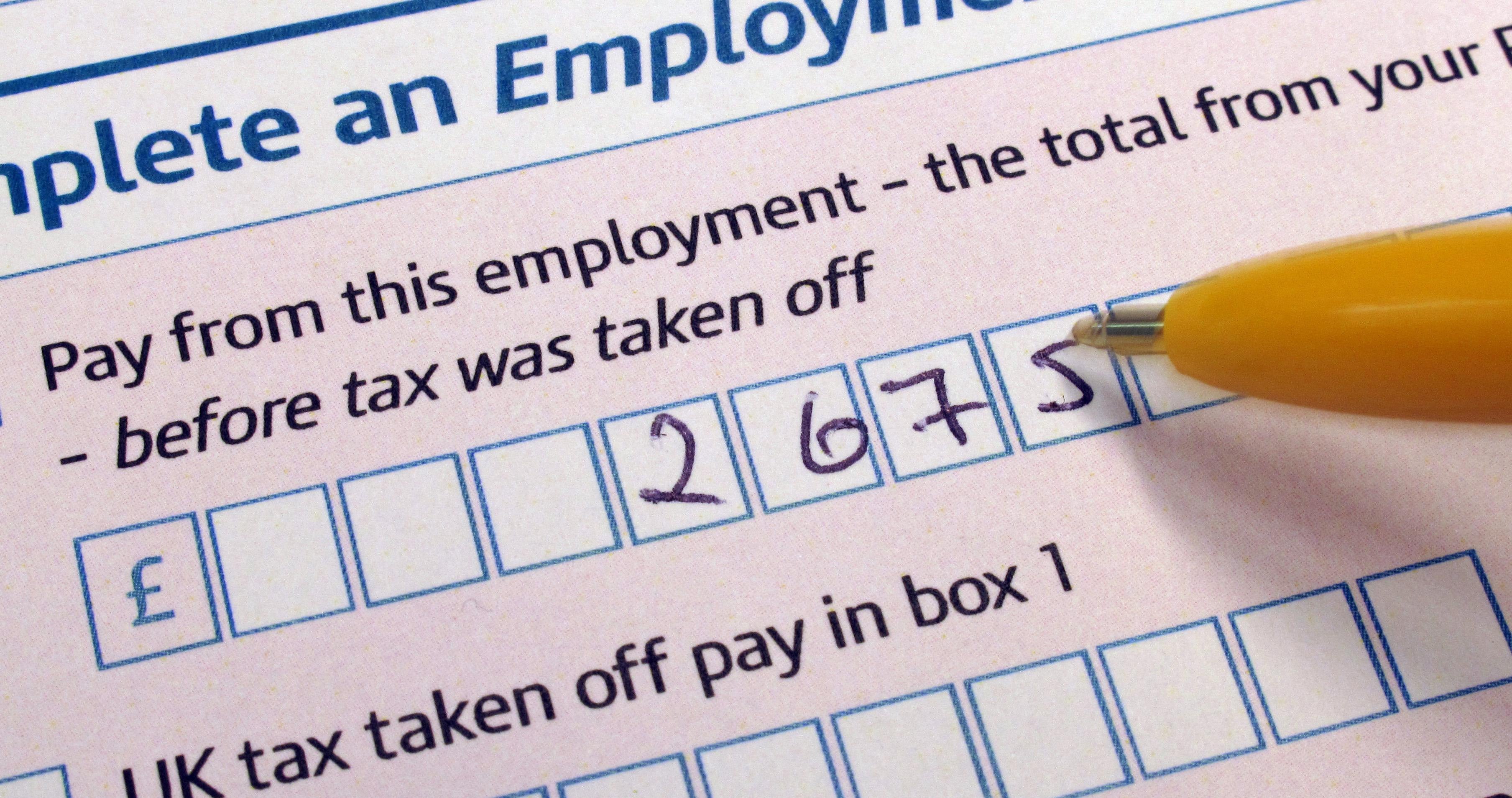

2.3 million taxpayers have until end of February to avoid late filing penalties

Some 2.3 million customers who were expected to file by January 31 now have until February 28 to submit their late 2020/21 tax return, HMRC said.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.More than two million taxpayers need to file their self-assessment returns by the end of February in order to avoid penalties.

More than 10.2 million customers filed their 2020/21 tax returns by the usual January 31 deadline, figures from HM Revenue and Customs (HMRC) show.

Some 2.3 million remaining customers who were expected to file by January 31 now have until February 28 to submit their late 2020/21 tax return and avoid a late filing penalty.

HMRC previously announced it was waiving penalties for a month for late filing of tax returns and late payments.

It means anyone who was unable to file by January 31 will not receive a late filing penalty – provided they file by February 28.

However, interest will be charged from February 1 on any amounts outstanding, as usual, so it is still better to pay as soon as possible.

HMRC said more than 630,000 customers filed on the January 31 deadline day and the peak was between 4pm and 4.59pm, when 52,475 customers completed their self-assessment.

Some 20,947 customers completed their tax return in the final hour before midnight.

Myrtle Lloyd, HMRC’s director general for customer services, said: “We’re waiving penalties this year, to give those who missed the deadline an extra month.

“And customers can set up a monthly payment plan online if they’re worried about paying their tax bill. Search ‘self assessment’ on gov.uk to find out more.”