high interest rate world

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.When do you think interest rates will rise? The fact is we don’t know yet. It’s unlikely, but it could even happen today as the Bank of England’s interest-rate setting committee meets.

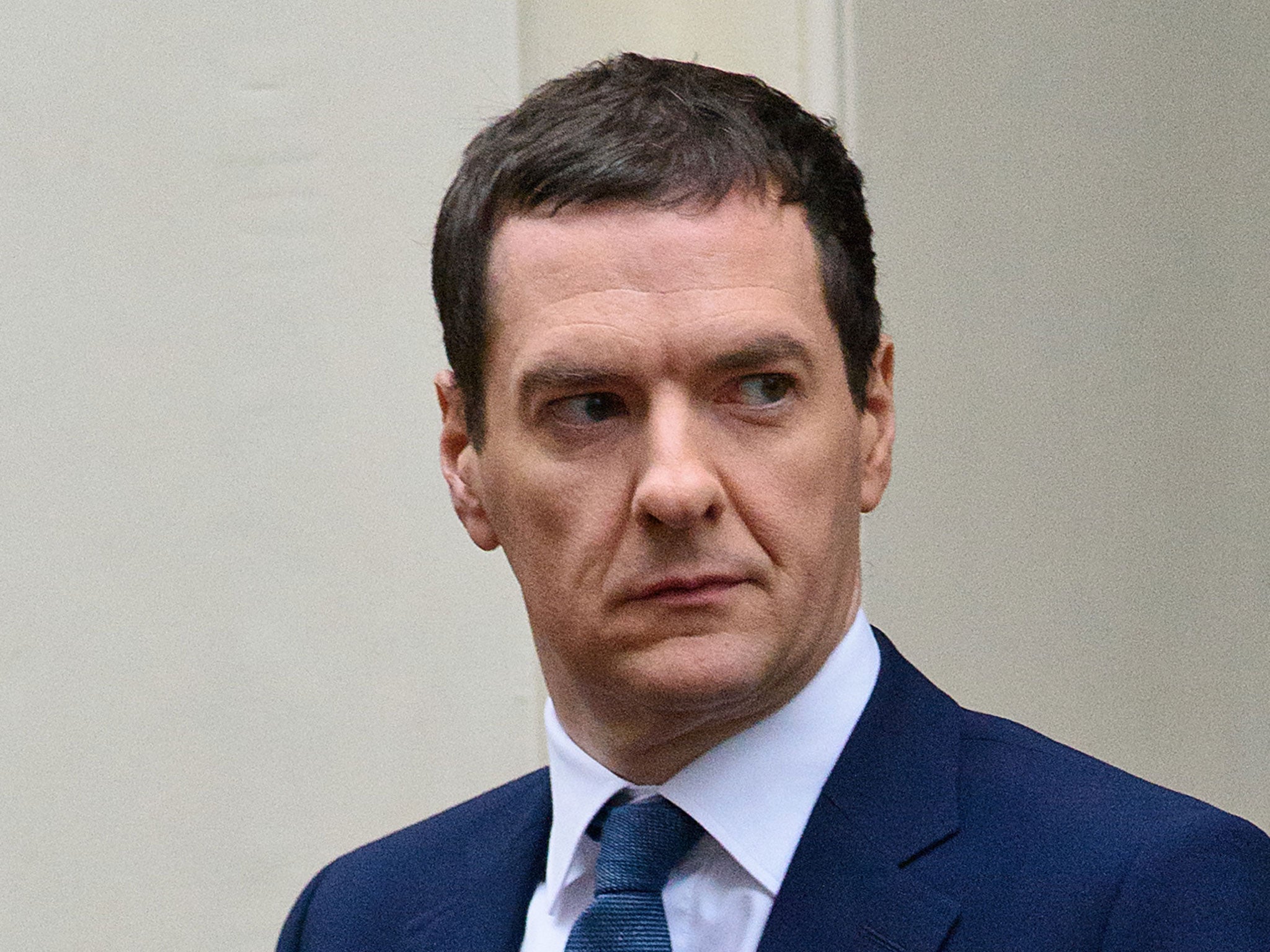

But nearly four out of 10 people struggling with their finances has no idea that rates could rise soon. That’s despite last week’s George Osborne Cardiff speech when he warned Britons to prepare for interest rate rises.

“Those with existing financial problems will be at the sharp end of interest rate rises when they do arrive,” warned Joanna Elson, chief executive of the Money Advice Trust. “After nearly eight years of ultra-low rates, we need to do much more as a society to prepare people for a higher interest rate economy.”

She said the government, the financial services industry and advice agencies like National Debtline should work together to communicate clear, consistent messages to the public on what steps they should take.

The charity is concerned that public debate around the impact of interest rate rises has so far centred around households with mortgages only, ignoring the impact of those in private rented accommodation who are likely to face higher rents as landlords pass on the additional cost to their tenants.

National Debtline’s 5 steps to prepare for interest rate rises

- Prepare a household budget

If you don’t already have a budget, there has never been a better time to take this step – which is probably the single biggest thing you can do to start to get to grips with your personal finances. Look at what you have coming in each month and what you need to spend your money on – remembering to include annual costs like car insurance by dividing the annual cost by 12.

- If you have a mortgage, consider fixing now

If you are mortgage payer and are on a variable or tracker rate, now could be a good time to switch to a fixed deal. Everyone’s circumstances are different and it may be that you want to seek professional advice – but doing this while rates are low could be a decision that you look back at as a good one in the future.

- Deal with existing debts now

If you are already in arrears with your mortgage, rent or any other kind of debt, don’t delay dealing with them. When interest rates rise you could find your costs increase and in some cases, your existing debts become more expensive, and so take this opportunity to reduce them now where you can.

- Maximise your income and re-examine your costs

Some advice that is always worth considering is to find out if you can maximise your income. That could include making sure you are claiming all the benefits to which you are entitled, making sure you are paying the right tax or looking at the hours you work. At the same time, if you are worried, now is a good time to re-examine your costs to see if there are any savings you could make.

- Seek free advice if you are struggling

Remember that you don’t need to do any of this alone. If you are worried about how interest rate rises might affect you or if you are struggling to cope with existing debts or unpaid bills, seek free advice from a charity-run service like National Debtline as soon as possible.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments