Sales of electric vehicles rise by 144 per cent as diesel cars decline in popularity

Preliminary figures suggest fall of diesel vehicles around 2.3 per cent

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In a depressed new car market, sales of electric vehicles rose by 144 per cent in 2019, while diesel models continued the sharp slide in popularity witnessed in recent years. Overall, Brexit uncertainties, weak consumer and business confidence and slow overall economic growth helped push new car sales down.

Preliminary figures suggest a fall of around 2.3 per cent in 2019, to 2.3 million units.

According to the Society of Motor Manufacturers and Traders, the main industry body, new cars sales will fall again in 2020, albeit by less than previously forecast and with the rate of decline slowing – down another 1.6 per cent by 2021.

Diesel is a major factor in the current market – a fall of 21.8 per cent last year as many potential customers simply postpone buying new until they have more clarity about future taxation and regulation of diesels.

Mike Hawes, chief executive of the SMMT described it as a another “turbulent 12 months” with the trade facing the same tough challenges.

As one of the few bright features in a gloomy scene, the growing acceptance and popularity of pure electric cars and stands out as a trend that should help, albeit in a modest way, the government to achieve its targets on CO2 emissions.

However, pure electric cars, driven by batteries alone, still only account for about 38,000 sales, or 1.6 per cent of the total of over 2 million; less than half of the sales achieved by the Ford Fiesta, still the UK’s best seller.

Electric car sales would need to hit about 600,000 to match current vehicles emissions targets. Moreover, CO2 emissions are actually up, partly because of the fall in diesel sales and partly due to the fashion for SUVs. Although diesel is now perceived to be a dirtier fuel than petrol, less fossil fuel is burned per mile by a diesel car compared to a petrol powered one, and therefore it is on that measure considered greener.

For electrics, improved range between charges – more than 250 miles in many cases – plus a wider range of relatively affordable electric models and some tax breaks are shifting public attitudes.

In 2020, new mainstream pure-electric (ie, not petrol-electric hybrids) models will arrive from Vauxhall, Peugeot, Mini, Smart, Volvo and VW, among others, while the Korean makes Kia and Hyundai have set the pace for technical achievements.

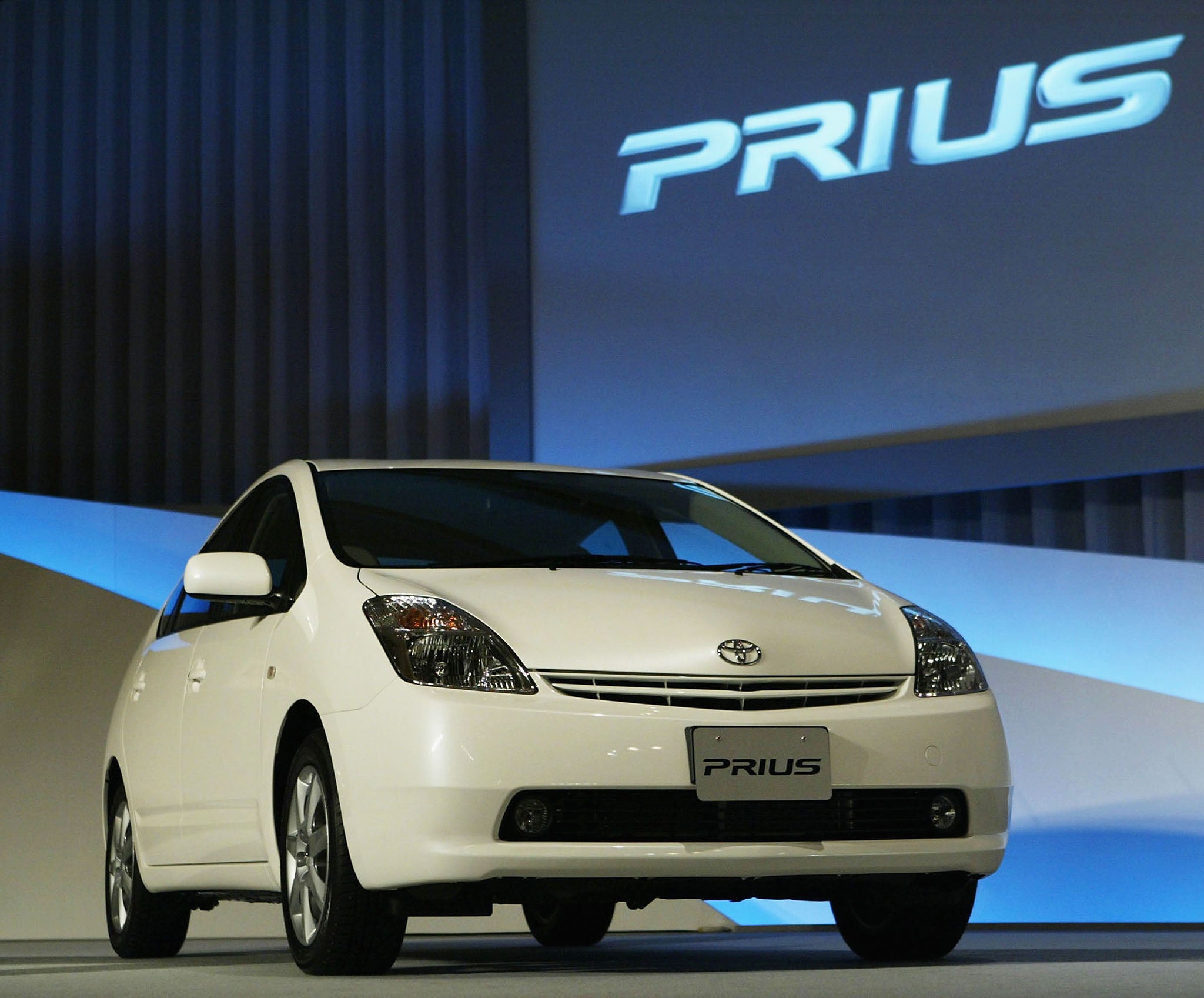

Petrol-electric hybrids such as the Toyota Prius also had a good year – up a fifth to take a 4 per cent share of the market. They too seem to be benefiting from the continuing backlash against diesel. Although diesel-powered cars are still a viable option for many higher-mileage motorists, the VW “dieselgate” scandal, an image problem and uncertainty about public authorities taxing or banning them has collapsed demand. Only one in four new vehicles now sold has a diesel engine, compared with about half a few years ago.

On Brexit, the SMMT stressed once again the importance of frictionless trade and the jobs that depend on UK vehicle manufacturing; but say that they are yet to meet Andrea Leadsom, the Secretary of State for Business, Energy and Industrial Strategy, since she was appointed in July last year.

The SMMT also indicated that meeting existing CO2 emissions post-Brexit may be more challenging because car makers will no longer be able to use sales of smaller vehicles elsewhere in the EU to keep their average CO2 figures down. Some makes or models would then become unviable in the UK market, narrowing consumer choice in, say, high performance executive or sports cars.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments