18 industries which are being killed by millennials

Changing tastes between millennials and previous generations have hit some companies hard

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Millennials have been blamed for a lot, but in 2018, failing to win them over can mean the difference between growth and death for an industry.

They are growing up, moving out of their parents' homes and having children of their own. But their tastes still do not necessarily line up with those of the generations that came before in some key ways.

From napkins to motorcycles, here are the industries that have been hit hardest by millennials:

Casual-dining chains like Buffalo Wild Wings and TGI Fridays

Executives may say that the death of the industry at the hand of millennials has been overstated.

However, the fact remains that brands such as Buffalo Wild Wings, Ruby Tuesday and Applebee's have faced sales slumps and dozens of restaurant closures as casual-dining chains have struggled to attract customers and increase sales.

"Millennial consumers are more attracted than their elders to cooking at home, ordering delivery from restaurants and eating quickly, in fast-casual or quick-serve restaurants," Buffalo Wild Wings' then-CEO Sally Smith wrote in a letter to shareholders in 2017, prior to leaving the company.

Millennial distaste for the category has been so great that Buffalo Wild Wings and TGI Fridays have actually said they do not even want to be called casual-dining chains any more.

"I don't see the competitive set of Buffalo Wild Wings being a traditional casual-dining place," Inspire Brands chief executive officer (CEO) Paul Brown said soon after Inspire completed its acquisition of Buffalo Wild Wings. "When it was growing gangbusters, it didn't position itself against its traditional cast of casual-dining players."

Traditional weddings

Couples are increasingly ditching banquet halls and hotel reception rooms in favour of unconventional venues such as barns and farms, according to a survey from wedding website The Knot.

In general, weddings — from venues to dresses — are becoming more casual. Wedding planners told Business Insider that many clients are getting married later and funding their own weddings, meaning they do not have to stick to their parents' traditions.

"Ten years ago brides and grooms were relying on their parents to solely fund weddings," said one planner. "Now people are empowered by doing what they want to do and they want it to be a reflection of who they are."

Beer

Millennials simply are not drinking as much beer as generations past.

Beer consumption among drinkers from 21 to 24 has fallen roughly 3 per cent per year over the last 15 years. Beer penetration fell one percentage point in the US market from 2016 to 2017, while both wine and spirits were unmoved, according to Nielsen data. And, per-capita consumption of beer in the US dropped by nearly 10 per cent from 2008 to 2017, according to Euromonitor data.

The brands that are being hit the hardest include massively popular American brands such as Coors and Bud Light.

Mayonnaise

An article in Philadelphia magazine with the headline "How Millennials Killed Mayonnaise" sparked debate in April.

According to Euromonitor, mayonnaise sales fell 6.7 per cent in the US between 2012 and 2017, The Wall Street Journal reported, adding that brands like Hellmann's and Kraft have had to slash prices to keep shoppers interested, with mayonnaise prices falling 0.6 per cent from the first quarter of 2017 to 2018, as overall packaged-food prices increased by 1.6 per cent, according to Nielsen data.

"Condiments are more competitive than they've ever been," Jennifer Healy, head of marketing for the Heinz brand, told the newspaper. "Ten years ago, it was much more simple."

The "starter homes" market

Millennials are finally buying homes. A 2017 report from the real-estate website and app Zillow found that millennials — i.e. people between the ages of 18 and 34 — are the largest group of homebuyers in the US. However, it took them longer to get to this point than other generations.

Spencer Rascoff, Zillow's CEO, explained why millennials are delaying their first home purchases: "As a result of limited starter-home inventory, they're renting longer. And when they buy their first home, they're buying a much nicer home than a prior generation.

"I mean, many people are basically skipping starter homes; they're renting until their 30s, and that first house they buy is a million dollars, and they just are not even buying the $200,000, $300,000, $400,000 home, which is a total mind shift as compared with previous generations. So they're still buying homes — they're just buying them later and buying them bigger."

Department stores like Macy's and Sears

As millennials flock to e-commerce sites and fast-fashion brands like H&M and Zara, department stores such as Macy's and Sears have suffered, closing hundreds of stores across the US.

Part of the reason is when millennials do spend money, they are spending more on experiences like restaurants and travelling. Millennials are less drawn to aspirational, designer brands and they are perfectly happy saving money by buying private-label lines, which further hurts traditional department stores.

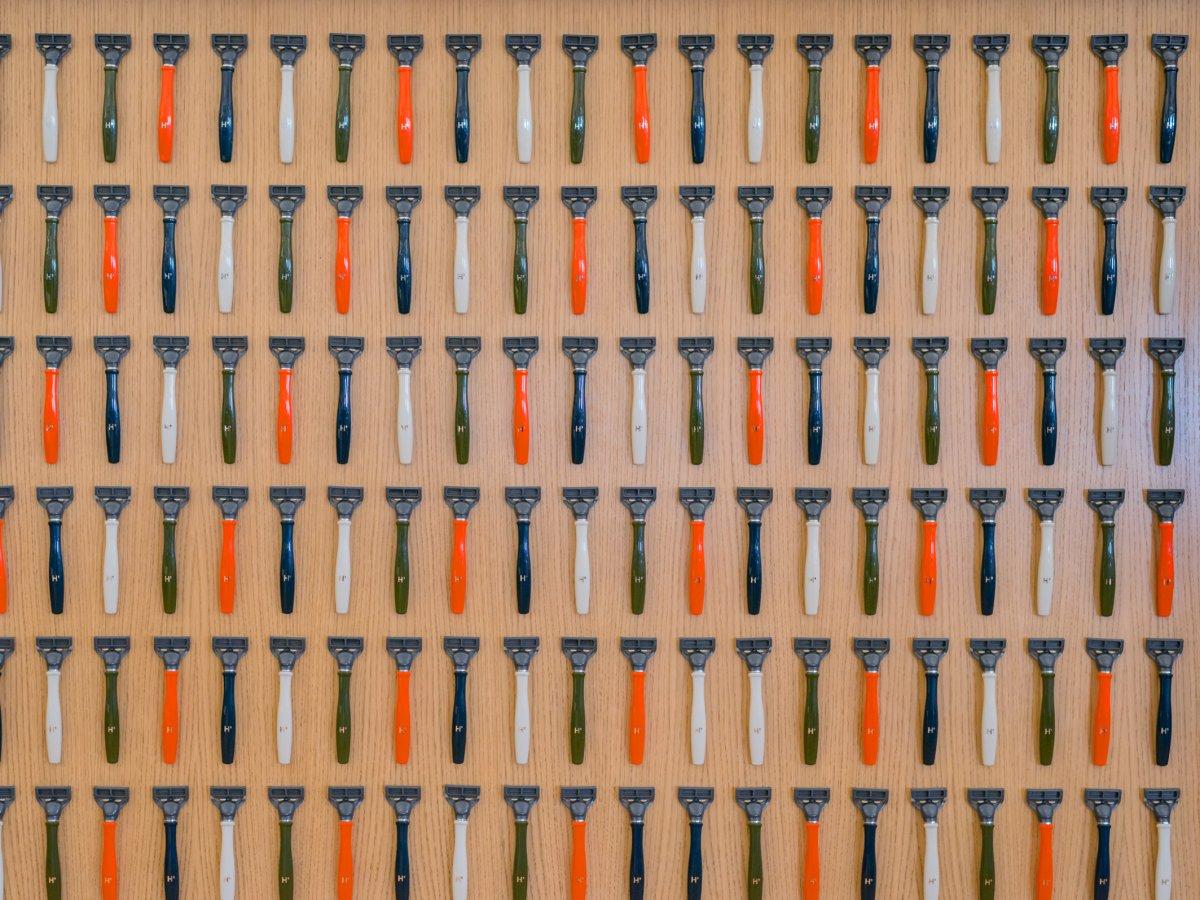

Razors

The rise of a laid-back approach to shaving, most popular among men under the age of 45, is causing some serious problems and strategic readjustments in the razor industry. CNN reports Gillette even had to stage an "intervention" last year, slashing prices by an average of 12 per cent and pushing facial-hair-maintenance tools like a beard trimmer.

According to Gillette, studies show that the average number of times men shave per month has fallen from 3.7 to 3.2 over the last decade. As a result, razor-industry sales fell 5.1 per cent by June, compared to the year prior.

Toys

Fertility hit a record low in 2016, bringing the rate among women ages 15 to 44 to 62 births per 1,000 women. That's creating issues for industries aimed at babies and children.

"Most of our end-customers are newborns and children and, as a result, our revenues are dependent on the birth rates in countries where we operate," Toys R Us wrote in its 2017 annual filing, prior to filing for bankruptcy. "In recent years, many countries' birth rates have dropped or stagnated as their population ages and education and income levels increase."

Toys R Us is not alone. Though they have not had to resort to bankruptcy, Build A Bear and local toy stores have reported similar issues.

"Breastaurant" chains like Hooters

People ages 18 to 24 are 19 per cent less likely to search for breasts on the pornographic website Pornhub compared with all other age groups, according to an analysis conducted by the website.

For "breastaurants" like Hooters and Twin Peaks, a loss of interest in breasts is bad for business. The number of Hooters locations in the US dropped by more than 7 per cent from 2012 to 2016 and sales have stagnated, according to industry reports.

Hooters has struggled to win over millennials for some time now. In 2012, the chain attempted to revamp its image with updated decor and new menu items to attract more millennial and female customers. Earlier this year, the chain announced plans to boost sales by expanding its delivery business.

"Delivery [solves] the polarising issue the brand has had," CEO Terry Marks said at the ICR Retail conference in January. Many people wouldn't step foot in our restaurants, but they want our product," he said.

Cereal

Cereal sales have hit a slump over the last few years. US cereal sales have dropped 11 per cent over the last five years, hitting roughly $9bn in 2017, according to Mintel data.

Almost 40 per cent of millennials surveyed by Mintel said cereal was an inconvenient breakfast choice because they had to clean up after eating it, The New York Times reported in 2016.

Instead, younger consumers are turning to convenient options that can be eaten on the go with minimal clean-up, from yogurt to fast-food breakfast sandwiches.

Golf

While millennials have created new fitness crazes, like SoulCycle and barre classes, golf has failed to capture their interest in the same manner.

Golf participation in the US declined 1.2 per cent in 2016, according to a 2017 report by the National Golf Foundation. Sales also fell, totalling $3.57 billion in 2017, down from $3.6 billion in 2016. The Business Journals reported that the number of golf courses and country clubs in the US has reached a 10-year low.

"From the golf industry statistics, we know that rounds are down," Matt Powell of the industry-research firm NPD said in a video in 2016. "We know that millennials are not picking up the game, and boomers are aging out. The game is in decline."

Home cooking

A UBS report from earlier this year estimates that by 2030, online food delivery could command 10 per cent of the total food-services market. That could spell bad news for companies known for their ready-made or home-prepared meals, such as General Mills and Kraft Heinz.

"At scale, ubiquitous on-demand and subscription delivery of prepared food could potentially spell the end of cooking at home," the report states.

Motorcycles

Millennial indifference seems to be playing a part in motorcycle makers' sales slump over the last decade.

"Our data suggests the younger Gen Y population is adopting motorcycling at a far lower rate than prior generations," AB analyst David Beckel said in a 2017 note downgrading its rating of Harley-Davidson shares from "outperform" to "market perform."

Harley-Davidson is debuting new models and partnerships in an attempt to attract younger Americans to the brand.

"Younger people aren't taking up motorcycles like they used to, and that's led to a long slide in the size of the market in the US, which is already quite competitive," Business Insider's Matthew DeBord reported in July. "The Harley image of open-road freedom doesn't necessarily dovetail with the enthusiasm of millennials for city living."

Old-school yoghurt

Plain old "spoonable" yoghurt is being swept aside for newer variations, with Mintel predicting a 5 per cent decline in overall sales from 2017 to 2022. General Mills reported in September that yoghurt sales dropped 2 per cent in the US in the most recent quarter, due to declines in Greek and light yoghurt sales.

Instead, General Mills is turning to up-and-coming types of yoghurt to boost sales, such as "French-style" Oui by Yoplait.

"In July, we added our presence in simply better yogurt with YQ, a new yoghurt made with ultra-filtered milk that appeal to modern weight managers, seeking high protein, less sugar, simple ingredients and great taste and is 99% lactose-free," CEO Jeff Harmening said in a call with investors.

Pop

In 2006, soda sales by volume declined in the United States for the first time in 20 years. Every year since then, the decline has continued, with Coke and Pepsi brands falling 2 per cent and 4.5 per cent, respectively, by volume in the US in 2017, according to Beverage Digest.

Many of Coca-Cola's attempts to boost sales have focused on convincing millennials to buy lower-calorie beverages.

Diet Coke relaunched earlier in 2018 with a millennial-focused ad campaign with new flavours and social-media influencers. Coca-Cola has also made a number of acquisitions of trendy beverage brands, including Australian kombucha maker Organic & Raw Trading Co, sparkling-water brand Topo Chico and coconut-water brand Zico.

Bar soap

Bar soap sales fell 2.2 per cent from 2014 to 2015, a time when the rest of the shower-and-bath category grew, according to Mintel.

And, millennials are at least partly to blame.

"Almost half (48 per cent) of all US consumers believe bar soaps are covered in germs after use, a feeling that is particularly strong among consumers aged 18-24 (60 per cent), as opposed to just 31 per cent of older consumers aged 65-plus," Mintel wrote in a press release.

Napkins

Younger consumers are opting for paper towels over napkins, according a Washington Post article from 2016.

The Post points to a survey conducted by Mintel, which highlights that only 56 per cent of shoppers said they had bought napkins in the past six months. At the same time, 86 per cent surveyed said they had purchased paper towels.

Paper towels are more functional than napkins and can be used for more purposes. The Post noted that millennials are more likely to eat meals outside of the home, contributing to the decline.

Fabric softener

Sales of liquid fabric softeners fell 15 per cent in the US from 2007 to 2015, The Wall Street Journal reported. Market leader Downy fell 26 per cent in the same period.

According to Downy maker Procter & Gamble's head of global fabric care, millennials "don't even know what the product is for."

Read more:

• Here's Where You'll Find The Richest And Poorest Members Of Congress

• Japanese people who can't afford elder care are reviving a practice known as 'granny dumping'

• Amazon facilitated charity donations to Islamic extremists through its Amazon Smile scheme

Read the original article on Business Insider UK. © 2016. Follow Business Insider UK on Twitter.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments