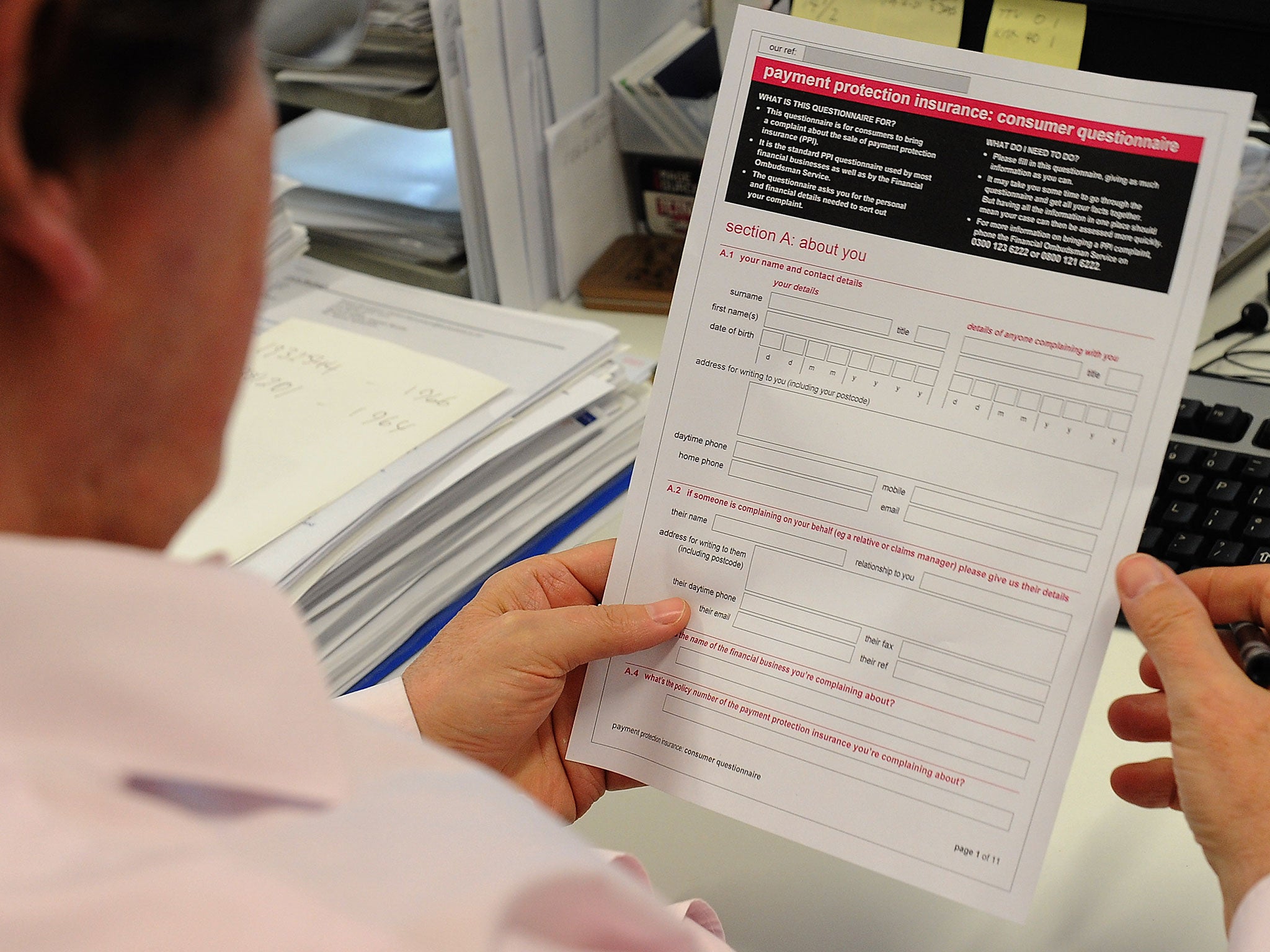

Banks face fresh wave of PPI compensation claims after landmark ruling

The PPI scandal has already cost Britain’s banks around £24 billion

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Britain’s high street banks could be facing a much bigger bill for mis-selling payment protection insurance (PPI) than they have planned for.

Already the estimated bill to compensate victims of the nation’s biggest-ever financial scandal is close to £25bn, but that figure could soon start to escalate after the City watchdog warned that it was considering new rules on how and why customers should be compensated.

The Financial Conduct Authority admitted it could be forced to introduce the new rules following a landmark court ruling. It could open the door to a landslide of fresh claims for compensation, not only for those who may have had claims turned down in the past but even for those who have already been paid out for being sold the often useless and expensive insurance.

The latest wrinkle to the scandal centres on alarmingly high commission payments to lenders and advisers. It was revealed in court proceedings that intermediaries were charging almost three-quarters of the cost of cover as their commission. But with many of the commissions hidden from victims, they have not previously formed part of compensation claims or payouts.

In November the Supreme Court ruled in the Plevin v Paragon case that failing to disclose commission made the relationship between lender and borrower unfair. Susan Plevin, a 59-year old college lecturer, was charged £5,780 as an upfront PPI premium on a £39,870 loan.

But 71.8 per cent of the premium was commission, with credit broker LLP Processing receiving £1,870 and lender Paragon getting £2,280.

Ms Plevin was not told about the commission and launched proceedings against the two firms in 2009 for mis-selling because the policy was useless for her but also on the basis that the PPI agreement was unfair because of the non-disclosure of the commissions. Because LLP went bust, she was paid £3,000 from the Financial Services Compensation Scheme but the case against Paragon continued through the courts until last year’s ruling.

In November Lord Sumption ruled that failing to disclose commissions led to a “sufficiently extreme inequality of knowledge and understanding” and that there was a “tipping point” in that inequality. He did not stipulate what the tipping point was, but said that 71.8 per cent was “a long way beyond it”.

The FCA revealed last January that it was reviewing trends for PPI complaints and raised the prospect of setting a time limit on claims. The regulator said any changes in light of the Plevin case would be part of that review and that it expected to report over the next few months, when it would confirm whether compensation would be awarded for PPI sales that involved undisclosed commissions.

Since January it has been considering whether it needs to introduce the additional rules and, ahead of its next PPI update, expected in July, divulged its considerations to the market. However, it refused to be drawn on the potential impact on past compensation payouts, but confirmed it will be holding talks with “relevant stakeholders” in the next few months.

Complaints about PPI still account for the majority of the cases being dealt with by the financial ombudsman, although they halved over the year to 31 March.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments