NFT millionaire Beeple says crypto art is bubble and will ‘absolutely go to zero’

Artist warns investors that digital assets are ‘extremely speculative’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The cryptocurrency art boom involving non fungible tokens (NFTs) is an “irrational exuberance bubble”, according to an artist who recently sold a piece for nearly $70 million (£50m) using the technology.

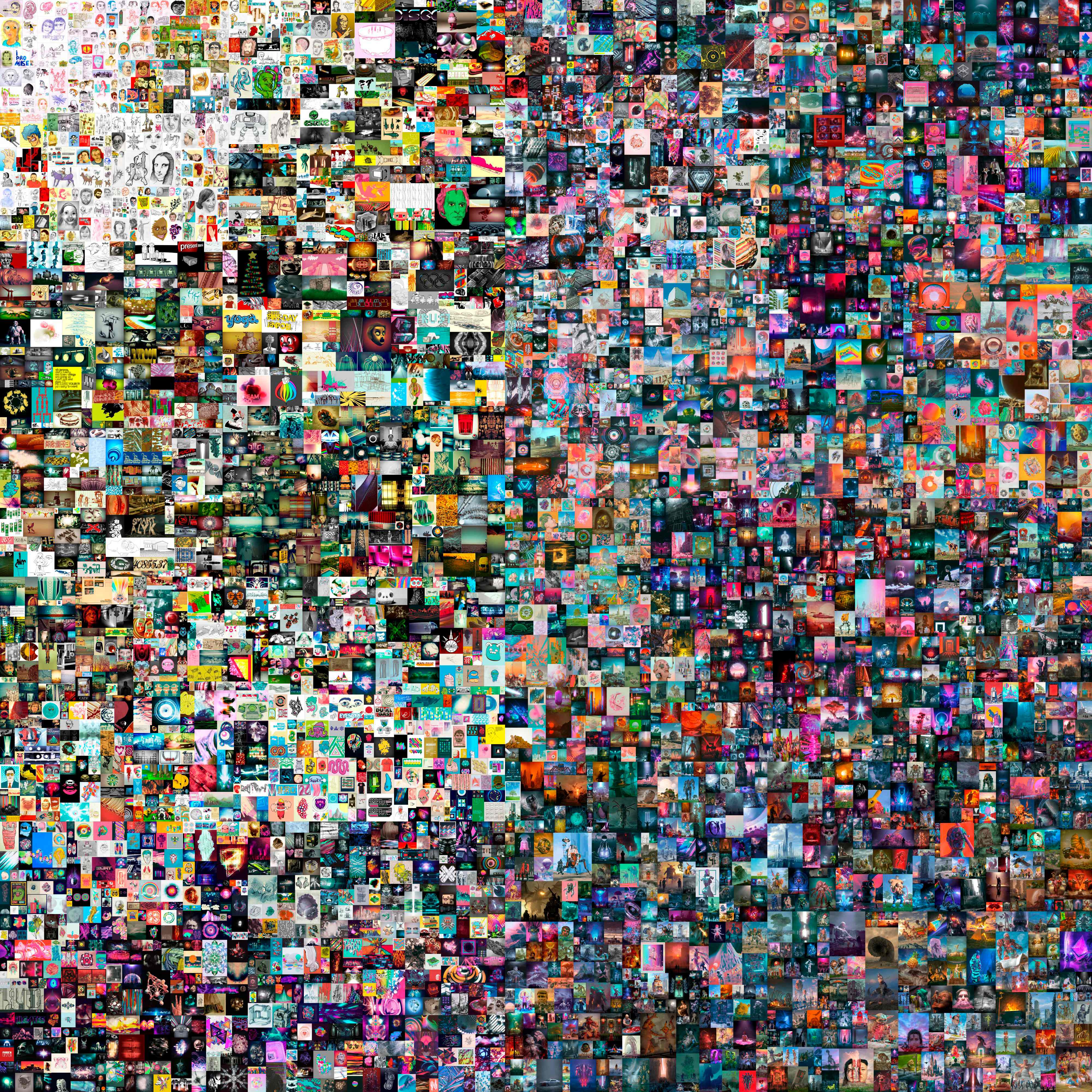

Beeple, whose real name is Mike Winkelmann, became the third most-valuable living artist earlier this month when he sold a collection titled “Everydays” as an NFT through Christie’s.

Online bidding for his digital collage started at $100 (£72) and sold for $69.3 million.

Appearing on the Sway podcast this week, Mr Winkelmann revealed that it had been less than six months since he first learnt what an NFT is.

Their popularity has soared in 2021, with artists and celebrities making huge amounts of money by selling digital ownership of something – be it a piece of art or a tweet – through an immutable online ledger called a blockchain.

Read more:

It is the same technology that underpins bitcoin and payments for NFTs are also made using cryptocurrency.

When asked if he was worried about NFTs being the “second level of a pyramid scheme” – the first one being cryptocurrency itself – Mr Winkelmann disagreed but described it as “extremely speculative” and risky for investors.

“This is for people who are looking to take some risks, because a lot of this stuff will absolutely go to zero,” he said.

“If you just look at art historically, blue chip stuff does pretty well over time. But most of it goes to zero. That’s just how it is. And I believe NFTs will be no different. And I believe it’s absolutely in an irrational exuberance bubble that is – we’re there.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments