Income insurance – can you buy certainty amid Covid-19?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Perhaps one of the things it’s been hardest to cope with in 2020 is the sudden removal of control.

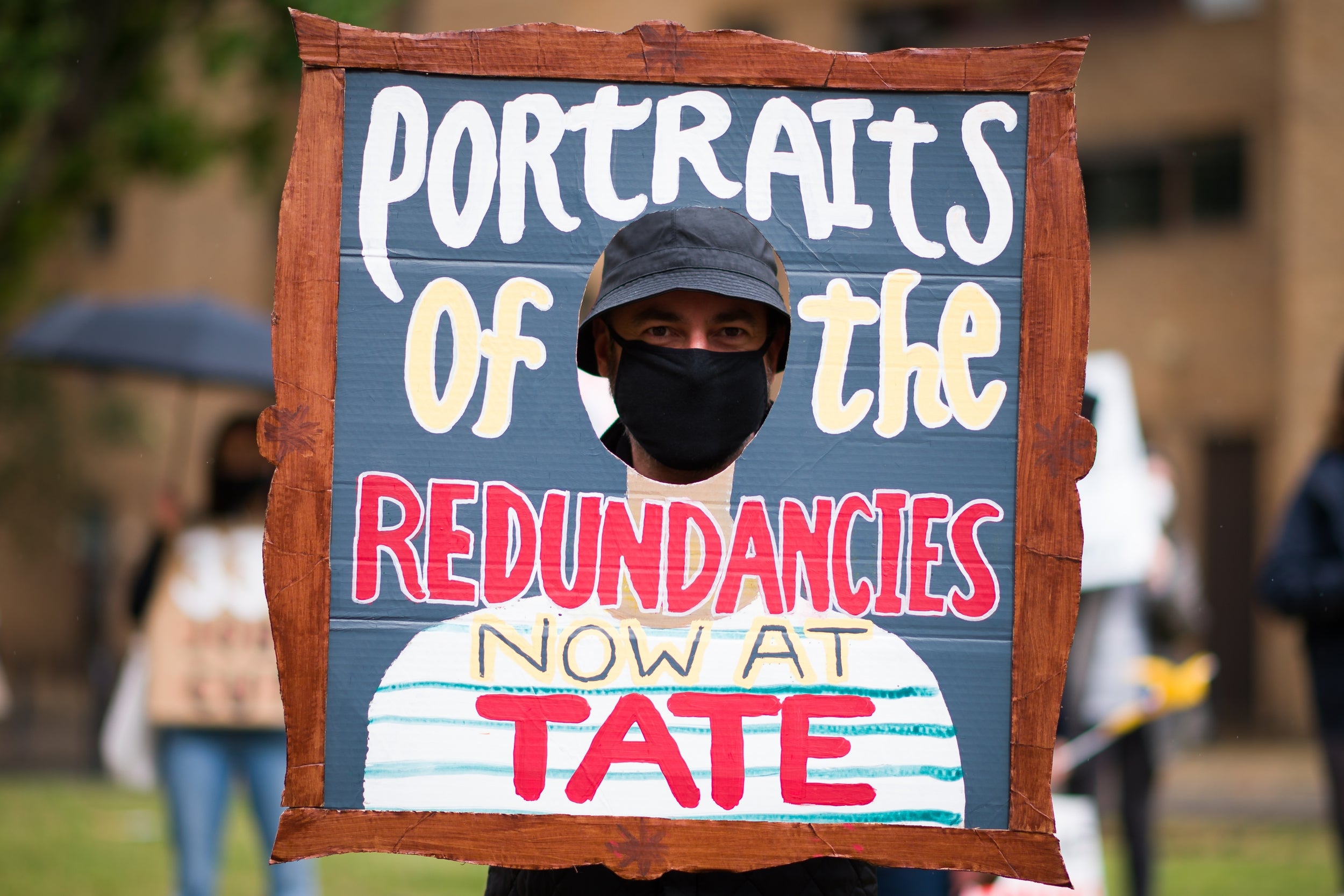

While the country works to manage the virus, individually it has been hard not to feel powerless as we faced first the virus, then lockdown and now the job losses that just keep coming.

In fact, the Bank of England has warned that there could be 2.5 million people out of work by the end of the year as the furlough scheme winds up.

Amid all this uncertainty, it’s tempting to try to buy some certainty with insurance products. Income protection insurance may seem an obvious answer to the cuts to jobs we’re seeing in almost every sector.

Yet it’s vital to understand the limitations of new insurance policies in a Covid world so you don’t risk buying a product that doesn’t actually provide the support you think it does.

Insurers have scrambled to re-evaluate the risks they are able to manage and many immediately pulled Covid-19 cover from their newly sold policies, meaning they would not pay out if policyholders fell ill with the virus.

Not to be confused with short-term, controversial PPI or payment protection insurance that covers a single bill, these policies are designed to replace an entire income if necessary - right up to the point of retirement if the policyholder is never able to work again due to illness or an accident. A lifeline for a claiming policyholder, they can be very expensive agreements to pay out on, especially if lots of people claim at once.

As the scope of the economic impact began to show, many insurers simply took their unemployment protection policies off the market.

It is still possible to buy some forms of income protection insurance that cover policyholders if they can't physically work but unemployment insurance is very difficult to get hold of and policies that do cover it are likely to have extensive restrictions.

Knowing the limits

If income protection insurance was purchased before the virus became a known event and if it did include cover for redundancy then it should still pay out.

However, if you are hoping to buy an insurance policy now that might provide some support and protection in the immediate future then it may be far harder to get the reassurance you need.

The research agency GlobalData reports that insurers in the UK have temporarily removed unemployment cover from their policies, despite soaring demand for insurance because of fears of job losses.

It also suggests that a spike in the number of purchases of income protection insurance sold without advice could mean many consumers don’t actually understand the limitations of the cover they have bought.

Beatriz Benito, senior insurance analyst at GlobalData, says: “It is still possible to purchase income protection that provides long-term accident and sickness cover.

“Some individuals may buy these policies being unaware that they do not provide cover against job losses – given the strong growth of the unadvised channel in recent years.”

If you are currently in the market for income protection insurance then make sure you understand exactly what the limits of any policy are. Some may simply refuse to cover redundancy at this time, some may defer the time when you can make a claim, sometimes for as long as a year.

And as with any insurance product, different policies give different levels of protection and cheaper is unlikely to be better. Some will agree to pay an income for a fixed period, such as a year, while more comprehensive policies will continue to pay successful claims for far longer.

Future demand

While it may not be as possible to buy income protection insurance that includes unemployment cover in the middle of an economic crisis, one likely outcome of the current uncertainty could be a spike in future demand for this kind of protection.

Rod Jones, head of partnerships at the comparison site ActiveQuote, said: “Like any protection policy, maximising the cover available to you relies heavily on putting cover in place at a time in your life when you’re fit and healthy, and able to work, rather than waiting until something goes wrong and trying to seek assistance then.

“We saw a huge surge in the number of people looking to take out short-term income protection cover at the same time Covid-19 arrived in the UK, with overall enquiries surging by as much as 1,100%, which wasn’t entirely unexpected given conventional consumer attitudes to income protection generally.

“The hope now amongst insurers is that the rapid resurgence in longer term cover which has emerged since continues its upward trajectory, and that the message around the longer term benefits income protection can bring is finally beginning to sink in on a much broader basis.”

Benito agrees: “Covid-19 will trigger appetite for income protection products in the medium to longer term and raise awareness of the benefits they provide.

“Individuals will become warier about unprecedented events and will rethink how best to protect themselves against them.”

Perhaps that’s not solely down to the pandemic. HSBC Life UK surveyed a number of independent financial advisers and found many anticipate demand for these policies rising among self-employed people and those whose employers do not provide comprehensive benefits.

Mark Hussein, CEO of HSBC Life UK, says: “It is interesting that advisers expect to experience demand from self-employed and gig economy workers. These groups rely on regular work and are unlikely to have the same level of protection offered as those individuals working for an employer offering benefits such as critical illness cover or death in service, so it’s vital that they protect their income.”

The current economic and medical emergency means it may be hard to find an income protection policy that provides the cover people want. There are simply no shortcuts to certainty and safety.

However, advisers and analysts anticipate significant growth in these policies in the future. 2020 has shown us how quickly things can change and how rapidly a strong financial position can be overturned by circumstances beyond an individual's control.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments