Homes 'made £1bn' for investors

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

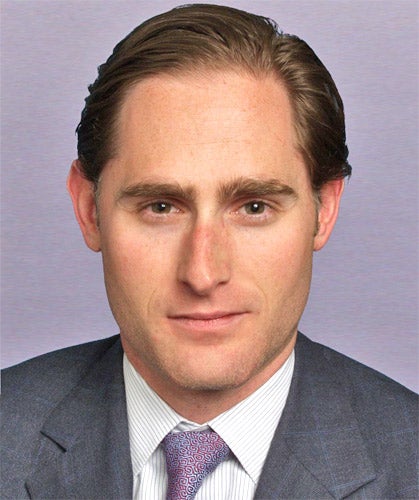

Your support makes all the difference.When Joseph Baratta announced the purchase of the Southern Cross care homes group for £162m in 2004, the high-flyer from the Blackstone private equity giant behind the deal was at pains to underline a strategy to build "a large, professionally managed company... with a focus on high-quality care delivery".

By the time the American finance house sold on Southern Cross in 2006, it had created a healthcare behemoth. From operating 160 homes in 2004,it was running nearly 600 homes and was on track to increase in value from £423m to £1bn.

Mr Baratta, a rising star within Blackstone, was sent to London to help set up its European hub at the age of 29 and is now, at 40, its de facto head of European operations.

Blackstone's reported profit from its oversight of Southern Cross was £1bn.

But, questions are now being asked about whether the roots of Southern Cross's current predicament lie in its rapid growth under its former American owner.

Critics argue that by hiving off the care homes operated by Southern Cross and the other companies it acquired under Blackstone, the group was stripped of its property assets and locked into uneconomic leases signed on the ultimately hollow premise that an ageing population would provide a steady and increasing income.

The squeeze on public spending has put paid to any such aspirations, leaving the care home operator with an occupancy rate of 85 per cent compared to 92 per cent in 2006.

The company currently has 16 per cent of its homes graded poor or adequate by the industry regulator and is facing imminent financial collapse.

Blackstone last night declined to comment on Southern Cross's predicament, pointing out that it has not owned the company – and therefore had any say in its day-to-day management – for five years. But the company strongly disputes any suggestion that its restructuring of the group is responsible for the current situation.

Far from selling off Southern Cross's assets, Blackstone inherited a large tranche of leases when it bought the company in 2004 and it is understood that by the time it disposed of the company there were only 20 homes which had been sold and leased back at the instigation of the private equity house.

A source said: "When we left Southern Cross it was fine. There is no reason for us to comment on a situation that is nothing to do with Blackstone."

Certainly the episode has done nothing to damage Mr Baratta's standing within Blackstone. Steve Schwarzman, the company's co-founder and its chief executive, went out of his way last summer to describe him as "one of our terrific young partners".

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments