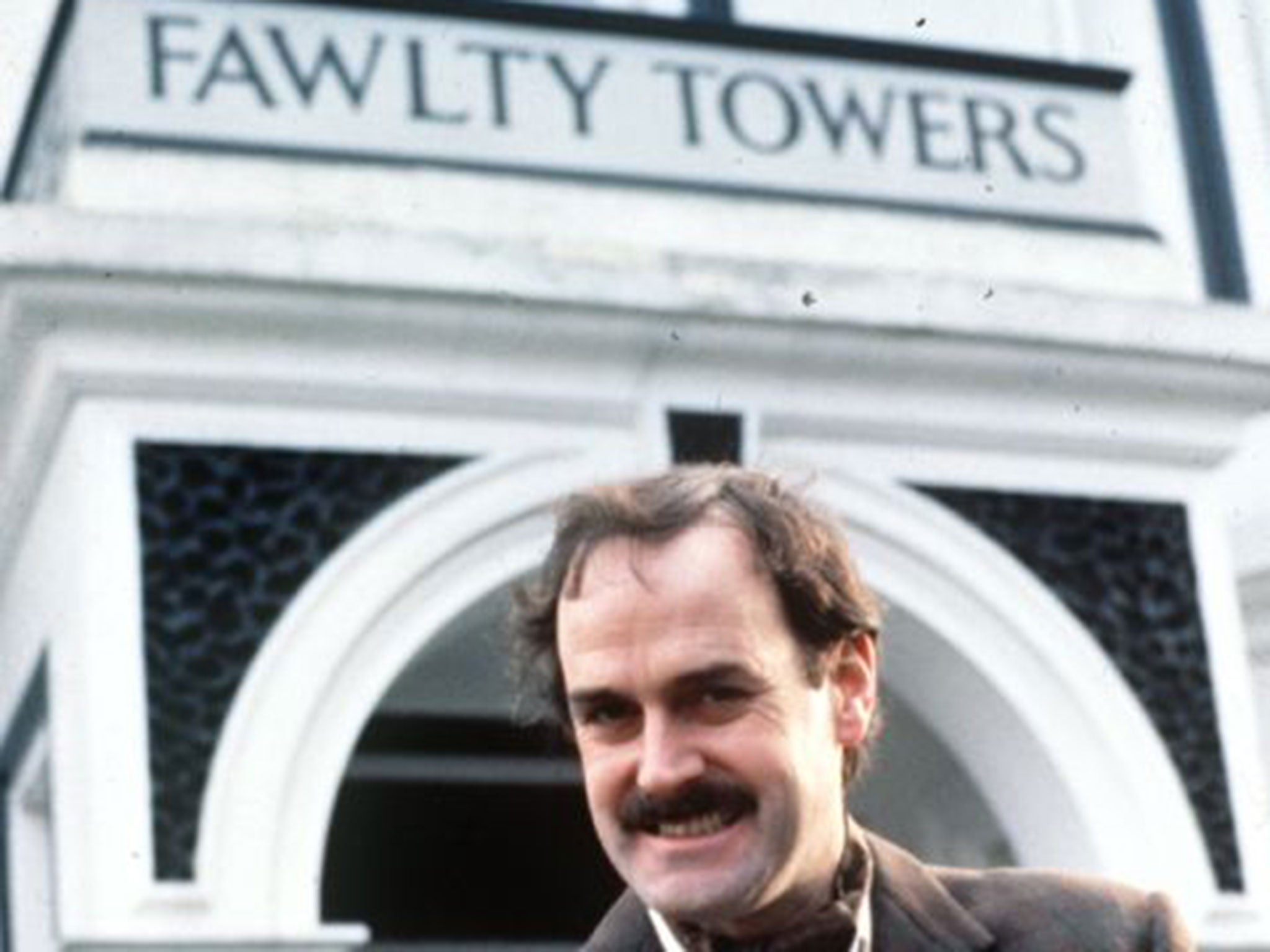

Fawlty finances? Torquay is named as Britain's insolvency hotspot

Coastal town have higher numbers of people going bust than anywhere else

Where are you most likely to go bust? On the English Riviera, reckons Experian. More specifically its new research suggests Torquay is Britain’s insolvency hotspot.

The location for the classic 70s sitcom Fawlty Towers saw an average of 16 out of every 10,000 households became insolvent in the second quarter of 2015.

Plymouth, Sittingbourne and Scarborough did only a little bit better, with 13 of every 10,000 households going bust between April and June this year.

In fact seaside areas came out the worst with half of the 10 worst towns for insolvencies located on the coast.

But watch out if you live in Hatfield in Hertfordshire. While it did not feature in the top 10, it suffered the fastest rise in insolvencies, up from six per 10,000 a year ago to eight.

On the other hand things are looking up for those in Hamilton in South Lanarkshire where the number of insolvent households plummeted from 13 per 10,000 to just three.

The good news is that the overall number of insolvencies is falling across the UK. But people are still experiencing difficulties.

Andy Wills, data director at Experian, said becoming insolvent can be the start of getting your finances back in order.

“For people still feeling the strain, higher property prices and living costs can make the road back to recovery difficult,” he said. “Becoming insolvent, however, is not the end of the road. With patience and the right guidance it is possible for people to rebuild a positive credit history.”

And there’s good news ahead for financially struggling people facing predatory creditors; from next month it will be harder for them to force you to go bankrupt. At the same time, if you decide to become insolvent, it’ll get easier and cheaper.

Changes to insolvency laws come into force on 1 October with the minimum debt needed before a creditor can ask a court to make an individual bankrupt climbing from £750 to £5,000.

At the same time the maximum level on debt relief orders – so-called bankruptcy lite - is rising from £15,000 to £20,000 and the asset level from £300 to £1,000.

That will make it easier for those with lower levels of debt but no realistic prospect of paying it off to start the long process of rebuilding their finances.

Towns with the highest insolvency rate

1. Torquay

2. Plymouth

3. Sittingbourne

4. Scarborough

5. Newport (Isle of Wight)

6. Chester-le-Street

7. Kingston-upon-Hull

8. Stoke on Trent (City Centre Hanley)

9. Bootle

10. Newcastle under Lyme

Top 10 towns/territories with the biggest rise in insolvencies

1. Hatfield

2. Horsham

3. Brentwood

4. Gravesend

5. Newark on Trent

6. Banbury

7. Bridgend

8. Newbury

9. Windsor

10. Richmond (London)

[source: Experian]

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments